Answered step by step

Verified Expert Solution

Question

1 Approved Answer

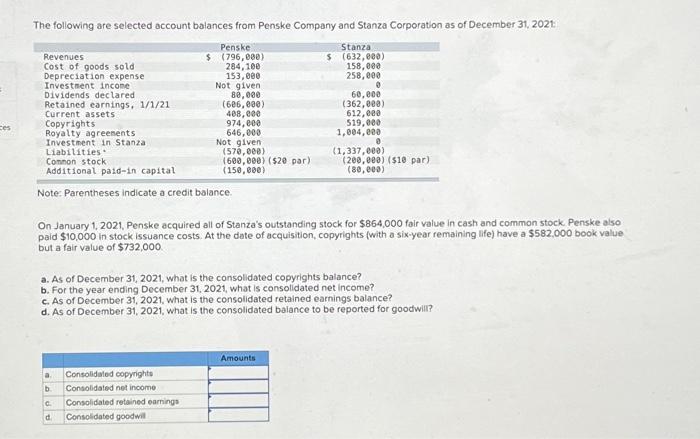

ces The following are selected account balances from Penske Company and Stanza Corporation as of December 31, 2021: Revenues Cost of goods sold Depreciation expense.

ces The following are selected account balances from Penske Company and Stanza Corporation as of December 31, 2021: Revenues Cost of goods sold Depreciation expense. Investment income Dividends declared Retained earnings, 1/1/21 Current assets Copyrights Royalty agreements Investment in Stanza Liabilities* $ Common stock Additional paid-in capital Note: Parentheses indicate a credit balance. Penske (796,000) 284,100 153,000 Not given 80,000 (606,000) 408,000 974,000 646,000 Not given (570,000) (600,000) ($20 par) (150,000) a. Consolidated copyrights b. Consolidated net income Consolidated retained earnings Consolidated goodwill C. d. $ Stanza (632,000) 158,000 258,000 Amounts 60,000 (362,000) 612,000 519,000 1,004,000 On January 1, 2021, Penske acquired all of Stanza's outstanding stock for $864,000 fair value in cash and common stock. Penske also paid $10,000 in stock issuance costs. At the date of acquisition, copyrights (with a six-year remaining life) have a $582,000 book value but a fair value of $732,000. (1,337,000) a. As of December 31, 2021, what is the consolidated copyrights balance? b. For the year ending December 31, 2021, what is consolidated net income? c. As of December 31, 2021, what is the consolidated retained earnings balance? d. As of December 31, 2021, what is the consolidated balance to be reported for goodwill? (200,000) ($10 par) (80,000)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started