Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ced Bank has assets of $150 million, liabilities of $135 million, and equity of $15 million. The t duration is six years and the duration

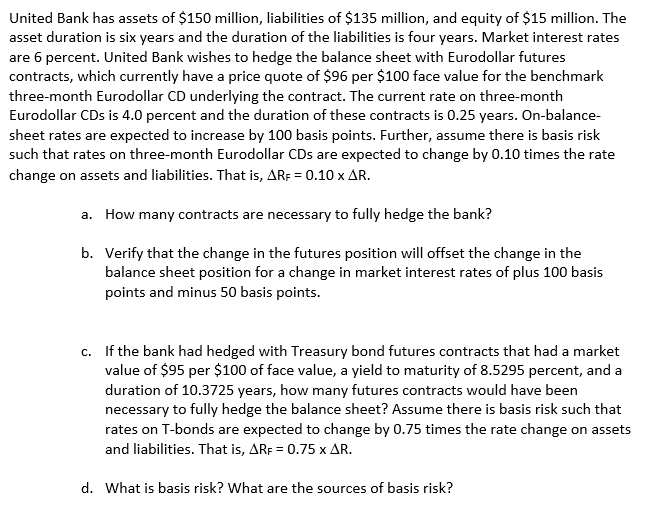

ced Bank has assets of $150 million, liabilities of $135 million, and equity of $15 million. The t duration is six years and the duration of the liabilities is four years. Market interest rates 6 percent. United Bank wishes to hedge the balance sheet with Eurodollar futures tracts, which currently have a price quote of $96 per $100 face value for the benchmark e-month Eurodollar CD underlying the contract. The current rate on three-month odollar CDs is 4.0 percent and the duration of these contracts is 0.25 years. On-balanceet rates are expected to increase by 100 basis points. Further, assume there is basis risk that rates on three-month Eurodollar CDs are expected to change by 0.10 times the rate nge on assets and liabilities. That is, RF=0.10R. a. How many contracts are necessary to fully hedge the bank? b. Verify that the change in the futures position will offset the change in the balance sheet position for a change in market interest rates of plus 100 basis points and minus 50 basis points. c. If the bank had hedged with Treasury bond futures contracts that had a market value of $95 per $100 of face value, a yield to maturity of 8.5295 percent, and a duration of 10.3725 years, how many futures contracts would have been necessary to fully hedge the balance sheet? Assume there is basis risk such that rates on T-bonds are expected to change by 0.75 times the rate change on assets and liabilities. That is, RF=0.75R. d. What is basis risk? What are the sources of basis risk

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started