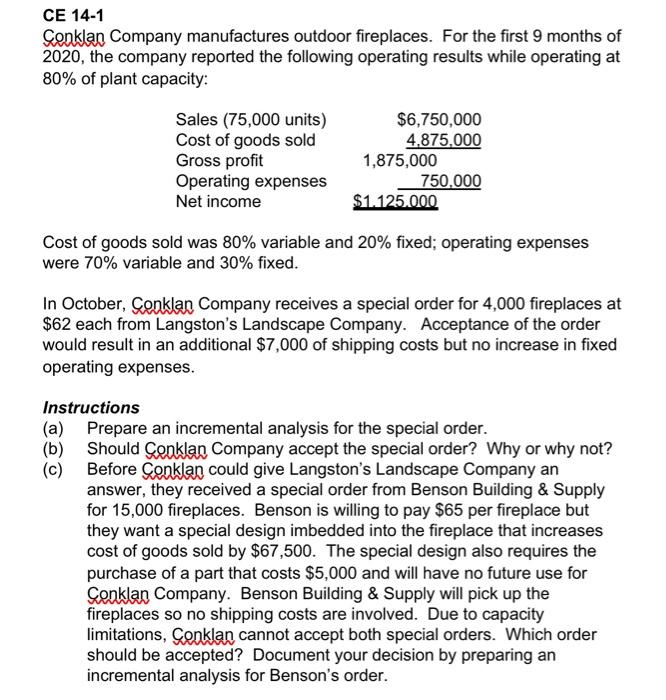

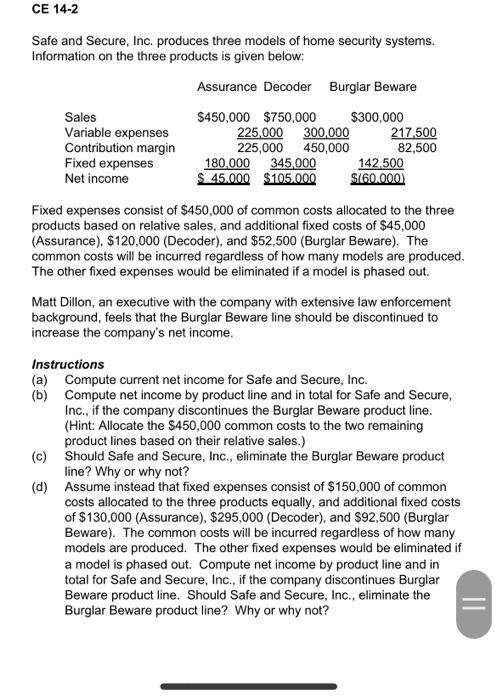

CE 14-1 Conklan Company manufactures outdoor fireplaces. For the first 9 months of 2020 , the company reported the following operating results while operating at 80% of plant capacity: Cost of goods sold was 80% variable and 20% fixed; operating expenses were 70% variable and 30% fixed. In October, Conklan Company receives a special order for 4,000 fireplaces at \$62 each from Langston's Landscape Company. Acceptance of the order would result in an additional $7,000 of shipping costs but no increase in fixed operating expenses. Instructions (a) Prepare an incremental analysis for the special order. (b) Should Conklan Company accept the special order? Why or why not? (c) Before Conklan could give Langston's Landscape Company an answer, they received a special order from Benson Building \& Supply for 15,000 fireplaces. Benson is willing to pay $65 per fireplace but they want a special design imbedded into the fireplace that increases cost of goods sold by $67,500. The special design also requires the purchase of a part that costs $5,000 and will have no future use for Conklan Company. Benson Building \& Supply will pick up the fireplaces so no shipping costs are involved. Due to capacity limitations, Genklan cannot accept both special orders. Which order should be accepted? Document your decision by preparing an incremental analysis for Benson's order. CE 14-2 Safe and Secure, Inc. produces three models of home security systems. Information on the three products is given below: Fixed expenses consist of $450,000 of common costs allocated to the three products based on relative sales, and additional fixed costs of $45,000 (Assurance), $120,000 (Decoder), and $52,500 (Burglar Beware). The common costs will be incurred regardless of how many models are produced. The other fixed expenses would be eliminated if a model is phased out. Matt Dillon, an executive with the company with extensive law enforcement background, feels that the Burglar Beware line should be discontinued to increase the company's net income. Instructions (a) Compute current net income for Safe and Secure, Inc. (b) Compute net income by product line and in total for Safe and Secure, Inc., if the company discontinues the Burglar Beware product line. (Hint: Allocate the $450,000 common costs to the two remaining product lines based on their relative sales.) (c) Should Safe and Secure, Inc., eliminate the Burglar Beware product line? Why or why not? (d) Assume instead that fixed expenses consist of $150,000 of common costs allocated to the three products equally, and additional fixed costs of $130,000 (Assurance), $295,000 (Decoder), and \$92,500 (Burglar Beware). The common costs will be incurred regardless of how many models are produced. The other fixed expenses would be eliminated if a model is phased out. Compute net income by product line and in total for Safe and Secure, Inc., if the company discontinues Burglar Beware product line. Should Safe and Secure, Inc., eliminate the