Question

Celebration Company uses a single plant-wide rate to allocate overhead and uses direct labor hours as its allocation base. At the beginning of the

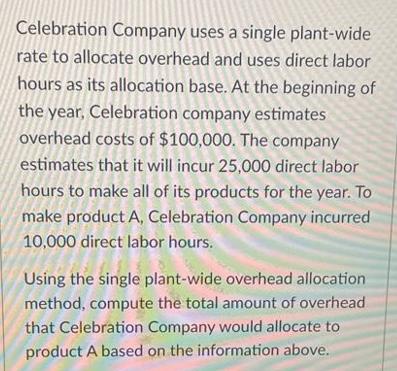

Celebration Company uses a single plant-wide rate to allocate overhead and uses direct labor hours as its allocation base. At the beginning of the year, Celebration company estimates overhead costs of $100,000. The company estimates that it will incur 25,000 direct labor hours to make all of its products for the year. To make product A, Celebration Company incurred 10,000 direct labor hours. Using the single plant-wide overhead allocation method, compute the total amount of overhead that Celebration Company would allocate to product A based on the information above.

Step by Step Solution

3.40 Rating (141 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the total amount of overhead that Celebration Company would allocate to product ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting

Authors: Kurt Heisinger, Joe Ben Hoyle

2nd edition

1453375723, 1453375724, 978-1453375716

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App