Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cdpitdi Duagening Example: Expansion Project Analysis: Mayco Inc would like to set up a new plant. Currently, Mayco has an option to buy an existing

Cdpitdi Duagening

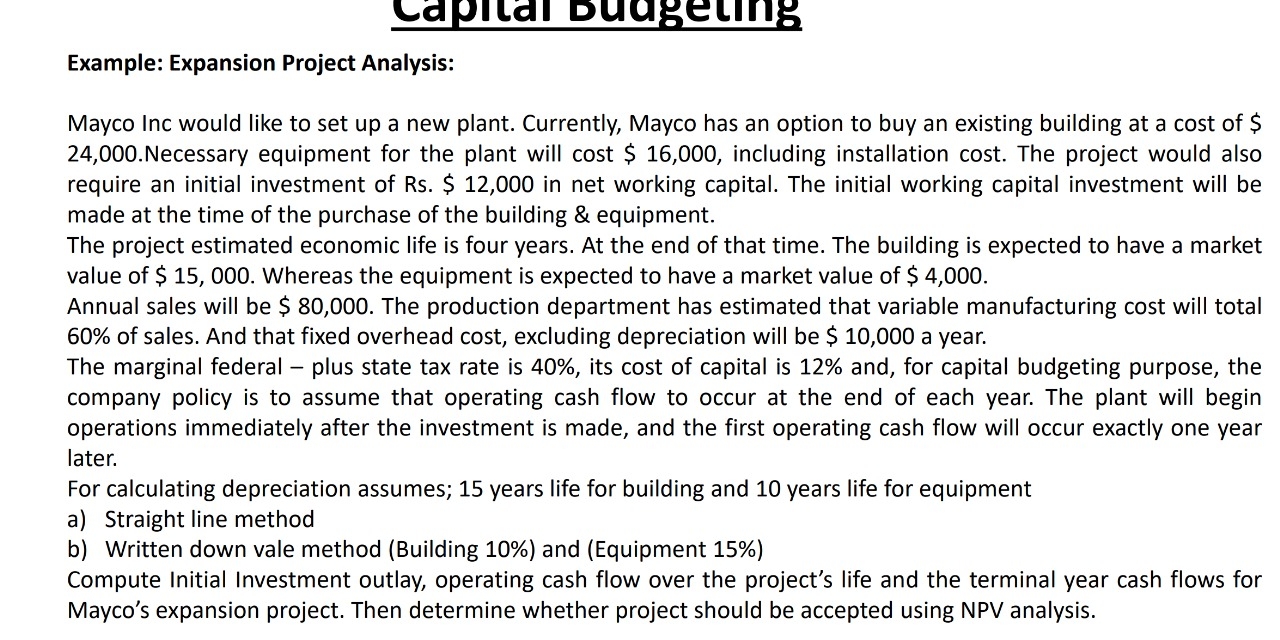

Example: Expansion Project Analysis:

Mayco Inc would like to set up a new plant. Currently, Mayco has an option to buy an existing building at a cost of $ Necessary equipment for the plant will cost $ including installation cost. The project would also require an initial investment of Rs $ in net working capital. The initial working capital investment will be made at the time of the purchase of the building & equipment.

The project estimated economic life is four years. At the end of that time. The building is expected to have a market value of $ Whereas the equipment is expected to have a market value of $

Annual sales will be $ The production department has estimated that variable manufacturing cost will total of sales. And that fixed overhead cost, excluding depreciation will be $ a year.

The marginal federal plus state tax rate is its cost of capital is and, for capital budgeting purpose, the company policy is to assume that operating cash flow to occur at the end of each year. The plant will begin operations immediately after the investment is made, and the first operating cash flow will occur exactly one year later.

For calculating depreciation assumes; years life for building and years life for equipment

a Straight line method

b Written down vale method Building and Equipment

Compute Initial Investment outlay, operating cash flow over the project's life and the terminal year cash flows for Mayco's expansion project. Then determine whether project should be accepted using NPV analysis.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started