Question

*Founded in 1906, American Greetings operates predominantly in a single industry: the design, manufacture and sale of everyday and seasonal greeting cards and other social

*“Founded in 1906, American Greetings operates predominantly in a single industry: the design, manufacture and sale of everyday and seasonal greeting cards and other social expression products.” 10-K

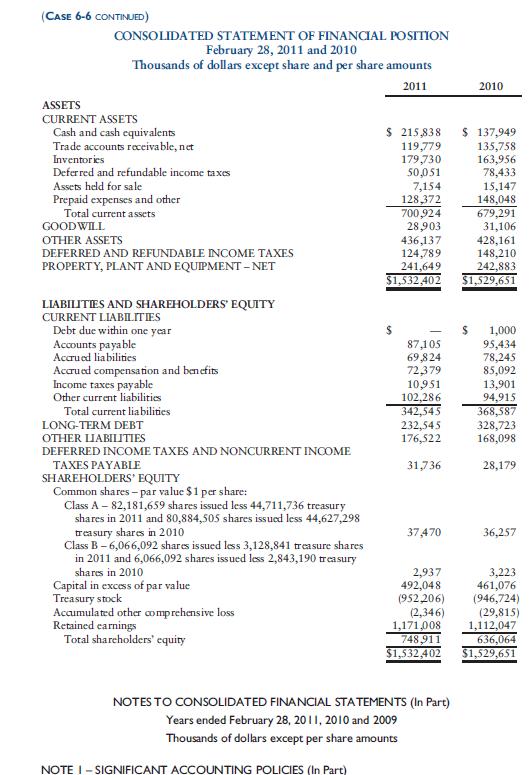

Cash Equivalents: The Corporation considers all highly liquid instruments purchased with an original maturity of less than three months to be cash equivalents.

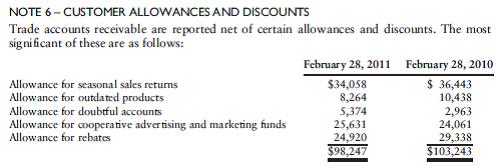

Allowance for Doubtful Accounts: The Corporation evaluates the collectibility of its accounts receivable based on a combination of factors. In circumstances where the Corporation is aware of a customer’s inability to meet its financial obligations, a specific allowance for bad debts against amounts due is recorded to reduce the receivable to the amount the Corporation reasonably expects will be collected. In addition, the Corporation recognizes allowances for bad debts based on estimates developed by using standard quantitative measures incorporating historical write-offs. See Note 6 for further information.

Customer Allowances and Discounts: The Corporation offers certain of its customers allowances and discounts including cooperative advertising, rebates, marketing allowances and various other allowances and discounts. These amounts are recorded as reductions of gross accounts receivable or included in accrued liabilities and are recognized as reductions of net sales when earned. These amounts are earned by the customer as product is purchased from the Corporation and are recorded based on the terms of individual customer contracts. See Note 6 for further information.

Concentration of Credit Risks: The Corporation sells primarily to customers in the retail trade, including those in the mass merchandise, drug store, discount retailer, supermarket and other channels of distribution. These customers are located throughout the United States, Canada, the United Kingdom, Australia, New Zealand and Mexico. Net sales from continuing operations to the Corporation’s five largest customers accounted for approximately 42%, 39% and 36% of total revenue in 2011, 2010 and 2009, respectively. Net sales to Wal-Mart Stores, Inc. and its subsidiaries accounted for approximately 15%, 14% and 15% of total revenue in 2011, 2010 and 2009, respectively. Net sales to Target Corporation accounted for approximately 14% and 13% of total revenue in 2011 and 2010, respectively, and less than 10% in 2009.

The Corporation conducts business based on periodic evaluations of its customers’ financial condition and generally does not require collateral to secure their obligation to the Corporation. While the competitiveness of the retail industry presents an inherent uncertainty, the Corporation does not believe a significant risk of loss exists from a concentration of credit.

