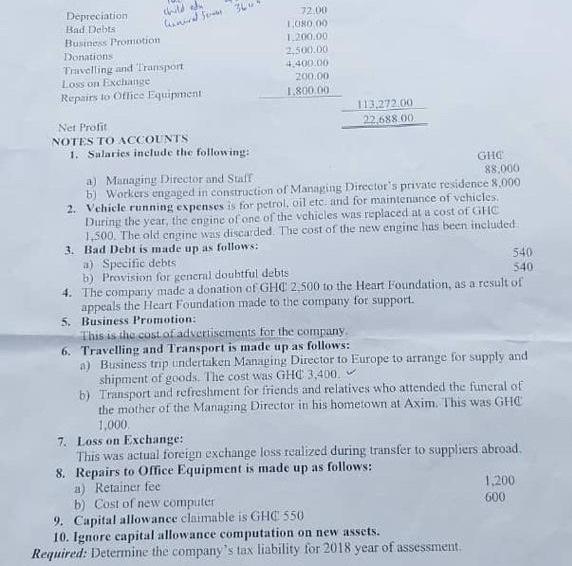

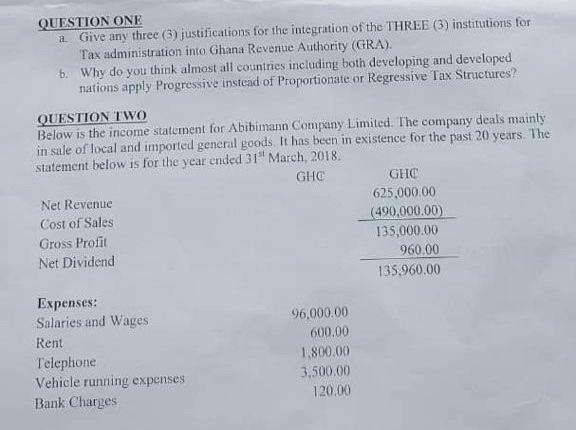

Cennival ho 360 Depreciation 72.00 Bad Debts 1 UND 00 Business Promotion 1.200,00 Donations 2.500.00 Travelling and Transport 4.400.00 Loss on Exchange 200.00 Repairs to Office Equipment 1.800.00 113.272.00 Net Prolit 22.688.00 NOTES TO ACCOUNTS 1. Salaries include the following: GHG a) Managing Director and State 88,000 b) Workers engaged in construction of Managing Director's private residence 8.000 2. Vehicle running expenses is for petrol, oil etc and for maintenance of vehicles During the year, the engine of one of the chicles was replaced at a cost of GHO 1,500. The old engine was discarded. The cost of the new engine has been included 3. Bad Debt is made up as follows: a) Specific debts 540 b) Provision for general doubtful debts 540 4. The company made a donation of GHC 2.500 to the Heart Foundation, as a result of appeals the Heart Foundation made to the company for support. 5. Business Promotion: This is the cost of advertisements for the company 6. Travelling and Transport is made up as follows: a) Business trip undertaken Managing Director to Europe to arrange for supply and shipment of goods. The cost was GHC 3,400. b) Transport and refreshment for friends and relatives who attended the funcral of the mother of the Managing Director in his hometown at Axim. This was GHC 1,000 7. Loss on Exchange: This was actual foreign exchange loss realized during transfer to suppliers abroad, 8. Repairs to Office Equipment is made up as follows: a) Retainer fee 1.200 b) Cost of new computer 600 9. Capital allowance claimable is GHC 550 10. Ignore capital allowance computation on new assets. Required: Determine the company's tax liability for 2018 year of assessment QUESTION ONE a Give any three (3) justifications for the integration of the THREE (3) institutions for Tax administration into Ghana Revenue Authority (GRA). b. Why do you think almost all countries including both developing and developed nations apply Progressive instead of Proportionate or Regressive Tax Structures? QUESTION TWO Below is the income statement for Abiblmann Company Limited. The company deals mainly in sule of local and imported general goods. It has been in existence for the past 20 years. The statement below is for the year ended 31 March, 2018 GHG GHO Net Revenue 625,000.00 Cost of Sales (490,000.00) Gross Profit 135,000.00 Net Dividend 960.00 135.960.00 Expenses: Salaries and Wages 96,000.00 Rent 600.00 Telephone 1.800.00 Vehicle running expenses 3,500.00 Bank Charges 120.00 Cennival ho 360 Depreciation 72.00 Bad Debts 1 UND 00 Business Promotion 1.200,00 Donations 2.500.00 Travelling and Transport 4.400.00 Loss on Exchange 200.00 Repairs to Office Equipment 1.800.00 113.272.00 Net Prolit 22.688.00 NOTES TO ACCOUNTS 1. Salaries include the following: GHG a) Managing Director and State 88,000 b) Workers engaged in construction of Managing Director's private residence 8.000 2. Vehicle running expenses is for petrol, oil etc and for maintenance of vehicles During the year, the engine of one of the chicles was replaced at a cost of GHO 1,500. The old engine was discarded. The cost of the new engine has been included 3. Bad Debt is made up as follows: a) Specific debts 540 b) Provision for general doubtful debts 540 4. The company made a donation of GHC 2.500 to the Heart Foundation, as a result of appeals the Heart Foundation made to the company for support. 5. Business Promotion: This is the cost of advertisements for the company 6. Travelling and Transport is made up as follows: a) Business trip undertaken Managing Director to Europe to arrange for supply and shipment of goods. The cost was GHC 3,400. b) Transport and refreshment for friends and relatives who attended the funcral of the mother of the Managing Director in his hometown at Axim. This was GHC 1,000 7. Loss on Exchange: This was actual foreign exchange loss realized during transfer to suppliers abroad, 8. Repairs to Office Equipment is made up as follows: a) Retainer fee 1.200 b) Cost of new computer 600 9. Capital allowance claimable is GHC 550 10. Ignore capital allowance computation on new assets. Required: Determine the company's tax liability for 2018 year of assessment QUESTION ONE a Give any three (3) justifications for the integration of the THREE (3) institutions for Tax administration into Ghana Revenue Authority (GRA). b. Why do you think almost all countries including both developing and developed nations apply Progressive instead of Proportionate or Regressive Tax Structures? QUESTION TWO Below is the income statement for Abiblmann Company Limited. The company deals mainly in sule of local and imported general goods. It has been in existence for the past 20 years. The statement below is for the year ended 31 March, 2018 GHG GHO Net Revenue 625,000.00 Cost of Sales (490,000.00) Gross Profit 135,000.00 Net Dividend 960.00 135.960.00 Expenses: Salaries and Wages 96,000.00 Rent 600.00 Telephone 1.800.00 Vehicle running expenses 3,500.00 Bank Charges 120.00