Answered step by step

Verified Expert Solution

Question

1 Approved Answer

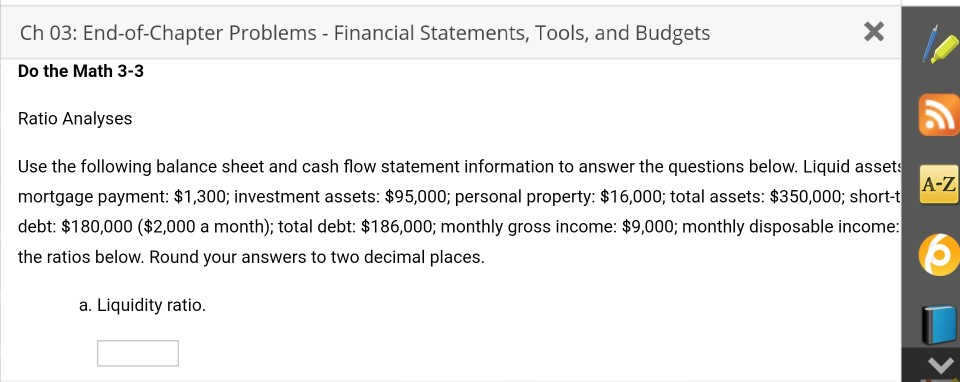

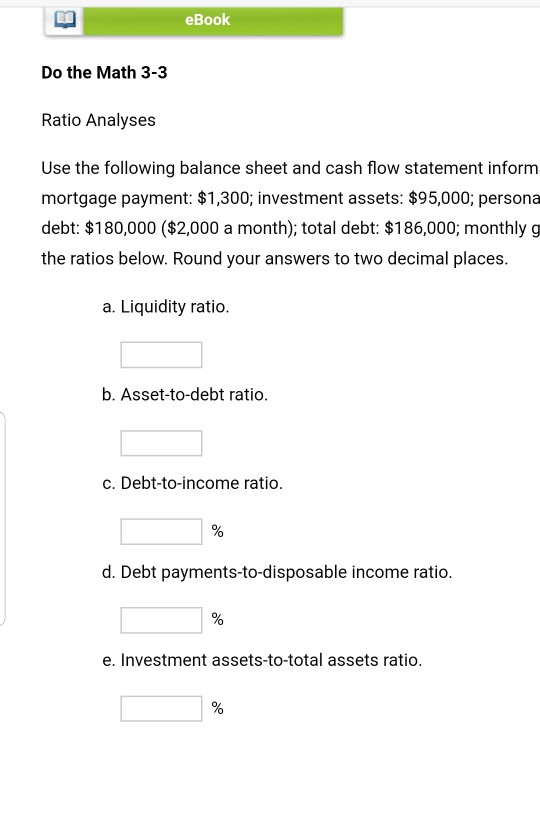

Ch 03: End-of-Chapter Problems - Financial Statements, Tools, and Budgets Do the Math 3-3 Ratio Analyses A-Z Use the following balance sheet and cash flow

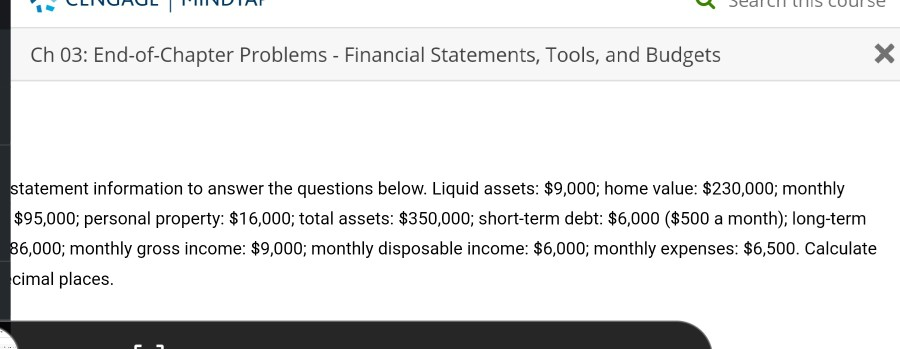

Ch 03: End-of-Chapter Problems - Financial Statements, Tools, and Budgets Do the Math 3-3 Ratio Analyses A-Z Use the following balance sheet and cash flow statement information to answer the questions below. Liquid assets mortgage payment: $1,300; investment assets: $95,000; personal property: $16,000; total assets: $350,000; short-t debt: $180,000 ($2,000 a month); total debt: $186,000; monthly gross income: $9,000; monthly disposable income: the ratios below. Round your answers to two decimal places. e a. Liquidity ratio. eBook Do the Math 3-3 Ratio Analyses Use the following balance sheet and cash flow statement inform mortgage payment: $1,300; investment assets: $95,000; persona debt: $180,000 ($2,000 a month); total debt: $186,000; monthly g the ratios below. Round your answers to two decimal places. a. Liquidity ratio. b. Asset-to-debt ratio. c. Debt-to-income ratio. d. Debt payments-to-disposable income ratio. e. Investment assets-to-total assets ratio. CLIVURUL MIIDIA Sedl LIT LIIS LUuise Ch 03: End-of-Chapter Problems - Financial Statements, Tools, and Budgets X statement information to answer the questions below. Liquid assets: $9,000; home value: $230,000; monthly $95,000; personal property: $16,000; total assets: $350,000; short-term debt: $6,000 ($500 a month); long-term 86,000; monthly gross income: $9,000; monthly disposable income: $6,000; monthly expenses: $6,500. Calculate cimal places. Ch 03: End-of-Chapter Problems - Financial Statements, Tools, and Budgets Do the Math 3-3 Ratio Analyses A-Z Use the following balance sheet and cash flow statement information to answer the questions below. Liquid assets mortgage payment: $1,300; investment assets: $95,000; personal property: $16,000; total assets: $350,000; short-t debt: $180,000 ($2,000 a month); total debt: $186,000; monthly gross income: $9,000; monthly disposable income: the ratios below. Round your answers to two decimal places. e a. Liquidity ratio. eBook Do the Math 3-3 Ratio Analyses Use the following balance sheet and cash flow statement inform mortgage payment: $1,300; investment assets: $95,000; persona debt: $180,000 ($2,000 a month); total debt: $186,000; monthly g the ratios below. Round your answers to two decimal places. a. Liquidity ratio. b. Asset-to-debt ratio. c. Debt-to-income ratio. d. Debt payments-to-disposable income ratio. e. Investment assets-to-total assets ratio. CLIVURUL MIIDIA Sedl LIT LIIS LUuise Ch 03: End-of-Chapter Problems - Financial Statements, Tools, and Budgets X statement information to answer the questions below. Liquid assets: $9,000; home value: $230,000; monthly $95,000; personal property: $16,000; total assets: $350,000; short-term debt: $6,000 ($500 a month); long-term 86,000; monthly gross income: $9,000; monthly disposable income: $6,000; monthly expenses: $6,500. Calculate cimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started