Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CDS Valuation. A credit default swap on a $10,000,000, is a two-year agreement, whereby B (the protection buyer) agrees to pay S (the guarantor,

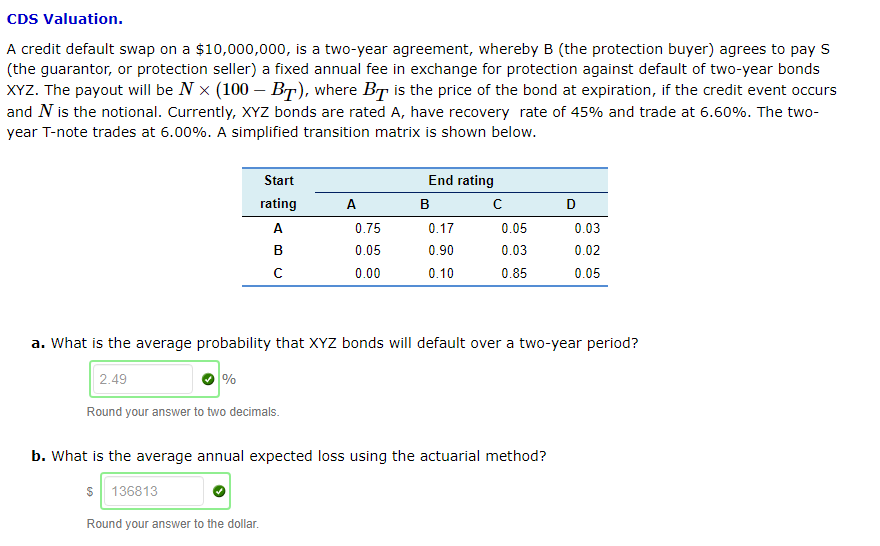

CDS Valuation. A credit default swap on a $10,000,000, is a two-year agreement, whereby B (the protection buyer) agrees to pay S (the guarantor, or protection seller) a fixed annual fee in exchange for protection against default of two-year bonds XYZ. The payout will be N x (100 - BT), where BT is the price of the bond at expiration, if the credit event occurs and N is the notional. Currently, XYZ bonds are rated A, have recovery rate of 45% and trade at 6.60%. The two- year T-note trades at 6.00%. A simplified transition matrix is shown below. Start End rating rating A B C D A 0.75 0.17 0.05 0.03 B 0.05 0.90 0.03 0.02 C 0.00 0.10 0.85 0.05 a. What is the average probability that XYZ bonds will default over a two-year period? 2.49 % Round your answer to two decimals. b. What is the average annual expected loss using the actuarial method? $ 136813 Round your answer to the dollar.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started