Answered step by step

Verified Expert Solution

Question

1 Approved Answer

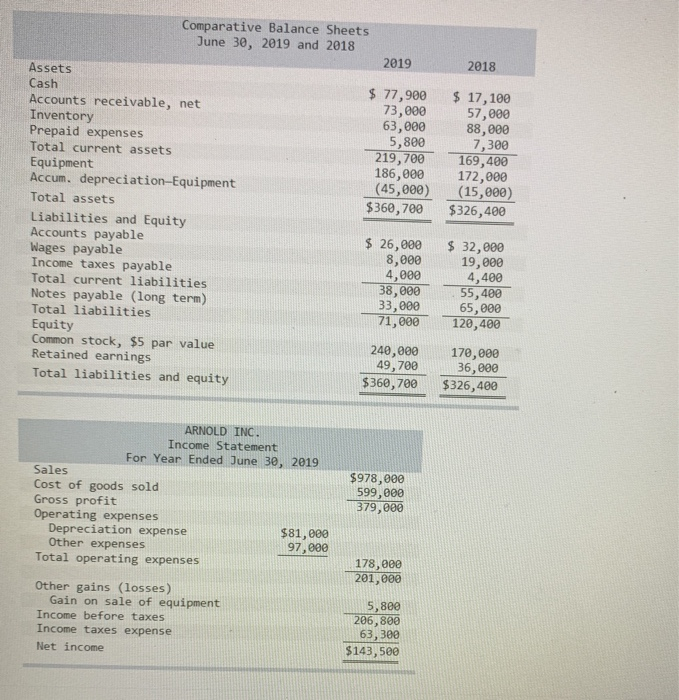

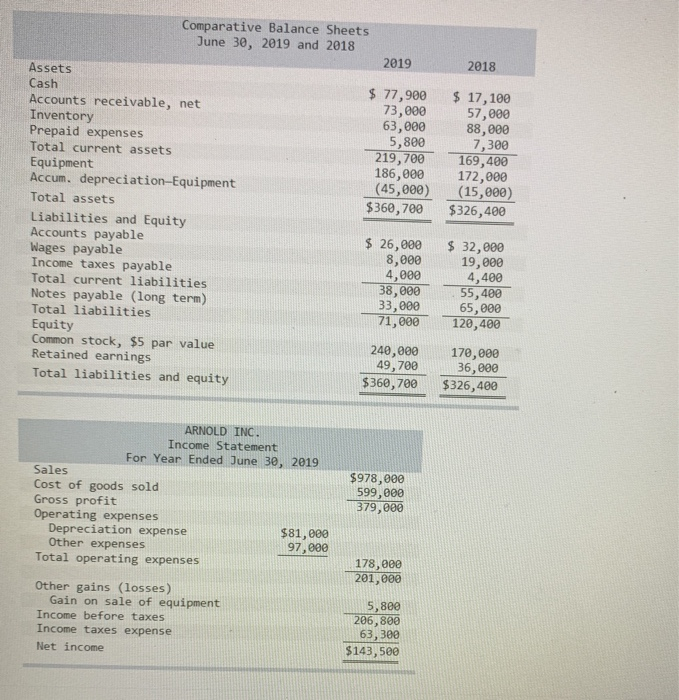

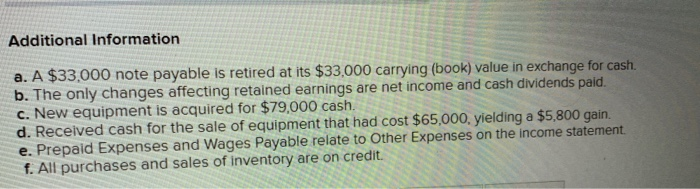

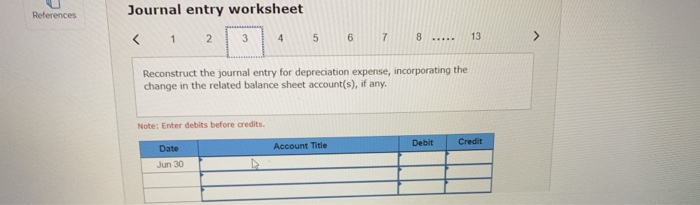

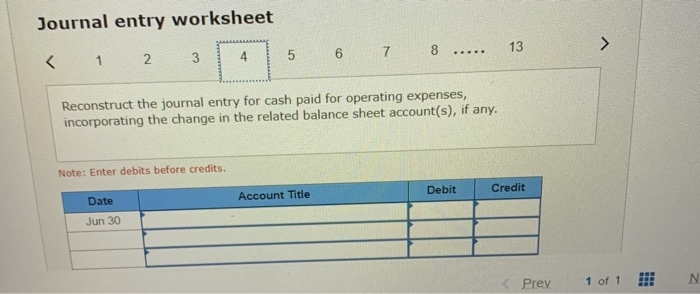

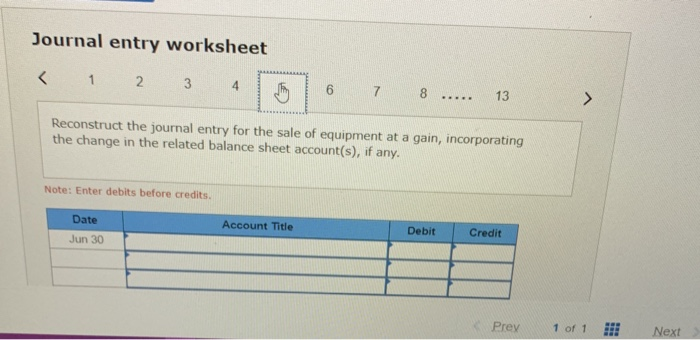

ch 12 GL 12-11 Comparative Balance Sheets June 30, 2019 and 2018 2019 2018 $ 77,900 73,000 63,000 5,800 219,700 186,000 (45,000) $360,700 $ 17,100

ch 12 GL 12-11

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started