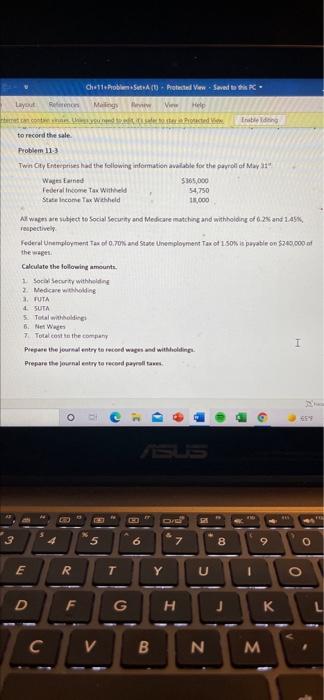

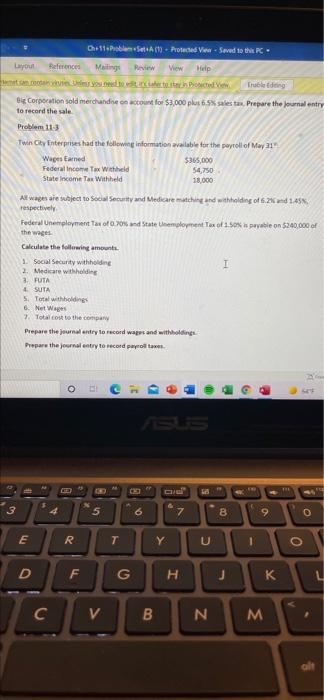

Ch 11. Problem St. Pete ViewSaved to - Layout Feleon Mailing w View Help con una postelected in Esbe to record the sale Problem 11 Twin Cty Entreprises had the following information available for the payroll of May Was Earned $365.000 Federal Income Tax Withheld 54,750 Stace Income Tax Wehheld 13,000 AX Wer diect to Social Security and Medicare matching and withholding of 0.2% and 1.49% respectively Federal Unemployment Tex of 0.70% and State Unemployment Tax of Som s payable on $200.000 the Calculate the following amounts 1 Social Security withholding 2 Medce withholding 3. PUTA 4 SUTA 5. Total withholdings 6. Net wees 7 Total cost the company I Prepare the journal entry to record wages and withholding Prepare the journal entry to record ayollare o O c e 5 ON s 5 6 7 8 2 9 o E R T Y U D F G G H K M V B N . Ch 11. Problemet (0) Protected ViewSaved to the Layout References Mailing Review New Help Trubleding Big Corporation sold merchandise on account for $1,000 plus 6.5% sales tas. Prepare the Journal entry to record the sale Problem 113 Twin City Enterprises had the following information available for the payroll of May 1 Wages Earned $365,000 Federal income Tax Withheld 54,750 Statelecome Tax Withheld 18.000 Alwages are wject to Social Security and Medicare matching and withholding of 5.2 1.45 respectively Federal Unemployment Tax of 0.70% and State Unemployment Tax of 1.Sok peable on $340,000 of the wel Calculate the following amounts. 1. Social Security withholding 1 2. Medicare withholding 3. FUTA 4. SUTA 5. Total withholdings 6. Net Wages 7. To co to the company Prepare the journal entry to record was and withholdings Prepare the journal entry to record payroll taxes c 09 Du 5 3 5 6 7 8 2 9 E R T Y U 1 O D F G C V B Z . Ch 11. Problem St. Pete ViewSaved to - Layout Feleon Mailing w View Help con una postelected in Esbe to record the sale Problem 11 Twin Cty Entreprises had the following information available for the payroll of May Was Earned $365.000 Federal Income Tax Withheld 54,750 Stace Income Tax Wehheld 13,000 AX Wer diect to Social Security and Medicare matching and withholding of 0.2% and 1.49% respectively Federal Unemployment Tex of 0.70% and State Unemployment Tax of Som s payable on $200.000 the Calculate the following amounts 1 Social Security withholding 2 Medce withholding 3. PUTA 4 SUTA 5. Total withholdings 6. Net wees 7 Total cost the company I Prepare the journal entry to record wages and withholding Prepare the journal entry to record ayollare o O c e 5 ON s 5 6 7 8 2 9 o E R T Y U D F G G H K M V B N . Ch 11. Problemet (0) Protected ViewSaved to the Layout References Mailing Review New Help Trubleding Big Corporation sold merchandise on account for $1,000 plus 6.5% sales tas. Prepare the Journal entry to record the sale Problem 113 Twin City Enterprises had the following information available for the payroll of May 1 Wages Earned $365,000 Federal income Tax Withheld 54,750 Statelecome Tax Withheld 18.000 Alwages are wject to Social Security and Medicare matching and withholding of 5.2 1.45 respectively Federal Unemployment Tax of 0.70% and State Unemployment Tax of 1.Sok peable on $340,000 of the wel Calculate the following amounts. 1. Social Security withholding 1 2. Medicare withholding 3. FUTA 4. SUTA 5. Total withholdings 6. Net Wages 7. To co to the company Prepare the journal entry to record was and withholdings Prepare the journal entry to record payroll taxes c 09 Du 5 3 5 6 7 8 2 9 E R T Y U 1 O D F G C V B Z