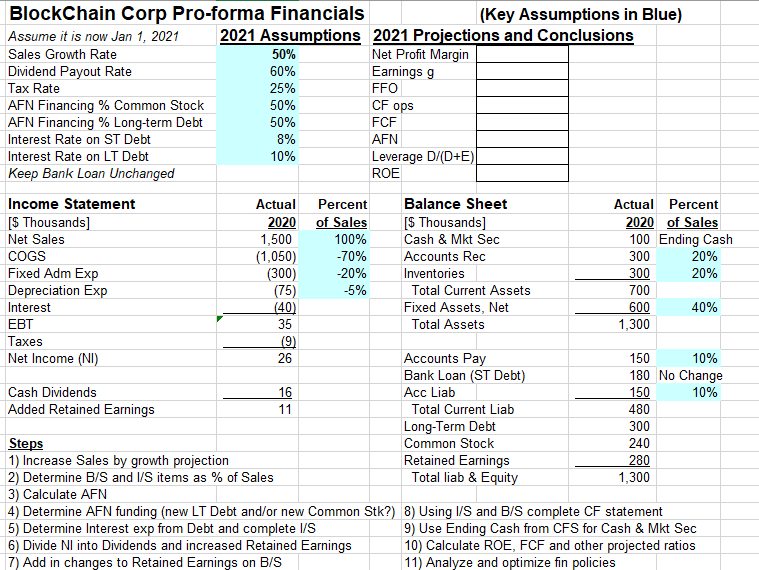

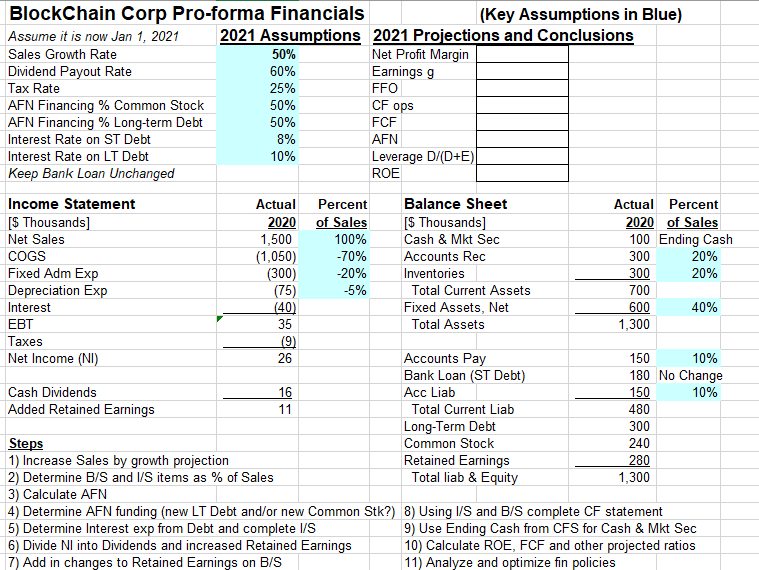

CF ops BlockChain Corp Pro-forma Financials (Key Assumptions in Blue) Assume it is now Jan 1, 2021 2021 Assumptions 2021 Projections and Conclusions Sales Growth Rate 50% Net Profit Margin Dividend Payout Rate 60% Earnings g Tax Rate 25% FFO AFN Financing % Common Stock 50% AFN Financing % Long-term Debt 50% FCF Interest Rate on ST Debt 8% AFN Interest Rate on LT Debt 10% Leverage D/(D+E) Keep Bank Loan Unchanged ROE Income Statement Actual Percent Balance Sheet Actual Percent [$ Thousands) 2020 of Sales [$ Thousands] 2020 of Sales Net Sales 1,500 100% Cash & Mkt Sec 100 Ending Cash COGS (1,050) -70% Accounts Rec 300 20% Fixed Adm Exp (300) -20% Inventories 300 20% Depreciation Exp (75) -5% Total Current Assets 700 Interest (40) Fixed Assets, Net 600 40% EBT 35 Total Assets 1,300 Taxes (9) Net Income (NI) 26 Accounts Pay 10% Bank Loan (ST Debt) 180 No Change Cash Dividends 16 Acc Liab 150 10% Added Retained Earnings 11 Total Current Liab 480 Long-Term Debt 300 Steps Common Stock 240 1) Increase Sales by growth projection Retained Earnings 280 2) Determine B/S and I/S items as % of Sales Total liab & Equity 1,300 3) Calculate AFN 4) Determine AFN funding (new LT Debt and/or new Common Stk?) 8) Using I/S and B/S complete CF statement 5) Determine Interest exp from Debt and complete I/S 9) Use Ending Cash from CFS for Cash & Mkt Sec 6) Divide Nl into Dividends and increased Retained Earnings 10) Calculate ROE, FCF and other projected ratios 7) Add in changes to Retained Earnings on B/S 11) Analyze and optimize fin policies 150 CF ops BlockChain Corp Pro-forma Financials (Key Assumptions in Blue) Assume it is now Jan 1, 2021 2021 Assumptions 2021 Projections and Conclusions Sales Growth Rate 50% Net Profit Margin Dividend Payout Rate 60% Earnings g Tax Rate 25% FFO AFN Financing % Common Stock 50% AFN Financing % Long-term Debt 50% FCF Interest Rate on ST Debt 8% AFN Interest Rate on LT Debt 10% Leverage D/(D+E) Keep Bank Loan Unchanged ROE Income Statement Actual Percent Balance Sheet Actual Percent [$ Thousands) 2020 of Sales [$ Thousands] 2020 of Sales Net Sales 1,500 100% Cash & Mkt Sec 100 Ending Cash COGS (1,050) -70% Accounts Rec 300 20% Fixed Adm Exp (300) -20% Inventories 300 20% Depreciation Exp (75) -5% Total Current Assets 700 Interest (40) Fixed Assets, Net 600 40% EBT 35 Total Assets 1,300 Taxes (9) Net Income (NI) 26 Accounts Pay 10% Bank Loan (ST Debt) 180 No Change Cash Dividends 16 Acc Liab 150 10% Added Retained Earnings 11 Total Current Liab 480 Long-Term Debt 300 Steps Common Stock 240 1) Increase Sales by growth projection Retained Earnings 280 2) Determine B/S and I/S items as % of Sales Total liab & Equity 1,300 3) Calculate AFN 4) Determine AFN funding (new LT Debt and/or new Common Stk?) 8) Using I/S and B/S complete CF statement 5) Determine Interest exp from Debt and complete I/S 9) Use Ending Cash from CFS for Cash & Mkt Sec 6) Divide Nl into Dividends and increased Retained Earnings 10) Calculate ROE, FCF and other projected ratios 7) Add in changes to Retained Earnings on B/S 11) Analyze and optimize fin policies 150