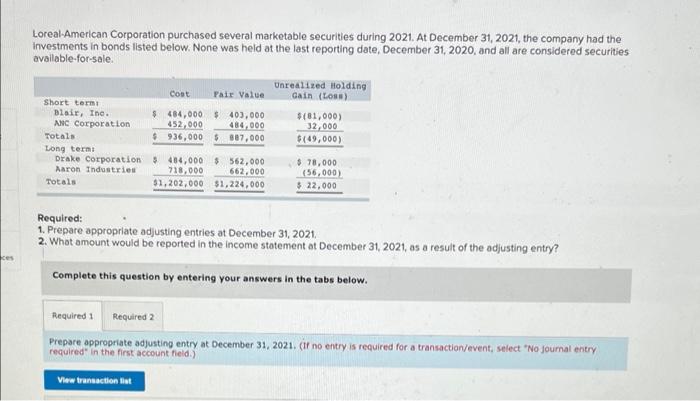

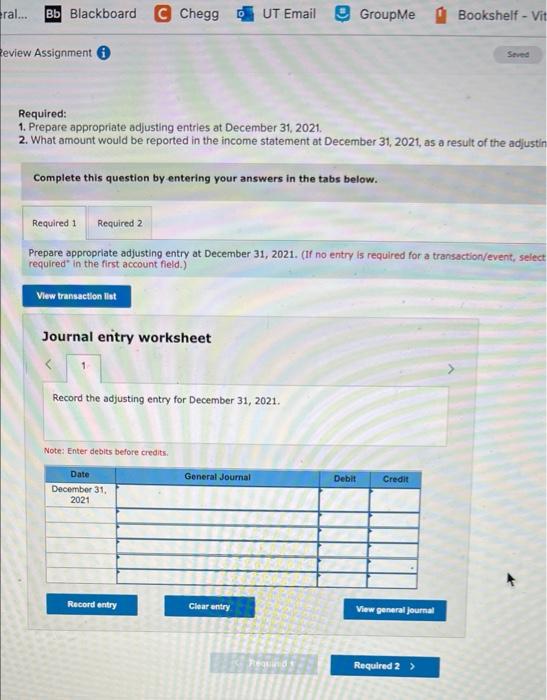

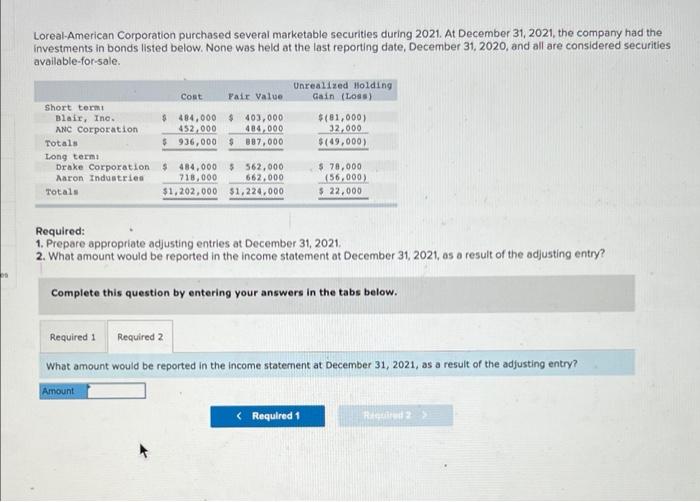

ces Loreal-American Corporation purchased several marketable securities during 2021. At December 31, 2021, the company had the investments in bonds listed below. None was held at the last reporting date, December 31, 2020, and all are considered securities available-for-sale. Short term: Blair, Inc. ANC Corporation. Totals Long term: Drake Corporation Aaron Industries Totals Cost Fair Value $ 484,000 $ 403,000 452,000 484,000 $936,000 $ 987,000 $ 484,000 $ 562,000 718,000 662,000 $1,202,000 $1,224,000 Unrealized Holding Gain (Loss) $(81,000) 32,000 $(49,000) $ 78,000 (56,000) $ 22,000 Required: 1. Prepare appropriate adjusting entries at December 31, 2021. 2. What amount would be reported in the income statement at December 31, 2021, as a result of the adjusting entry? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare appropriate adjusting entry at December 31, 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list eral... Bb Blackboard C CheggUT Email GroupMe Review Assignment Complete this question by entering your answers in the tabs below. Required: 1. Prepare appropriate adjusting entries at December 31, 2021. 2. What amount would be reported in the income statement at December 31, 2021, as a result of the adjustin View transaction list Required 1 Required 2 Prepare appropriate adjusting entry at December 31, 2021. (If no entry is required for a transaction/event, select required in the first account field.) Journal entry worksheet Record the adjusting entry for December 31, 2021. Note: Enter debits before credits. Date December 31, 2021 Record entry General Journal Clear entry Requind Debit Credit Bookshelf - Vit View general journal Seved Required 2 > Loreal-American Corporation purchased several marketable securities during 2021. At December 31, 2021, the company had the investments in bonds listed below. None was held at the last reporting date, December 31, 2020, and all are considered securities available-for-sale. Short termi Blair, Inc. ANC Corporation Totals Long term: Drake Corporation Aaron Industries Totals Cost Fair Value Amount $ 484,000 $403,000 452,000 484,000 $936,000 $ 887,000 $ 484,000 $ 562,000 718,000 662,000 $1,202,000 $1,224,000 Unrealized Holding Gain (Loss) $(81,000) 32,000 $(49,000) Required: 1. Prepare appropriate adjusting entries at December 31, 2021. 2. What amount would be reported in the income statement at December 31, 2021, as a result of the adjusting entry? Complete this question by entering your answers in the tabs below. $ 78,000 (56,000) $ 22,000 Required 1 Required 2 What amount would be reported in the income statement at December 31, 2021, as a result of the adjusting entry?