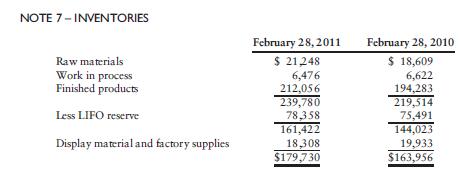

Inventories: Finished products, work in process and raw materials inventories are carried at the lower of cost or market. The last-in, first-out (LIFO) cost method is used for certain domestic inventories, which approximate 80% of the total pre-LIFO consolidated inventories at February 28, 2011 and 2010, respectively. International inventories and the remaining domestic inventories principally use the first-in, first-out (FIFO) method except for display material and factory supplies which are carried at average cost. The Corporation allocates fixed production overhead to inventory based on the normal capacity of the production facilities. Abnormal amounts of idle facility expense, freight, handling costs and wasted material are treated as a current period expense. See Note 7 for further information.

Certain customer allowances and discounts are settled in cash. These accounts, primarily rebates, which are classified as “Accrued liabilities” on the Consolidated Statement of Financial Position, totaled $11,913 and $15,326 as of February 28, 2011 and 2010, respectively.

There were no material LIFO liquidations in 2011 and 2009. During 2010, inventory quantities declined resulting in the liquidation of LIFO inventory layers carried at lower costs compared with current year purchases. The income statement effect of such liquidation on material, labor and other production costs was approximately $13,000. Inventory held on location for retailers with SBT arrangements, which is included in finished products, totaled

approximately $42,000 and $38,000 as of February 28, 2011 and 2010, respectively.

a. Based on these data, calculate the following for 2011 and 2010:

1. Days’ sales in receivables

2. Accounts receivable turnover (gross receivables at year-end)

3. Days’ sales in inventory

4. Inventory turnover (use inventory at year-end)

5. Working capital

6. Current ratio

7. Acid-test ratio

b. Comment on each ratio individually.

c. 1. Describe the individual allowance consideration.

2. Are some of these allowance considerations normal for most companies?

d. What would be the inventory balance at February 28, 2011 if the LIFO reserve were removed?

e. Were there material LIFO liquidations in 2011, 2010 or 2009?

f. Comment on the apparent total liquidity.

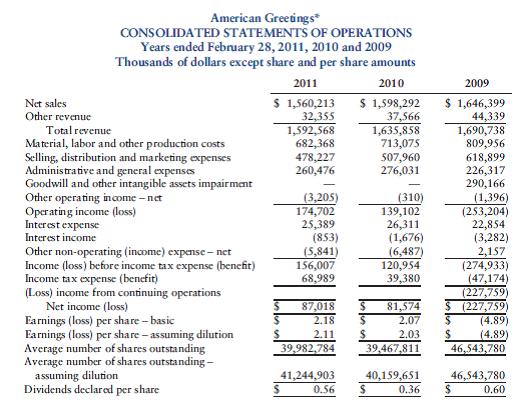

Net sales Other revenue American Greetings* CONSOLIDATED STATEMENTS OF OPERATIONS Years ended February 28, 2011, 2010 and 2009 Thousands of dollars except share and per share amounts 2011 2010 Total revenue Material, labor and other production costs Selling, distribution and marketing expenses Administrative and general expenses Goodwill and other intangible assets impairment Other operating income - net Operating income (loss) Interest expense Interest income Other non-operating (income) expense-net Income (loss) before income tax expense (benefit) Income tax expense (benefit) (Loss) income from continuing operations Net income (loss) Earnings (loss) per share-basic Earnings (loss) per share-assuming dilution Average number of shares outstanding Average number of shares outstanding - assuming dilution Dividends declared per share $ 1,560,213 32,355 1,592,568 682,368 478,227 260,476 (3,205) $ 174,702 25,389 (853) (5,841) 156,007 68,989 87,018 2.18 2.11 39,982,784 41,244,903 0.56 $ 1,598,292 37,566 1,635,858 713,075 507,960 276,031 $ (310) 139,102 26,311 (1,676) (6,487) 120,954 39,380 81,574 2.07 2.03 39,467,811 40,159,651 0.36 2009 $ 1,646,399 44,339 1,690,738 809,956 618,899 226,317 290,166 (1,396) (253,204) 22,854 (3,282) 2,157 (274,933) (47,174) (227,759) $ (227,759) (4.89) (4.89) 46,543,780 46,543,780 0.60

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a 1 Compute the days sales in receivables Formula for days ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started