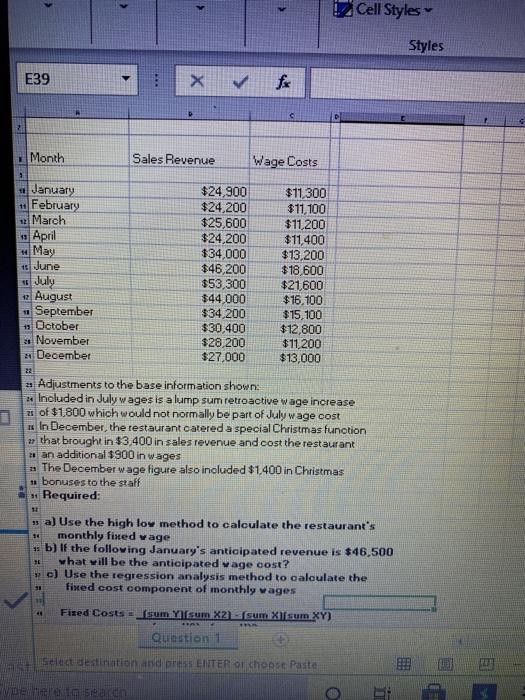

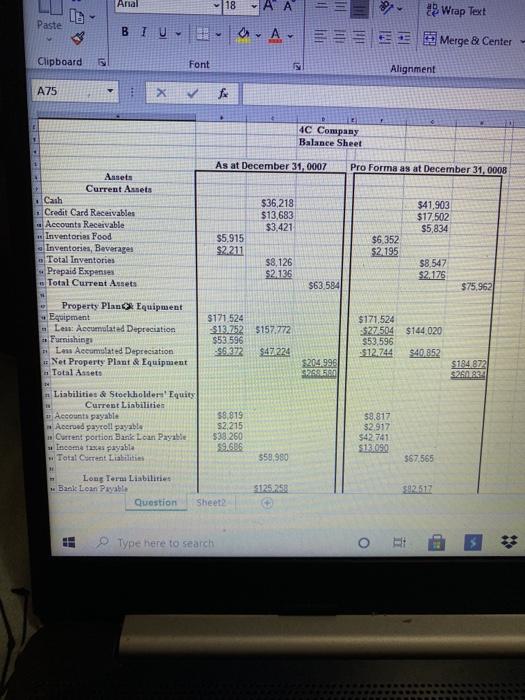

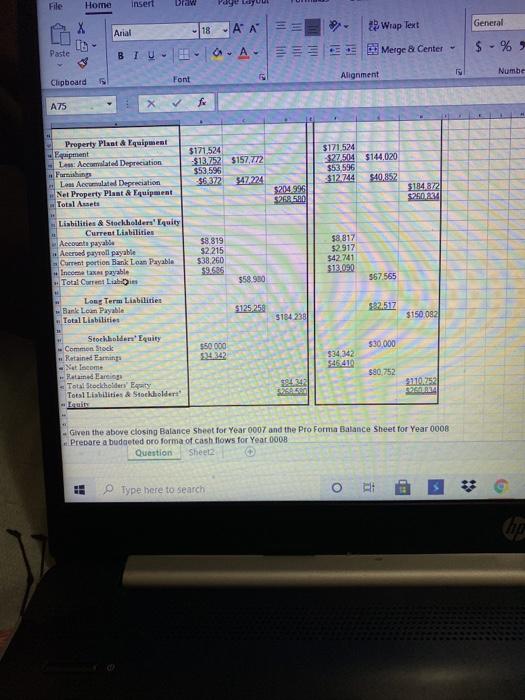

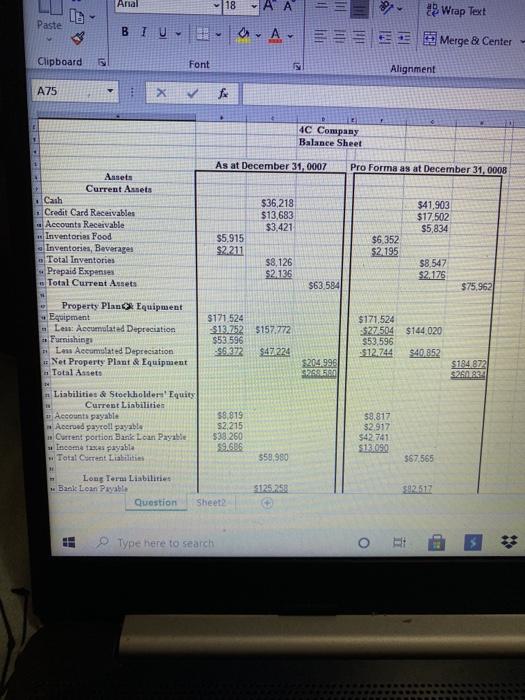

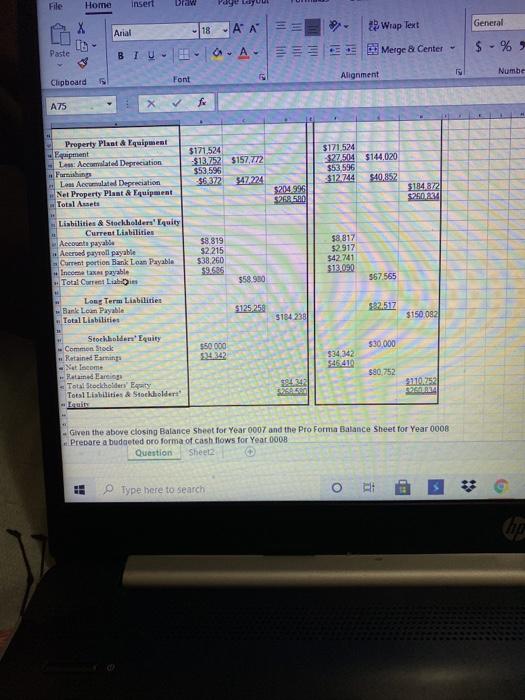

Cell Styles Styles E39 X fx D 2 Month Sales Revenue Wage Costs 1 11 13 1 January February March April May 15 June 5 July 12 August September 11 October 2 November December $24.900 $24,200 $25,600 $24,200 $34,000 $46,200 $53,300 $44 000 $34,200 $30,400 $28,200 $27,000 $11,300 $11,100 $11,200 $11,400 $13,200 $ 18,600 $21,600 $16.100 $15,100 $12,800 $11.200 $13,000 11 a Adjustments to the base information shown: * Included in July wages is a lump sum retroactive wage increase 23 of $1,800 which would not normally be part of July wage cost * In December, the restaurantcatered a special Christmas function that brought in $3,400 in sales revenue and cost the restaurant # an additional $900 in wages a The December wage figure also included $1.400 in Christmas 11 bonuses to the staff Required: 30 a) Use the high low method to calculate the restaurant's monthly fixed vage * b) If the following January's anticipated revenue is $46.500 what will be the anticipated vage cost? c) Use the regression analysis method to calculate the fixed cost component of monthly vages Fixed Costsum Yilsum.x2 sumsum XY) Question 1 Select destination and SS ENTER or choose Paste en con Arial 18 Wrap Text Paste BU A Merge & Center - Clipboard 2 Font Alignment A75 V fo 4C Company Balance Sheet 1 . 