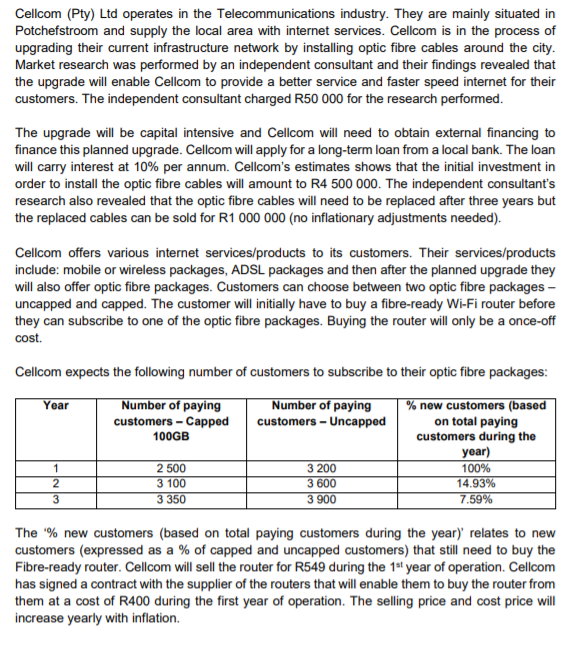

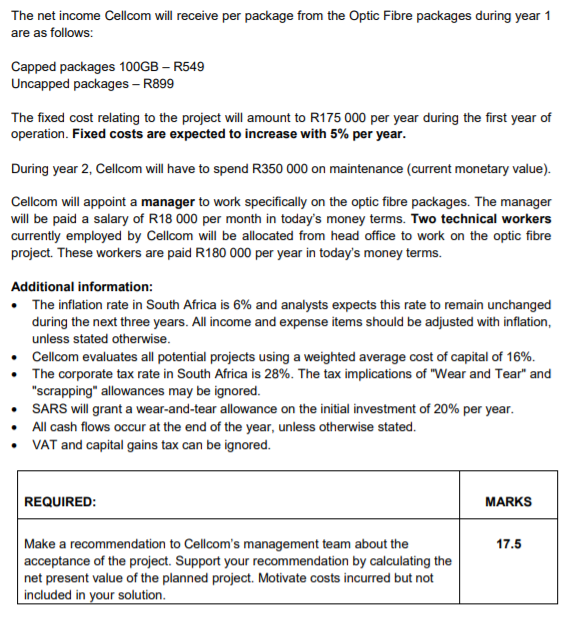

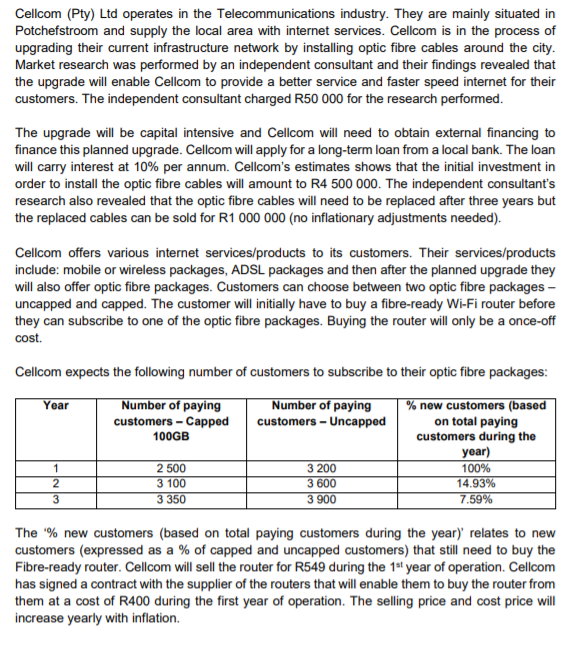

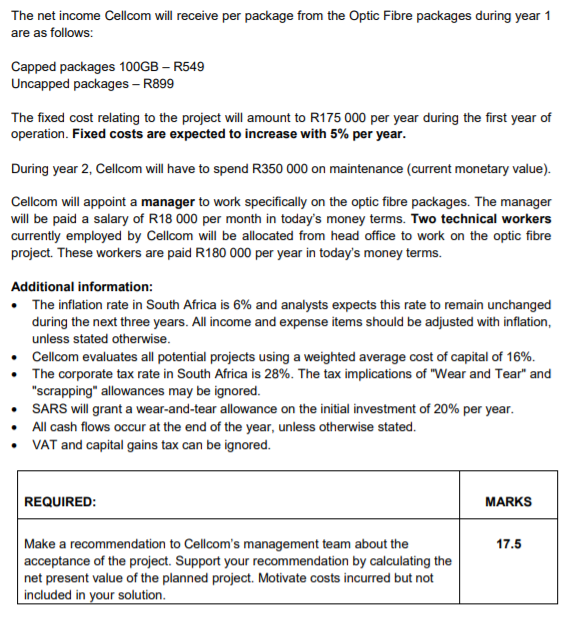

Cellcom (Pty) Ltd operates in the Telecommunications industry. They are mainly situated in Potchefstroom and supply the local area with internet services. Cellcom is in the process of upgrading their current infrastructure network by installing optic fibre cables around the city. Market research was performed by an independent consultant and their findings revealed that the upgrade will enable Cellcom to provide a better service and faster speed internet for their customers. The independent consultant charged R50 000 for the research performed. The upgrade will be capital intensive and Cellcom will need to obtain external financing to finance this planned upgrade. Cellcom will apply for a long-term loan from a local bank. The loan will carry interest at 10% per annum. Cellcom's estimates shows that the initial investment in order to install the optic fibre cables will amount to R4 500 000. The independent consultant's research also revealed that the optic fibre cables will need to be replaced after three years but the replaced cables can be sold for R1 000 000 (no inflationary adjustments needed). Cellcom offers various internet services/products to its customers. Their services/products include: mobile or wireless packages, ADSL packages and then after the planned upgrade they will also offer optic fibre packages. Customers can choose between two optic fibre packages - uncapped and capped. The customer will initially have to buy a fibre-ready Wi-Fi router before they can subscribe to one of the optic fibre packages. Buying the router will only be a once-off cost. Cellcom expects the following number of customers to subscribe to their optic fibre packages: Year Number of paying customers - Capped 100GB Number of paying customers - Uncapped % new customers (based on total paying customers during the year) 100% 14.93% 7.59% 2 3 2 500 3 100 3350 3 200 3 600 3 900 The % new customers (based on total paying customers during the year) relates to new customers (expressed as a % of capped and uncapped customers) that still need to buy the Fibre-ready router. Cellcom will sell the router for R549 during the 1st year of operation. Cellcom has signed a contract with the supplier of the routers that will enable them to buy the router from them at a cost of R400 during the first year of operation. The selling price and cost price will increase yearly with inflation. The net income Cellcom will receive per package from the Optic Fibre packages during year 1 are as follows: Capped packages 100GB - R549 Uncapped packages - R899 The fixed cost relating to the project will amount to R175 000 per year during the first year of operation. Fixed costs are expected to increase with 5% per year. During year 2, Cellcom will have to spend R350 000 on maintenance (current monetary value). Cellcom will appoint a manager to work specifically on the optic fibre packages. The manager will be paid a salary of R18 000 per month in today's money terms. Two technical workers currently employed by Cellcom will be allocated from head office to work on the optic fibre project. These workers are paid R180 000 per year in today's money terms. Additional information: The inflation rate in South Africa is 6% and analysts expects this rate to remain unchanged during the next three years. All income and expense items should be adjusted with inflation, unless stated otherwise. Cellcom evaluates all potential projects using a weighted average cost of capital of 16%. The corporate tax rate in South Africa is 28%. The tax implications of "Wear and Tear" and "scrapping" allowances may be ignored. SARS will grant a wear-and-tear allowance on the initial investment of 20% per year. All cash flows occur at the end of the year, unless otherwise stated. VAT and capital gains tax can be ignored. REQUIRED: MARKS 17.5 Make a recommendation to Cellcom's management team about the acceptance of the project. Support your recommendation by calculating the net present value