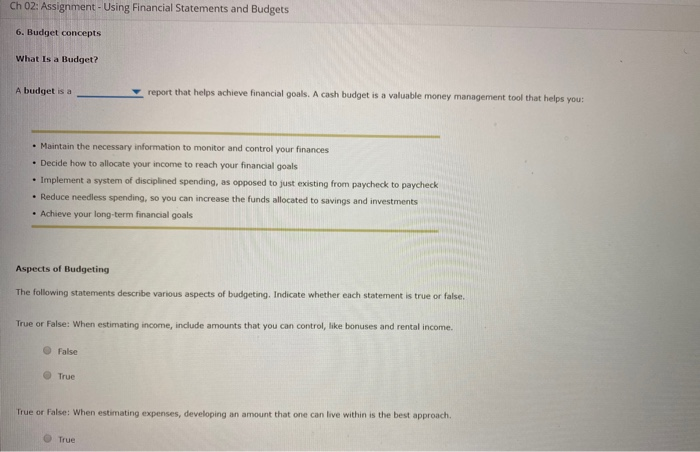

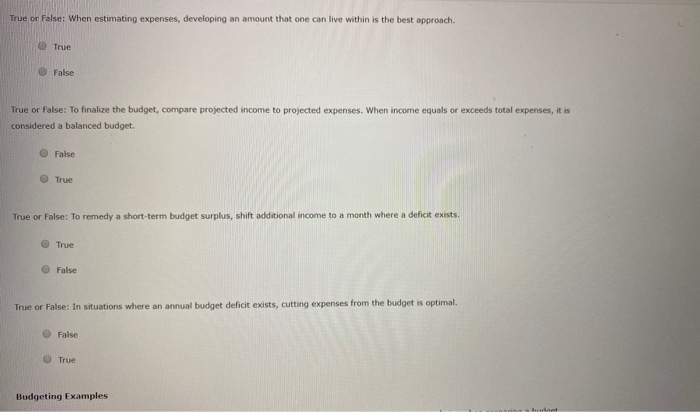

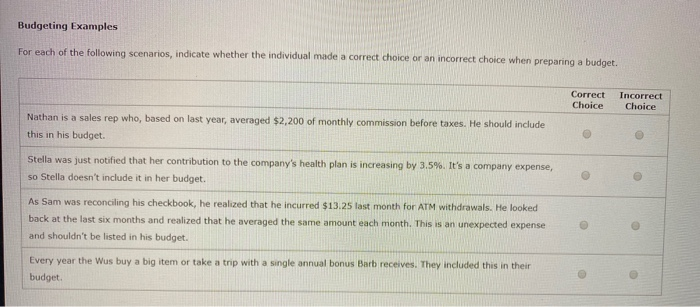

Ch 02: Assignment - Using Financial Statements and Budgets 6. Budget concepts What Is a Budget? A budget is a report that helps achieve financial goals. A cash budget is a valuable money management tool that helps you: Maintain the necessary information to monitor and control your finances Decide how to allocate your income to reach your financial goals Implement a system of disciplined spending, as opposed to just existing from paycheck to paycheck Reduce needless spending, so you can increase the funds allocated to savings and investments Achieve your long-term financial goals Aspects of Budgeting The following statements describe various aspects of budgeting. Indicate whether each statement is true or false. True or False: When estimating income, include amounts that you can control, like bonuses and rental income. False True True or False: When estimating expenses, developing an amount that one can live within is the best approach. True True or False: When estimating expenses, developing an amount that one can live within is the best approach. True False True or False: To finalize the budget, compare projected income to projected expenses. When income equals or exceeds total expenses, it is considered a balanced budget. False True True or False: To remedy a short-term budget surplus, shift additional income to a month where a deficit exists. True False True or False: In situations where an annual budget deficit exists, cutting expenses from the budget is optimal. False True Budgeting Examples Budgeting Examples For each of the following scenarios, indicate whether the individual made a correct choice or an incorrect choice when preparing a budget. Correct Choice Incorrect Choice Nathan is a sales rep who, based on last year, averaged $2,200 of monthly commission before taxes. He should include this in his budget. Stella was just notified that her contribution to the company's health plan is increasing by 3.5%. It's a company expense, so Stella doesn't include it in her budget. As Sam was reconciling his checkbook, he realized that he incurred $13.25 last month for ATM withdrawals. He looked back at the last six months and realized that he averaged the same amount each month. This is an unexpected expense and shouldn't be listed in his budget. Every year the Wus buy a big item or take a trip with a single annual bonus Barb receives. They included this in their budget Ch 02: Assignment - Using Financial Statements and Budgets 6. Budget concepts What Is a Budget? A budget is a report that helps achieve financial goals. A cash budget is a valuable money management tool that helps you: Maintain the necessary information to monitor and control your finances Decide how to allocate your income to reach your financial goals Implement a system of disciplined spending, as opposed to just existing from paycheck to paycheck Reduce needless spending, so you can increase the funds allocated to savings and investments Achieve your long-term financial goals Aspects of Budgeting The following statements describe various aspects of budgeting. Indicate whether each statement is true or false. True or False: When estimating income, include amounts that you can control, like bonuses and rental income. False True True or False: When estimating expenses, developing an amount that one can live within is the best approach. True True or False: When estimating expenses, developing an amount that one can live within is the best approach. True False True or False: To finalize the budget, compare projected income to projected expenses. When income equals or exceeds total expenses, it is considered a balanced budget. False True True or False: To remedy a short-term budget surplus, shift additional income to a month where a deficit exists. True False True or False: In situations where an annual budget deficit exists, cutting expenses from the budget is optimal. False True Budgeting Examples Budgeting Examples For each of the following scenarios, indicate whether the individual made a correct choice or an incorrect choice when preparing a budget. Correct Choice Incorrect Choice Nathan is a sales rep who, based on last year, averaged $2,200 of monthly commission before taxes. He should include this in his budget. Stella was just notified that her contribution to the company's health plan is increasing by 3.5%. It's a company expense, so Stella doesn't include it in her budget. As Sam was reconciling his checkbook, he realized that he incurred $13.25 last month for ATM withdrawals. He looked back at the last six months and realized that he averaged the same amount each month. This is an unexpected expense and shouldn't be listed in his budget. Every year the Wus buy a big item or take a trip with a single annual bonus Barb receives. They included this in their budget