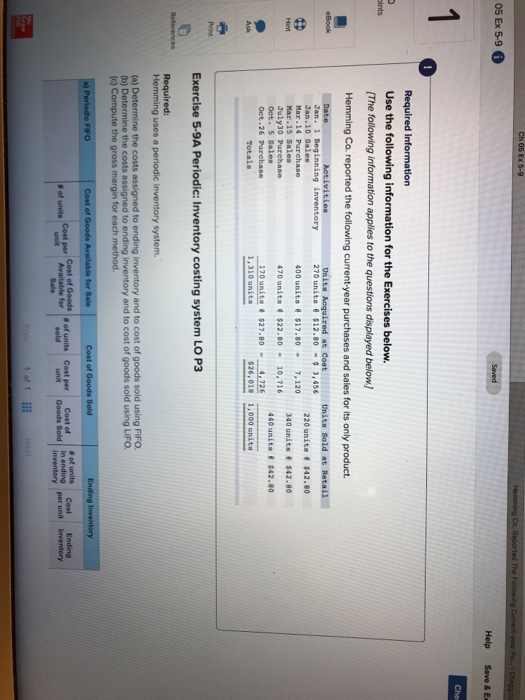

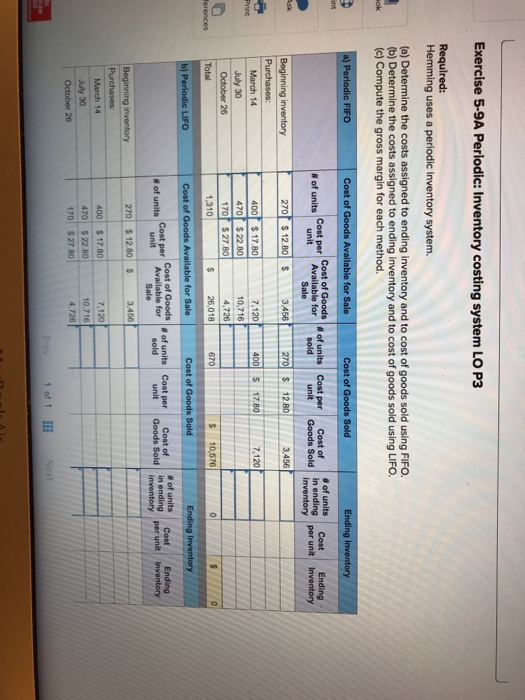

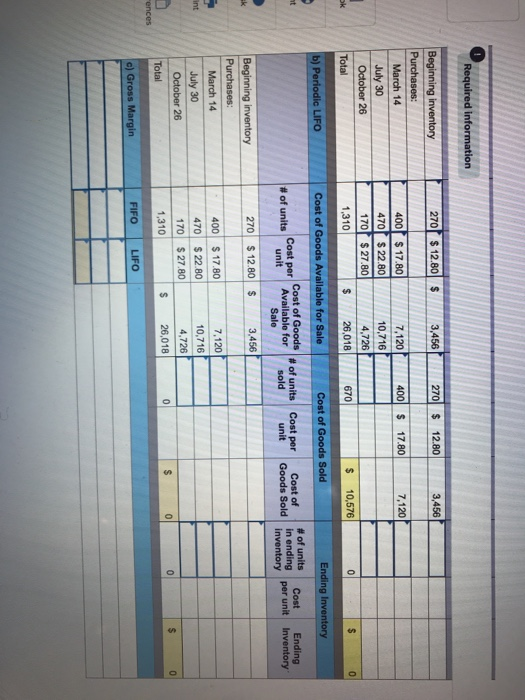

Ch 05 Ex -9 05 Ex 5-9 6 Che Required information Use the following information for the Exercises below. The following information applies to the questions displayed below Hemming Co. reported the following current-year purchases and sales for its only product. Mar.15 Sales uly30 Purchase Oct. 5 Sales Oct.26 Purchase 270 unita$12.80-3,456 400 units $17.807,120 470 units$22.8010,716 170 unite$27.804,26 220 units $42.80 340 units $42.80 440 unit $42.80 1,310 unite 26,018 1,000 unite Totals Exercise 5-9A Periodic: Inventory costing system LO P3 Hemming u (a) Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. b) Determine the costs assigned to ending inventory and to cost of goods sold using LIFG. (c) Compute the gross margin for each method. # of units Cost Ending t er Coin ending per unit Inventory # of units Cost per Cost of Goods Sold inventory Exercise 5-9A Periodic: Inventory costing system LO P3 Required: Hemming uses a periodic inventory system. (a) Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. (b) Determine the costs assigned to ending inventory and to cost of goods sold using LIFO (c) Compute the gross margin for each method. a) Periodic FIFO Cost of Goods Available for Sale Cost of Goods Sold Ending Cost per Cost of | #0f units Goods Sold in ending Cost per Available forsold unit Cost of Goods | # of units | Cost per | Goods #Of units | Cost | Ending Cost of # of units cost per # of units unit Sale 270 $ 12.803,456 400 17807,12040 14 S 17.80 7,120 July 30 October 26 470 $22.80 170 $27.80 10,716 4,726 $ 26,018 Total 1,310 670 $ 10,576 b) Periodic LIFO Cost of Cost of Goods Sold Cost of Goods Sale 1 # of units | Cost , Ending in ending per unit Inventory t able fornitGoods Sold inventorySRODO | # of units | Cost per Cost of Cost per # of units 1 unit Goods Sold ending unit Beginning inventory 270 $ 12.80 S3,456 400 $ 17.80 470 $22 80 170 $ 27 80 7,120 July 30 October 26 10,716 4,726 Required information 2707 8 12.80 M 3 45627012.8066 270 $ 12.80 S 3,456 3,456 7,120 4 10,716 4,726 7,120 400 $17.80 470 $22.80 170 $27.80 400 S 17.80 July 30 October 26 ok 1,310 $ 26,018 670 $ 10,576 b) Periodic LIFO Cost of Goods Available for Sale Cost of Goods Sold Ending Inventory Cost per Available for sold Cost of Goods | # of units | # of units | Cost # of units 1 Cost per unit Goods Soldnventornentory Ending unit unit Inventory inventory 270 $12.803,456 Purchases 400 $ 17.80 470 $ 22.80 170 $27.80 7,120 10,716 4,726 s 26,018 July 30 October 26 Total 1,310 FIFO LIFO