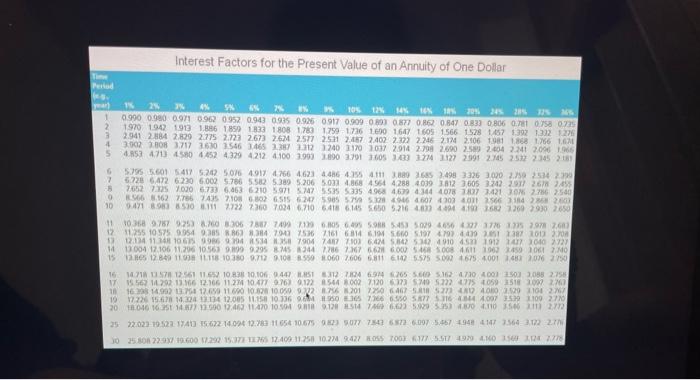

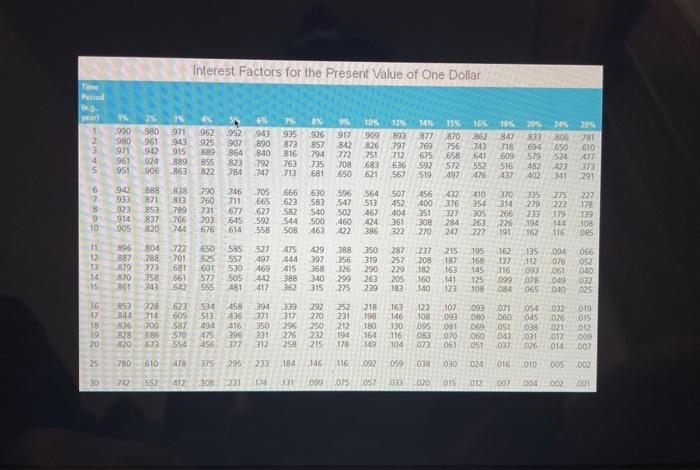

Ch 07: End of Chapter Problems - The Time Value of Money Back to Assignment Atta Average/3 24. Problem 7-24 Book Problem 7-24 Kim must choose between two investment anternatives, each costing $110,000. The first alternative generates $35,000 a year for four years. The second pays one large lump sum of $161.300 at the end of the fourth year. If the firm can use the required funds to make the investment at an annual cost of 8 percent, what are the present values of two investment at matives? Use Aspendix Band Apend to anwar the custon Round your answers to the nearest deltar. PV) Whichternative should be preferred? The Cat Memative should be preferred Interest Factors for the Present Value of an Annuity of One Dollar Period NE M 1 1 AX 5% 6% #% 10 12 14 16 18 20 24 25 1 0.990 0.980 0971 090 092 0943 0905 0.925 0917 0.909 098 0.877 0.8 0.847 033) 0.806 0.71 0.758 0775 2 1970 1942 1943 1886 1850 1833 1808 1789 1790 1716 1600 1647 160 1566 1526 1457 1392 1332 127 3 2.941 284 2820 2.775 2.723 2673 2.6M 2.577 2511 2:47 2.402 2.2 2.246 2.11 2106 1981 1868 1766 16M 3.002 2008 3.717 3630 1546 1465 23 212 1240 11702037 2.914 2.798 2.690 2.5 2.604 2.2 2.090 15 5 4.852 471) 450 4452 4.329 4212 4.100 1999 190 3.791 160S 143 1744 127 2991 2.45 2.522 2.145 2.181 5.795 601 5417 5.242 5076 4017 466 4623 4.486 435 4111 30 265 3.498 3326300 2.5 2534 20 2 6.226.472 620 6.002 5.786 5.582 5.389 5.206 5031 8684564 4288.4039 312 3605 2202 2917 26/12:45 7652 7.3 700 6733 6.463 6210 571 52 55 53354968469444078 107 3421 BO 27862540 0 66.162 2.766 ANS 210 GSIS 247 905 55.8 66 407 403 401 5666 2003 50 0.471 890 850 112722736070246.710 6418 614 5.60 5.216 417 419410600 1260 90 2650 11 10368 9.757 953 08.3067877499 219 6.05 60 59 453 5029 4656377629726 1211255 1057599549.85162 372 756 7161 681 61M 5.60 5.1976192 092 2013 2.200 1 12.134 11 14 10615 996 975347904 747 102 64MS5910 4 1012 2010 227 2004 12.106.11.204 10561 9.19 2.295 MS 3442786 2762 600 008 A 100 150 2061 2.NO 15 12 es 17 848 110 111 10350 9.712 9.108.550 8060 7.606 6,811 614 5.75 SN 675 4001 482 2076 2750 16 US7561 11652 103 10.1060407312704 634 265 5.6 5.720,00 2.5032088 2.755 1752 1792.13.66 12.06 1127 10.477076) 0.172 500 7120 520 525 2050 151 2002 2.0 1 1690 12.00 11.60 10.0 10.050922 20170527400 2,20 1102 10 215.6.2014 12.005 106 10.336 550 630 577 ST 007 350 2100 270 201801616. 147.300 2.40211470 105 18 0.12 SM 60529350 1032 25 22.023 10.52217413 162214004 12.78311 654 10.67593 077 741676.0075.4679447 7.5643.12 2.7 JO 35.302297 10.GOO 12.22 15.0 12.40911 750 10.77 2427 BOSS T003 175410152778 % 2 www Interest Factors for the Present Value of One Dollar 9 11 3 , 2% ret us E7% AHE