1 As at December 31, 0007 Pro Forma as at December 31, 0008 Assets Current Assets $36,218 $13,683 $3,421 $41,903 $17.502 $5,834 Credit Card Receivables Accounts Receivable Inventorias Food Inventories, Beverages Total Inventories - Prepaid Expenses Total Current Assets $5.915 $2.211 $6.352 $2195 $8,126 $2.126 $8.547 $2.126 $63,584 $75,962 1 Property Plan Equipment Equipment - Less: Accumulated Depreciation a Furnishing - Leu Accumulated Depreciation Net Property Plant & Equipment Total Assets $171 524 $13.752 5157.772 $53 596 $5372 $47.224 $171,524 $27504 $144.020 $53,596 $12.744 $40.852 $204.996 S250 $184.872 $260183 Liabilities & Stockholders' Equity Current Liabilities Accounts payable Accrued payroll payable Current portion Bank Loan Payable Income tax payable Total Current Liabilities $8,819 52.215 $38.260 59.686 59.817 $2.917 $42.741 $13090 558,950 067565 567565 Long Term Liabilities Bank Loan Payable Question $125258 2.517 Sheet2 11 Type here to search o 1: File Home insert Draw 101 General Arial 18 LS Paste ' ' HOA 2 Wrap Text Merge & Center $ - % BIU Font Alignment Numbe Clipboard A7S Property Plant & quipment quipment Lew: Accmated Depreciation $171.524 -$13.752 $157,772 $53,596 $6372 $47.224 $171.524 -$22504 $144.020 $53.596 $12.744 $40,852 Les Accumulated Depreciation Net Property Plant & Yquipment Total Assets $204.99 $268.580 $184,872 $260.234 Liabilities & Stockholders' quity Current Liabilities Accounts payable Aeered payroll payable Current portion Bank Loan Payable Income tax payable Total Current Labs Long Term Liabilities Bank Loan Payable Total Liabilities $8819 $2215 $38,260 $9.695 $8817 $2.917 $42741 $13.090 $58 900 567.565 $125 250 $32.517 $184.238 $150,082 $50 000 $30,000 $34342 $46.410 1 Stockholders' Equity - Common Stock Retained Earnings Nelecom Raamad ari