Burglar Beware product line? Why or why not? CE 14-1 Conklan Company manufactures outdoor fireplaces. For the first 9 months of 2020 , the company reported the following operating results while operating at 80% of plant capacity: Cost of goods sold was 80% variable and 20% fixed; operating expenses were 70% variable and 30% fixed. In October, Conklan Company receives a special order for 4,000 fireplaces at \$62 each from Langston's Landscape Company. Acceptance of the order would result in an additional $7,000 of shipping costs but no increase in fixed operating expenses. Instructions (a) Prepare an incremental analysis for the special order. (b) Should Conklan Company accept the special order? Why or why not? (c) Before Conklan could give Langston's Landscape Company an answer, they received a special order from Benson Building \& Supply for 15,000 fireplaces. Benson is willing to pay $65 per fireplace but they want a special design imbedded into the fireplace that increases cost of goods sold by $67,500. The special design also requires the purchase of a part that costs $5,000 and will have no future use for Conklan Company. Benson Building \& Supply will pick up the fireplaces so no shipping costs are involved. Due to capacity limitations, Genklan cannot accept both special orders. Which order should be accepted? Document your decision by preparing an incremental analysis for Benson's order. CE 14-2 Safe and Secure, Inc. produces three models of home security systems. Information on the three products is given below: Fixed expenses consist of $450,000 of common costs allocated to the three products based on relative sales, and additional fixed costs of $45,000 (Assurance), $120,000 (Decoder), and $52,500 (Burglar Beware). The common costs will be incurred regardless of how many models are produced. The other fixed expenses would be eliminated if a model is phased out. Matt Dillon, an executive with the company with extensive law enforcement background, feels that the Burglar Beware line should be discontinued to increase the company's net income. Instructions (a) Compute current net income for Safe and Secure, Inc. (b) Compute net income by product line and in total for Safe and Secure, Inc., if the company discontinues the Burglar Beware product line. (Hint: Allocate the $450,000 common costs to the two remaining product lines based on their relative sales.) (c) Should Safe and Secure, Inc., eliminate the Burglar Beware product line? Why or why not? (d) Assume instead that fixed expenses consist of $150,000 of common costs allocated to the three products equally, and additional fixed costs of $130,000 (Assurance), $295,000 (Decoder), and \$92,500 (Burglar Beware). The common costs will be incurred regardless of how many models are produced. The other fixed expenses would be eliminated if a model is phased out. Compute net income by product line and in total for Safe and Secure, Inc., if the company discontinues Burglar Beware product line. Should Safe and Secure, Inc., eliminate the Burglar Beware product line? Why or why not