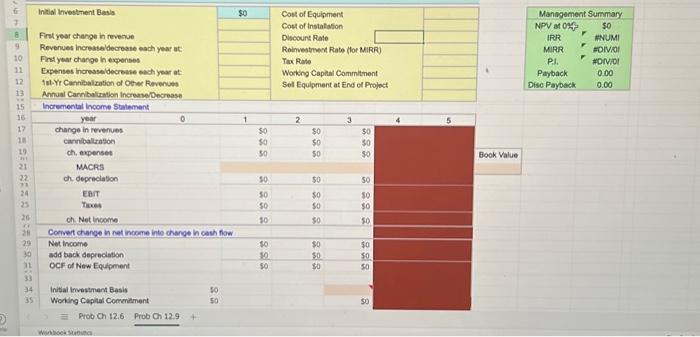

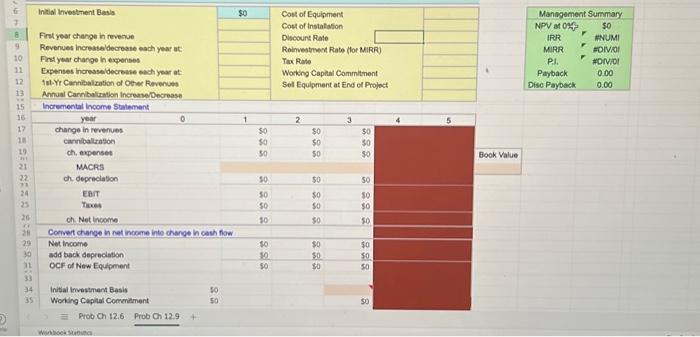

Ch 12 Problem \#9: You have been asked by the president of your company to evaluate the proposed acquisition of a new special-purpos truck for $60,000. The truck falls into the MACRS 3 - 3-year class, and it will be sold after three years for $20,000. Th use of the truck will require an increase in NWC (spare parts inventory) of $2,000. The truck will have no effect on revenues, but it is expected to save the firm $20,000 per year in before-tax operating costs, mainly labor. The firm's marginal tax rate is 40 percent, an opportunity cost of capital of 8 percent. What will the cash flows for this project be? Ch 12.9 Deliverable (100 total points): Complete the Ch 12 Problem \#9 Excel worksheet and answer the following questions (50 points). Q.3 What will the cash flows for this project be? (25 points) Q.4 According to the Management Report, should KADS go forward with the project? (25 points) Explain your answers in detail using the Capital Budgeting key topic and tools in Ch 13 and Ch 13 from the M: Finance textbook readings. Ch 12 Problem \#9: You have been asked by the president of your company to evaluate the proposed acquisition of a new special-purpos truck for $60,000. The truck falls into the MACRS 3 - 3-year class, and it will be sold after three years for $20,000. Th use of the truck will require an increase in NWC (spare parts inventory) of $2,000. The truck will have no effect on revenues, but it is expected to save the firm $20,000 per year in before-tax operating costs, mainly labor. The firm's marginal tax rate is 40 percent, an opportunity cost of capital of 8 percent. What will the cash flows for this project be? Ch 12.9 Deliverable (100 total points): Complete the Ch 12 Problem \#9 Excel worksheet and answer the following questions (50 points). Q.3 What will the cash flows for this project be? (25 points) Q.4 According to the Management Report, should KADS go forward with the project? (25 points) Explain your answers in detail using the Capital Budgeting key topic and tools in Ch 13 and Ch 13 from the M: Finance textbook readings