Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(c) (d) Celine Ltd has a factory where it manufactures t-shirts which are exported to the Europe market. The factory operates as a cash

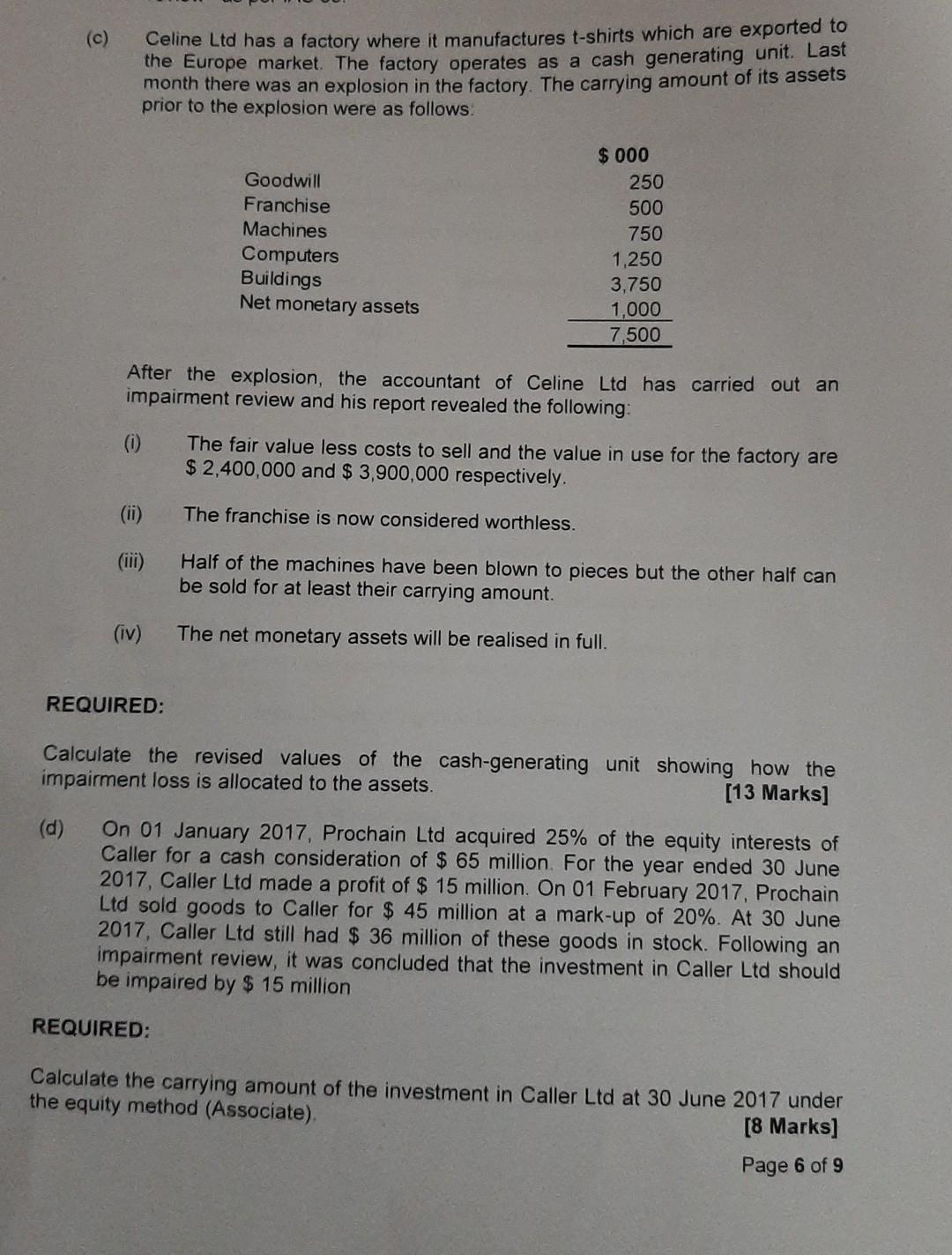

(c) (d) Celine Ltd has a factory where it manufactures t-shirts which are exported to the Europe market. The factory operates as a cash generating unit. Last month there was an explosion in the factory. The carrying amount of its assets prior to the explosion were as follows: (1) (ii) (iii) Goodwill Franchise Machines Computers Buildings Net monetary assets (iv) $000 After the explosion, the accountant of Celine Ltd has carried out an impairment review and his report revealed the following: 250 500 750 1,250 3,750 1,000 7,500 The fair value less costs to sell and the value in use for the factory are $2,400,000 and $3,900,000 respectively. The franchise is now considered worthless. Half of the machines have been blown to pieces but the other half can be sold for at least their carrying amount. The net monetary assets will be realised in full. REQUIRED: Calculate the revised values of the cash-generating unit showing how the impairment loss is allocated to the assets. [13 Marks] On 01 January 2017, Prochain Ltd acquired 25% of the equity interests of Caller for a cash consideration of $ 65 million. For the year ended 30 June 2017, Caller Ltd made a profit of $ 15 million. On 01 February 2017, Prochain Ltd sold goods to Caller for $ 45 million at a mark-up of 20%. At 30 June 2017, Caller Ltd still had $ 36 million of these goods in stock. Following an impairment review, it was concluded that the investment in Caller Ltd should be impaired by $ 15 million REQUIRED: Calculate the carrying amount of the investment in Caller Ltd at 30 June 2017 under the equity method (Associate). [8 Marks] Page 6 of 9

Step by Step Solution

★★★★★

3.38 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER PARTICULARS CARRYING VALUE LESS INDIVIDUAL IMPAIRMENT REVISE CARRYIN...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started