Question

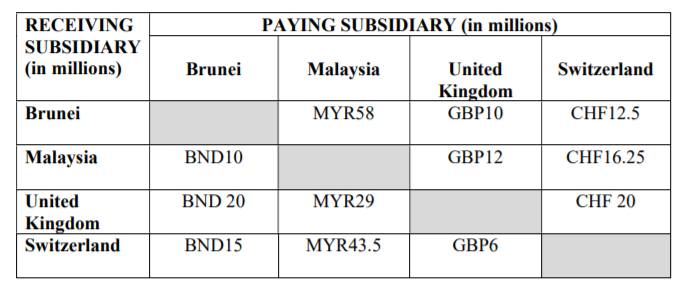

Cemerlang Inc. is a conglomerate company which has four subsidiaries located in Brunei, Malaysia, United Kingdom, and Switzerland. The exchange rates available for the company

Cemerlang Inc. is a conglomerate company which has four subsidiaries located in Brunei, Malaysia, United Kingdom, and Switzerland. The exchange rates available for the company are MYR2.9000/BND, GBP0.4000/BND and BND1.2500/CHF. The following is the intersubsidiary payments matrix for Cemerlang Inc in multiple currency.

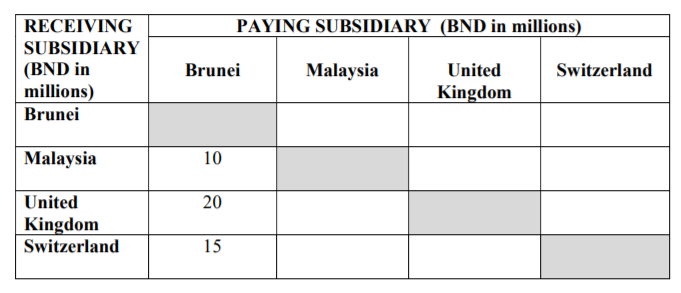

a. Convert all the cash flows into Brunei Dollar (BND) and fill in the table cells below to show the intersubsidiary payments matrix for Cemerlang Group. If the transaction cost is 2%, how much the company need to pay (in BND) if they decided not to do any netting?

Transaction cost in BND with no netting.

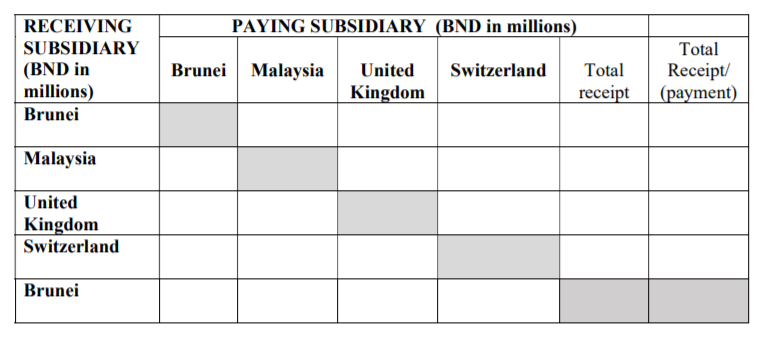

b. Perform multilateral netting by filling up the table below. If the transaction cost is 2%, how much the company need to pay (in BND) if they decided to do multilateral netting?

Transaction cost in BND with multilateral netting.

RECEIVING SUBSIDIARY (in millions) Brunei Malaysia United Kingdom Switzerland Brunei BND10 BND 20 BND15 PAYING SUBSIDIARY (in millions) Malaysia MYR58 MYR29 MYR43.5 United Kingdom GBP10 GBP12 GBP6 Switzerland CHF12.5 CHF16.25 CHF 20 RECEIVING SUBSIDIARY (BND in millions) Brunei Malaysia United Kingdom Switzerland Brunei 10 20 PAYING SUBSIDIARY (BND in millions) 15 Malaysia United Kingdom Switzerland RECEIVING SUBSIDIARY (BND in millions) Brunei Malaysia United Kingdom Switzerland Brunei PAYING SUBSIDIARY (BND in millions) Brunei Malaysia United Switzerland Total Kingdom receipt Total Receipt/ (payment)

Step by Step Solution

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answers RECEIVING SUBSIDIARYBRUENI A Calculation Paying Subsidiary Amount in BND ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started