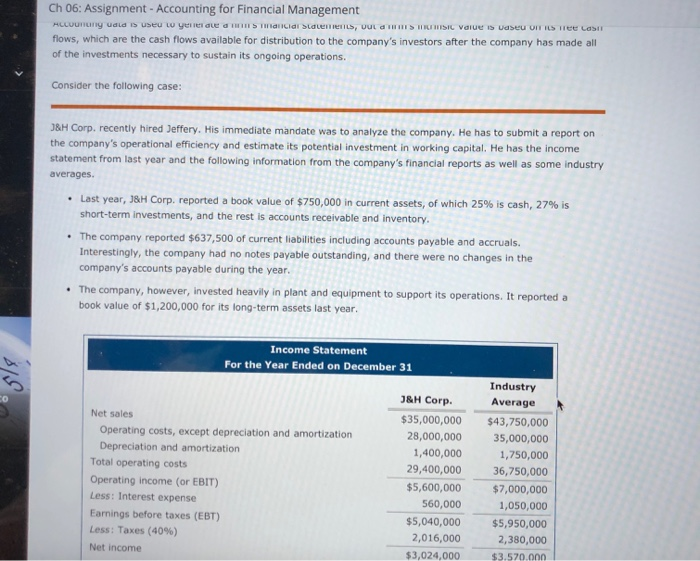

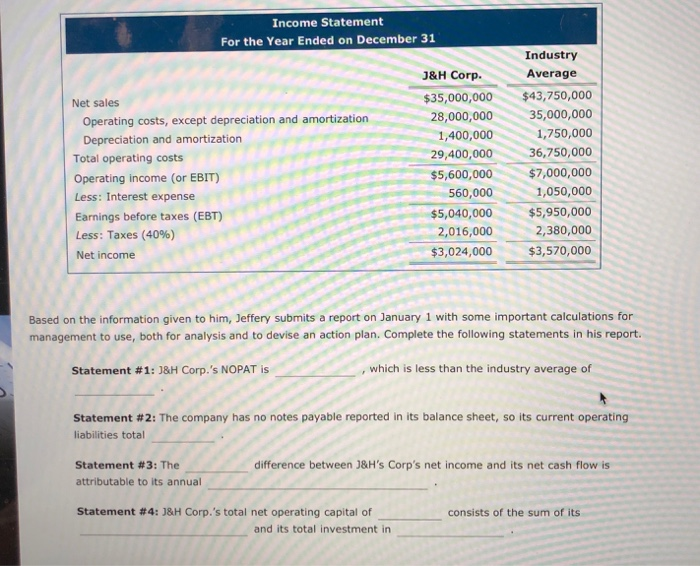

Ch 06: Assignment - Accounting for Financial Management HLLUUILIy udia is useu Lo yeiei ae a IIIS TnaIciai StateneILS, OUL dTHIIS IRIHISIC vaiue is uaseu on ILS TTEE Cas flows, which are the cash flows available for distribution to the company's investors after the company has made all of the investments necessary to sustain its ongoing operations. Consider the following case: J&H Corp. recently hired Jeffery. His immediate mandate was to analyze the company. He has to submit a report on the company's operational efficiency and estimate its potential investment in working capital. He has the income statement from last year and the following information from the company's financial reports as well as some industry averages. Last year, J8H Corp. reported a book value of $750,000 in current assets, of which 25% is cash, 27% is short-term investments, and the rest is accounts receivable and inventory. The company reported $637,500 of current liabilities including accounts payable and accruals. Interestingly, the company had no notes payable outstanding, and there were no changes in the company's accounts payable during the year. The company, however, invested heavily in plant and equipment to support its operations. It reported a book value of $1,200,000 for its long-term assets last year. Income Statement For the Year Ended on December 31 Industry J&H Corp. Average Net sales $35,000,000 $43,750,000 Operating costs, except depreciation and amortization Depreciation and amortization Total operating costs 28,000,000 35,000,000 1,400,000 1,750,000 29,400,000 36,750,000 Operating income (or EBIT) $5,600,000 $7,000,000 Less: Interest expense 560,000 1,050,000 Earnings before taxes (EBT) $5,040,000 2,016,000 $5,950,000 Less: Taxes (40%) 2,380,000 Net income $3,024,000 $3.570.000 Income Statement For the Year Ended on December 31 Industry Average J&H Corp. $35,000,000 28,000,000 1,400,000 $43,750,000 Net sales 35,000,000 Operating costs, except depreciation and amortization 1,750,000 Depreciation and amortization 36,750,000 29,400,000 Total operating costs $7,000,000 $5,600,000 Operating income (or EBIT) 1,050,000 560,000 Less: Interest expense $5,950,000 $5,040,000 Earnings before taxes (EBT) 2,380,000 2,016,000 Less: Taxes (40%) $3,570,000 $3,024,000 Net income Based on the information given to him, Jeffery submits a report on January 1 with some important calculations for management to use, both for analysis and to devise an action plan. Complete the following statements in his report. ,which is less than the industry average of Statement #1: 18H Corp.'s NOPAT is Statement #2: The company has no notes payable reported in its balance sheet, so its current operating liabilities total difference between J&H's Corp's net income and its net cash flow is Statement #3: The attributable to its annual Statement #4: J&H Corp.'s total net operating capital of consists of