of the planned project. Motivate costs incurred but not included in your solution. Cellcom (Pty) Ltd operates in the Telecommunications industry. They are mainly situated in Potchefstroom and supply the local area with internet services. Cellcom is in the process of upgrading their current infrastructure network by installing optic fibre cables around the city. Market research was performed by an independent consultant and their findings revealed that the upgrade will enable Cellcom to provide a better service and faster speed internet for their customers. The independent consultant charged R50 000 for the research performed. The upgrade will be capital intensive and Cellcom will need to obtain external financing to finance this planned upgrade. Cellcom will apply for a long-term loan from a local bank. The loan will carry interest at 10% per annum. Cellcom's estimates shows that the initial investment in order to install the optic fibre cables will amount to R4 500 000. The independent consultant's research also revealed that the optic fibre cables will need to be replaced after three years but the replaced cables can be sold for R1 000 000 (no inflationary adjustments needed). Cellcom offers various internet services/products to its customers. Their services/products include: mobile or wireless packages, ADSL packages and then after the planned upgrade they will also offer optic fibre packages. Customers can choose between two optic fibre packages - uncapped and capped. The customer will initially have to buy a fibre-ready Wi-Fi router before they can subscribe to one of the optic fibre packages. Buying the router will only be a once-off cost. Cellcom expects the following number of customers to subscribe to their optic fibre packages: Year Number of paying customers - Capped 100GB Number of paying customers - Uncapped % new customers (based on total paying customers during the year) 100% 14.93% 7.59% 2 3 2 500 3 100 3350 3 200 3 600 3 900 The % new customers (based on total paying customers during the year) relates to new customers (expressed as a % of capped and uncapped customers) that still need to buy the Fibre-ready router. Cellcom will sell the router for R549 during the 1st year of operation. Cellcom has signed a contract with the supplier of the routers that will enable them to buy the router from them at a cost of R400 during the first year of operation. The selling price and cost price will increase yearly with inflation. The net income Cellcom will receive per package from the Optic Fibre packages during year 1 are as follows: Capped packages 100GB - R549 Uncapped packages - R899 The fixed cost relating to the project will amount to R175 000 per year during the first year of operation. Fixed costs are expected to increase with 5% per year. During year 2, Cellcom will have to spend R350 000 on maintenance (current monetary value). Cellcom will appoint a manager to work specifically on the optic fibre packages. The manager will be paid a salary of R18 000 per month in today's money terms. Two technical workers currently employed by Cellcom will be allocated from head office to work on the optic fibre project. These workers are paid R180 000 per year in today's money terms. Additional information: The inflation rate in South Africa is 6% and analysts expects this rate to remain unchanged during the next three years. All income and expense items should be adjusted with inflation, unless stated otherwise. Cellcom evaluates all potential projects using a weighted average cost of capital of 16%. The corporate tax rate in South Africa is 28%. The tax implications of "Wear and Tear" and "scrapping" allowances may be ignored. SARS will grant a wear-and-tear allowance on the initial investment of 20% per year. All cash flows occur at the end of the year, unless otherwise stated. VAT and capital gains tax can be ignored. REQUIRED: MARKS 17.5 Make a recommendation to Cellcom's management team about the acceptance of the project. Support your recommendation by calculating the net present value of the planned project. Motivate costs incurred but not included in your solution