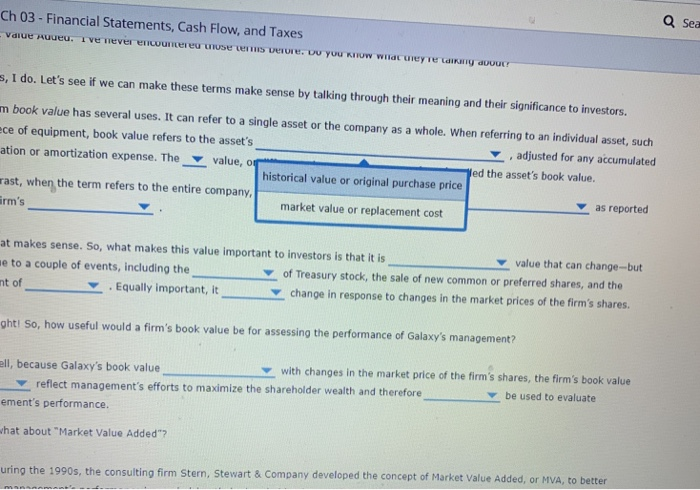

Ch 03 - Financial Statements, Cash Flow, and Taxes - Value kuueu. Ive never Encountered use en verre. Do you KITOW Wildc uey Te der Q Sea s, I do. Let's see if we can make these terms make sense by talking through their meaning and their significance to investors. m book value has several uses. It can refer to a single asset or the company as a whole. When referring to an individual asset, such ece of equipment, book value refers to the asset's adjusted for any accumulated ation or amortization expense. The value, or Wed the asset's book value. historical value or original purchase price rast, when the term refers to the entire company, as reported Erm's market value or replacement cost at makes sense. So, what makes this value important to investors is that it is value that can change--but se to a couple of events, including the of Treasury stock, the sale of new common or preferred shares, and the nt of . Equally important, it change in response to changes in the market prices of the firm's shares. ght! So, how useful would a firm's book value be for assessing the performance of Galaxy's management? all, because Galaxy's book value with changes in the market price of the firm's shares, the firm's book value reflect management's efforts to maximize the shareholder wealth and therefore be used to evaluate ement's performance. what about "Market Value Added"? uring the 1990s, the consulting firm Stern, Stewart & Company developed the concept of Market Value Added, or MVA, to better Ch 03 - Financial Statements, Cash Flow, and Taxes - Value kuueu. Ive never Encountered use en verre. Do you KITOW Wildc uey Te der Q Sea s, I do. Let's see if we can make these terms make sense by talking through their meaning and their significance to investors. m book value has several uses. It can refer to a single asset or the company as a whole. When referring to an individual asset, such ece of equipment, book value refers to the asset's adjusted for any accumulated ation or amortization expense. The value, or Wed the asset's book value. historical value or original purchase price rast, when the term refers to the entire company, as reported Erm's market value or replacement cost at makes sense. So, what makes this value important to investors is that it is value that can change--but se to a couple of events, including the of Treasury stock, the sale of new common or preferred shares, and the nt of . Equally important, it change in response to changes in the market prices of the firm's shares. ght! So, how useful would a firm's book value be for assessing the performance of Galaxy's management? all, because Galaxy's book value with changes in the market price of the firm's shares, the firm's book value reflect management's efforts to maximize the shareholder wealth and therefore be used to evaluate ement's performance. what about "Market Value Added"? uring the 1990s, the consulting firm Stern, Stewart & Company developed the concept of Market Value Added, or MVA, to better