Answered step by step

Verified Expert Solution

Question

1 Approved Answer

to e not 4 Williams's part has been growing in the past 2 years, management is not only aware of the cyclical nature of

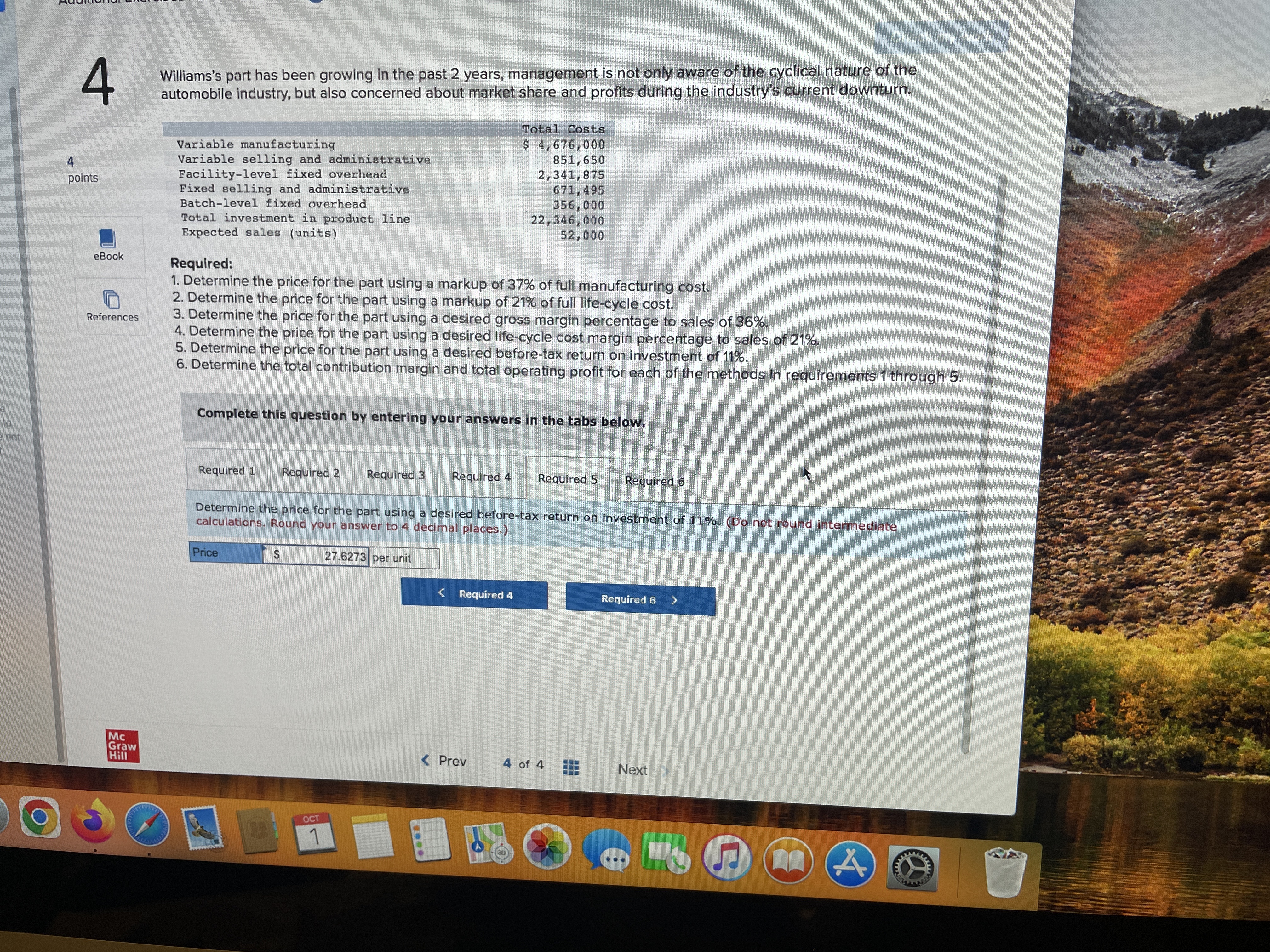

to e not 4 Williams's part has been growing in the past 2 years, management is not only aware of the cyclical nature of the automobile industry, but also concerned about market share and profits during the industry's current downturn. Total Costs 4 points eBook References Variable manufacturing Variable selling and administrative Facility-level fixed overhead Fixed selling and administrative Batch-level fixed overhead Total investment in product line Expected sales (units) Required: $ 4,676,000 851,650 2,341,875 671,495 356,000 22,346,000 52,000 1. Determine the price for the part using a markup of 37% of full manufacturing cost. 2. Determine the price for the part using a markup of 21% of full life-cycle cost. 3. Determine the price for the part using a desired gross margin percentage to sales of 36%. 4. Determine the price for the part using a desired life-cycle cost margin percentage to sales of 21%. 5. Determine the price for the part using a desired before-tax return on investment of 11%. 6. Determine the total contribution margin and total operating profit for each of the methods in requirements 1 through 5. Mc Graw Hill Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Determine the price for the part using a desired before-tax return on investment of 11%. (Do not round intermediate calculations. Round your answer to 4 decimal places.) Price $ OCT 27.6273 per unit V Required 4 Required 6 > < Prev 4 of 4 Next>> *

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Description Calculate the price and profitability metrics for a part produced by Williams considering various pricing strategies Given Data Total Vari...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started