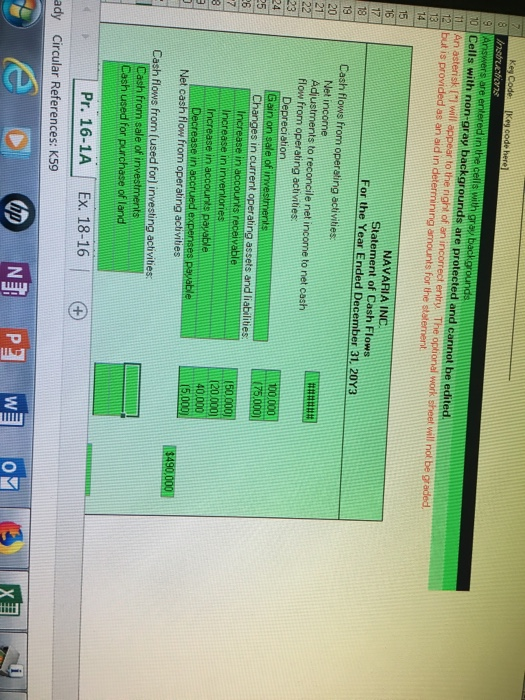

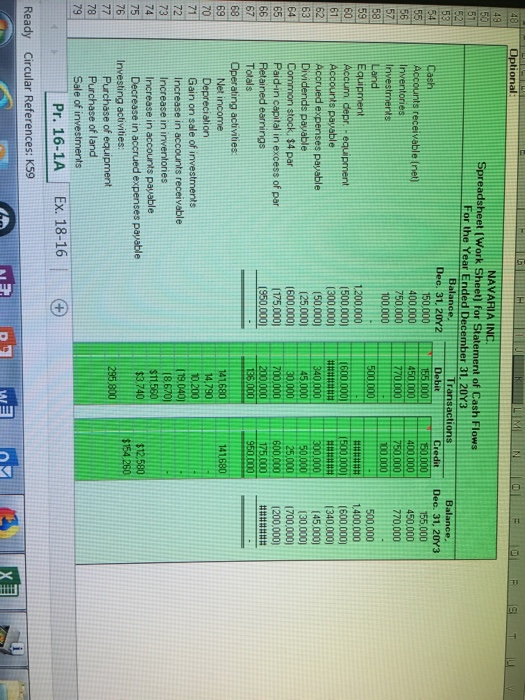

Cells with non-gray backgrounds are protected and cannot be edited.lm 2but is provided as an aid in determining amounts for the staternent NAVARIA INC. Statement of Cash Flows For the Year Ended December 31. 20Y3 Cash flows from operating activities Net income Adjustments to reconcile net income to net cash flow from operating activities: iation es in current operating assets and liabilities Increase in inventories 40 000 $490,000 Net cash flow from operating activities Cash flows from (used for) investing activities rom sale Cesh used for purchase of land | Pr. 16-1A | Ex. 18-16 | Circular References: K59 ady Optional NAVARIA INC Spreadsheet (Work Sheet) for Statement of Cash Flows For the Year Ended December 31. 20Y3 49 Balance. Dec. 31. 20Y2 Balance Dec. 31, 20Y3 Credit 150000 400,000 150000 155.000 450,000 770000 Accounts receivable ( Inventories 750.000 57 100,000 500,000 500000 Equipment 59 1200,000 (500,000) Accum depr. Hequipment Accounts payable Accrued expenses payable Dividends payable Common stock. $4 par Paid-in capital in excess of par Retained earnings Totals 1500 0001(600,000) 600000 (45.000] 30,000) 25,0001700,000) 600,000 1200,000) 300,000 50000 (50,000) (25,000) (600,000 (175,000) 340000 45.000 30000 700000 63 ### 17500 67 Operating activities 141 14.790 Net income Depreciation Gain on sale of investments Increase in accounts receivable Increase in inventories Increase in accounts payable $12.580 $154 Investing activities: Purchase of equipment Purchase of land Ex. 18-16G Pr. 16-1A Circular References: K59 Ready Cells with non-gray backgrounds are protected and cannot be edited.lm 2but is provided as an aid in determining amounts for the staternent NAVARIA INC. Statement of Cash Flows For the Year Ended December 31. 20Y3 Cash flows from operating activities Net income Adjustments to reconcile net income to net cash flow from operating activities: iation es in current operating assets and liabilities Increase in inventories 40 000 $490,000 Net cash flow from operating activities Cash flows from (used for) investing activities rom sale Cesh used for purchase of land | Pr. 16-1A | Ex. 18-16 | Circular References: K59 ady Optional NAVARIA INC Spreadsheet (Work Sheet) for Statement of Cash Flows For the Year Ended December 31. 20Y3 49 Balance. Dec. 31. 20Y2 Balance Dec. 31, 20Y3 Credit 150000 400,000 150000 155.000 450,000 770000 Accounts receivable ( Inventories 750.000 57 100,000 500,000 500000 Equipment 59 1200,000 (500,000) Accum depr. Hequipment Accounts payable Accrued expenses payable Dividends payable Common stock. $4 par Paid-in capital in excess of par Retained earnings Totals 1500 0001(600,000) 600000 (45.000] 30,000) 25,0001700,000) 600,000 1200,000) 300,000 50000 (50,000) (25,000) (600,000 (175,000) 340000 45.000 30000 700000 63 ### 17500 67 Operating activities 141 14.790 Net income Depreciation Gain on sale of investments Increase in accounts receivable Increase in inventories Increase in accounts payable $12.580 $154 Investing activities: Purchase of equipment Purchase of land Ex. 18-16G Pr. 16-1A Circular References: K59 Ready