Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cetak Bhd sells and leases out machines that print on bags. On January 2016, Cetak Bhd entered into a three-year non-cancellable lease with Intan

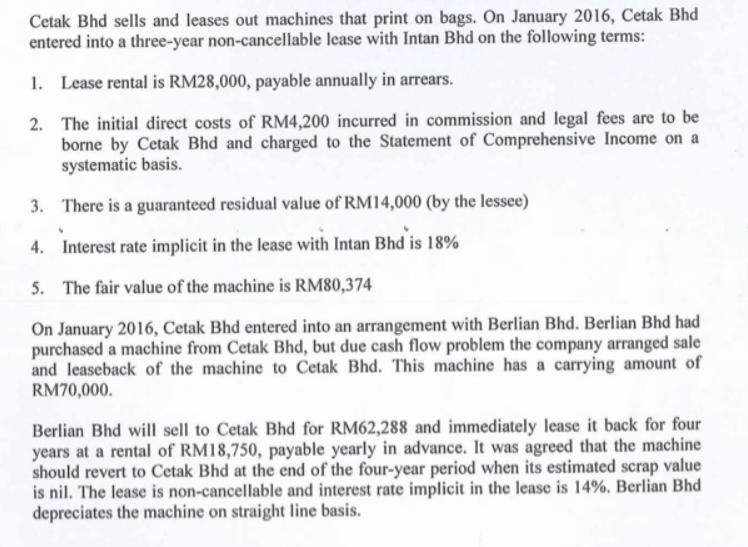

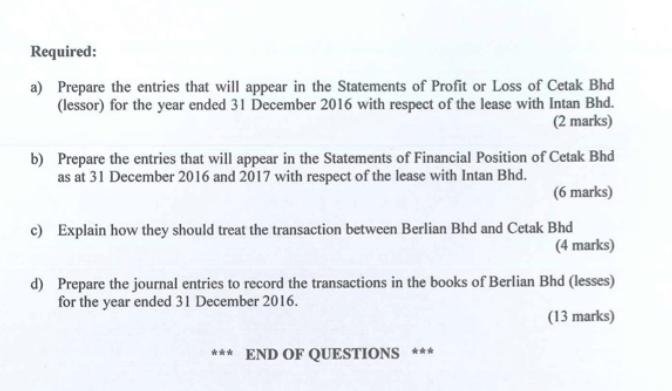

Cetak Bhd sells and leases out machines that print on bags. On January 2016, Cetak Bhd entered into a three-year non-cancellable lease with Intan Bhd on the following terms: 1. Lease rental is RM28,000, payable annually in arrears. 2. The initial direct costs of RM4,200 incurred in commission and legal fees are to be borne by Cetak Bhd and charged to the Statement of Comprehensive Income on a systematic basis. 3. There is a guaranteed residual value of RM14,000 (by the lessee) 4. Interest rate implicit in the lease with Intan Bhd is 18% 5. The fair value of the machine is RM80,374 On January 2016, Cetak Bhd entered into an arrangement with Berlian Bhd. Berlian Bhd had purchased a machine from Cetak Bhd, but due cash flow problem the company arranged sale and leaseback of the machine to Cetak Bhd. This machine has a carrying amount of RM70,000. Berlian Bhd will sell to Cetak Bhd for RM62,288 and immediately lease it back for four years at a rental of RM18,750, payable yearly in advance. It was agreed that the machine should revert to Cetak Bhd at the end of the four-year period when its estimated scrap value is nil. The lease is non-cancellable and interest rate implicit in the lease is 14%. Berlian Bhd depreciates the machine on straight line basis. Required: a) Prepare the entries that will appear in the Statements of Profit or Loss of Cetak Bhd (lessor) for the year ended 31 December 2016 with respect of the lease with Intan Bhd. (2 marks) b) Prepare the entries that will appear in the Statements of Financial Position of Cetak Bhd as at 31 December 2016 and 2017 with respect of the lease with Intan Bhd. (6 marks) c) Explain how they should treat the transaction between Berlian Bhd and Cetak Bhd (4 marks) d) Prepare the journal entries to record the transactions in the books of Berlian Bhd (lesses) for the year ended 31 December 2016. (13 marks) *** END OF QUESTIONS ***

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

EY Building a better working world Answer Working Notes Calcul...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started