Answered step by step

Verified Expert Solution

Question

1 Approved Answer

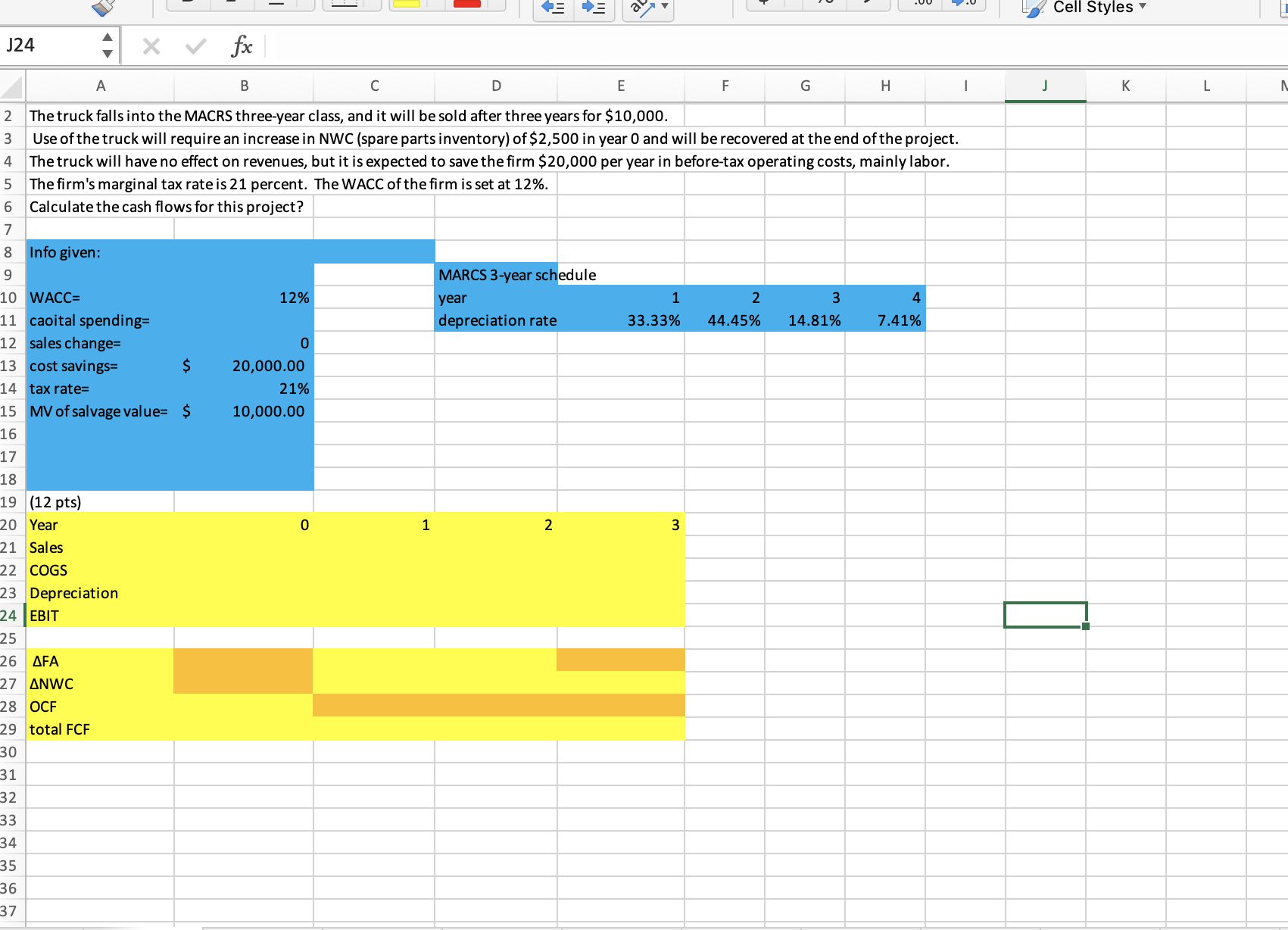

Cell Styles J24 fx The truck falls into the MACRS three-year class, and it will be sold after three years for $10,000. Use of the

Cell Styles J24 fx The truck falls into the MACRS three-year class, and it will be sold after three years for $10,000. Use of the truck will require an increase in NWC (spare parts inventory) of $2,500 in year 0 and will be recovered at the end of the project. The truck will have no effect on revenues, but it is expected to save the firm $20,000 per year in before-tax operating costs, mainly labor. The firm's marginal tax rate is 21 percent. The WACC of the firm is set at 12%. Calculate the cash flows for this project? Info given: WACC = caoital spending= sales change = cost savings= tax rate= MV of salvage value =$ MARCS 3-year schedule year depreciation rate (12 pts) Year Sales COGS Depreciation EBIT FA NWC OCF total FCF 0 1 2 3

Cell Styles J24 fx The truck falls into the MACRS three-year class, and it will be sold after three years for $10,000. Use of the truck will require an increase in NWC (spare parts inventory) of $2,500 in year 0 and will be recovered at the end of the project. The truck will have no effect on revenues, but it is expected to save the firm $20,000 per year in before-tax operating costs, mainly labor. The firm's marginal tax rate is 21 percent. The WACC of the firm is set at 12%. Calculate the cash flows for this project? Info given: WACC = caoital spending= sales change = cost savings= tax rate= MV of salvage value =$ MARCS 3-year schedule year depreciation rate (12 pts) Year Sales COGS Depreciation EBIT FA NWC OCF total FCF 0 1 2 3 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started