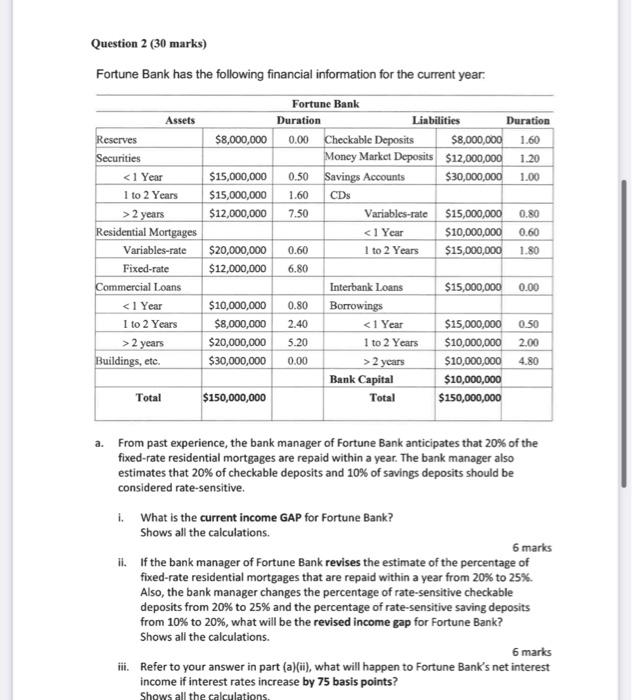

CDs Question 2 (30 marks) Fortune Bank has the following financial information for the current year. Fortune Bank Assets Duration Liabilities Duration Reserves $8,000,000 0.00 Checkable Deposits $8,000,000 1.60 Securities Money Market Deposits $12,000,000 1.20 2 years $12,000,000 7.50 Variables-rate $15,000,000 0.80 Residential Mortgages 2 years $20,000,000 5.20 1 to 2 Years $10,000,000 2.00 Buildings, etc. $30,000,000 0.00 > 2 years $10,000,000 4.80 Bank Capital $10,000,000 Total $150,000,000 Total $150,000,000 a. From past experience, the bank manager of Fortune Bank anticipates that 20% of the fixed-rate residential mortgages are repaid within a year. The bank manager also estimates that 20% of checkable deposits and 10% of savings deposits should be considered rate-sensitive 1. What is the current income GAP for Fortune Bank? Shows all the calculations. 6 marks ii. If the bank manager of Fortune Bank revises the estimate of the percentage of fixed-rate residential mortgages that are repaid within a year from 20% to 25%. Also, the bank manager changes the percentage of rate-sensitive checkable deposits from 20% to 25% and the percentage of rate-sensitive saving deposits from 10% to 20%, what will be the revised income gap for Fortune Bank? Shows all the calculations. 6 marks iii. Refer to your answer in part (a)(ii), what will happen to Fortune Bank's net interest income if interest rates increase by 75 basis points? Shows all the calculations CDs Question 2 (30 marks) Fortune Bank has the following financial information for the current year. Fortune Bank Assets Duration Liabilities Duration Reserves $8,000,000 0.00 Checkable Deposits $8,000,000 1.60 Securities Money Market Deposits $12,000,000 1.20 2 years $12,000,000 7.50 Variables-rate $15,000,000 0.80 Residential Mortgages 2 years $20,000,000 5.20 1 to 2 Years $10,000,000 2.00 Buildings, etc. $30,000,000 0.00 > 2 years $10,000,000 4.80 Bank Capital $10,000,000 Total $150,000,000 Total $150,000,000 a. From past experience, the bank manager of Fortune Bank anticipates that 20% of the fixed-rate residential mortgages are repaid within a year. The bank manager also estimates that 20% of checkable deposits and 10% of savings deposits should be considered rate-sensitive 1. What is the current income GAP for Fortune Bank? Shows all the calculations. 6 marks ii. If the bank manager of Fortune Bank revises the estimate of the percentage of fixed-rate residential mortgages that are repaid within a year from 20% to 25%. Also, the bank manager changes the percentage of rate-sensitive checkable deposits from 20% to 25% and the percentage of rate-sensitive saving deposits from 10% to 20%, what will be the revised income gap for Fortune Bank? Shows all the calculations. 6 marks iii. Refer to your answer in part (a)(ii), what will happen to Fortune Bank's net interest income if interest rates increase by 75 basis points? Shows all the calculations