Question

CEO Pulisic is considering an investment option: (20 points) His firm only likes investments with an IRR of 10% or more, in order to decide

CEO Pulisic is considering an investment option: (20 points)

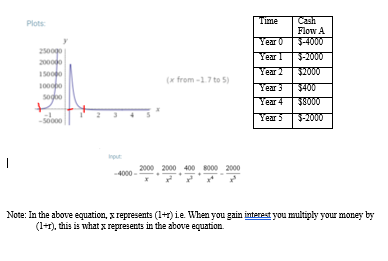

His firm only likes investments with an IRR of 10% or more, in order to decide whether this option is acceptable, the CEO first decides to calculate the IRR of the cash flow stream. He does this by calculating the NPV(Y) of the cash flow stream given a rate of return (X), and plots the result (generally the point where this plot crosses the x axis is the IRR). The equation he plots is (Y=) :

His plot looks like this

Unfortunately, this plot crosses the X axis at 3 places! So it has multiple possible rates of return. These can be seen in the graph, though the exact values show up in the link. The zeroes are approximately x= (-1.49,0.24, 1.12) . The CEO wants to understand what each of these numbers mean. He knows that since x is (1+r) if he were to invest $1 and get an interest rate of x, his money after a single period would become x. So for the first rate, i.e. -1.49, this means his $1 of money (assets), would become $1.49 of debt. Similarly if he waits another period, it would turn into $2.22 of assets. The CEO knows this is impossible, otherwise he could get rid of all his companys debt by investing it here for 1 period. Real interest rates either shrink or grow the investment, they cannot negate it, i.e. 0

- The CEO first notices that he could always turn multiple negative cash flows into a single negative cash flow by adding all the negative cash flows together, getting that much money at time 0, and just holding onto it until he needs to make the payments. Calculate the IRR of the above cash flow stream if all the negative cash flows are moved to year 0. (10 points)

- The CEO also knows that he doesnt have to just hold on to the money at time 0, he can find a temporary fund to invest it and then withdraw money to pay for the negative cash flows. However, hes not sure how well his investment will have to do to make the whole plan worthwhile. If the minimum attractive interest rate for the company is 10%, calculate what the temporary funds interest rate (annual effective) will have to be. (i.e. what fund interest rate makes the overall project have an IRR of 10%) (10 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started