the sum of its and its total investment in Ch 06: Assignment - Accounting for Financial Management HLLUUILIy udia is useu Lo yeiei ae a IIIS TnaIciai StateneILS, OUL dTHIIS IRIHISIC vaiue is uaseu on ILS TTEE Cas flows, which are the cash flows available for distribution to the company's investors after the company has made all of the investments necessary to sustain its ongoing operations. Consider the following case: J&H Corp. recently hired Jeffery. His immediate mandate was to analyze the company. He has to submit a report on the company's operational efficiency and estimate its potential investment in working capital. He has the income statement from last year and the following information from the company's financial reports as well as some industry averages. Last year, J8H Corp. reported a book value of $750,000 in current assets, of which 25% is cash, 27% is short-term investments, and the rest is accounts receivable and inventory. The company reported $637,500 of current liabilities including accounts payable and accruals. Interestingly, the company had no notes payable outstanding, and there were no changes in the company's accounts payable during the year. The company, however, invested heavily in plant and equipment to support its operations. It reported a book value of $1,200,000 for its long-term assets last year. Income Statement For the Year Ended on December 31 Industry J&H Corp. Average Net sales $35,000,000 $43,750,000 Operating costs, except depreciation and amortization Depreciation and amortization Total operating costs 28,000,000 35,000,000 1,400,000 1,750,000 29,400,000 36,750,000 Operating income (or EBIT) $5,600,000 $7,000,000 Less: Interest expense 560,000 1,050,000 Earnings before taxes (EBT) $5,040,000 2,016,000 $5,950,000 Less: Taxes (40%) 2,380,000 Net income $3,024,000 $3.570.000 Income Statement For the Year Ended on December 31 Industry Average J&H Corp. $35,000,000 28,000,000 1,400,000 $43,750,000 Net sales 35,000,000 Operating costs, except depreciation and amortization 1,750,000 Depreciation and amortization 36,750,000 29,400,000 Total operating costs $7,000,000 $5,600,000 Operating income (or EBIT) 1,050,000 560,000 Less: Interest expense $5,950,000 $5,040,000 Earnings before taxes (EBT) 2,380,000 2,016,000 Less: Taxes (40%) $3,570,000 $3,024,000 Net income Based on the information given to him, Jeffery submits a report on January 1 with some important calculations for management to use, both for analysis and to devise an action plan. Complete the following statements in his report. ,which is less than the industry average of Statement #1: 18H Corp.'s NOPAT is Statement #2: The company has no notes payable reported in its balance sheet, so its current operating liabilities total difference between J&H's Corp's net income and its net cash flow is Statement #3: The attributable to its annual Statement #4: J&H Corp.'s total net operating capital of consists of the sum of its and its total investment in