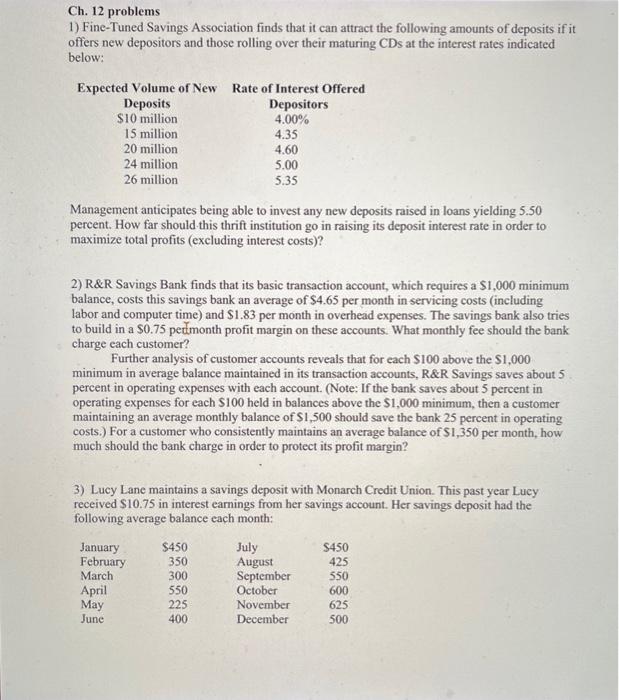

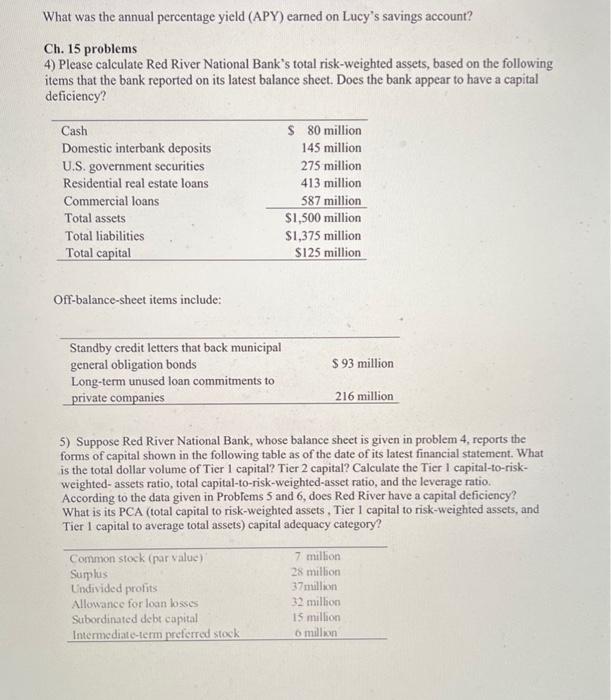

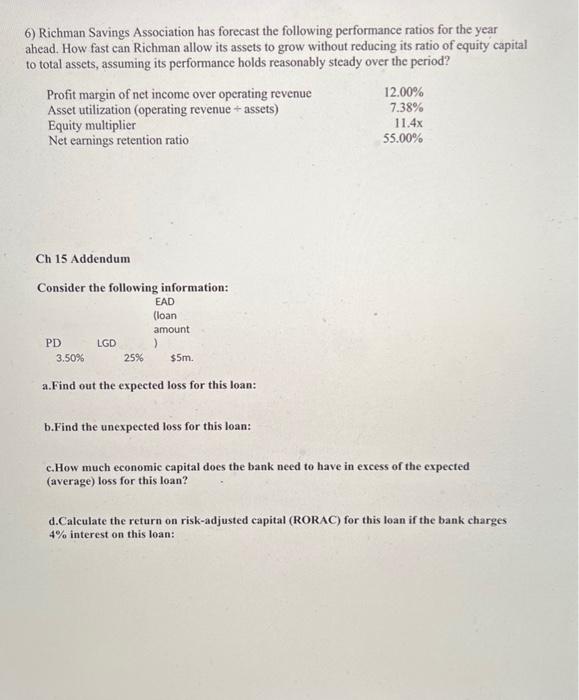

Ch. 12 problems 1) Fine-Tuned Savings Association finds that it can attract the following amounts of deposits if it offers new depositors and those rolling over their maturing CDs at the interest rates indicated below: Management anticipates being able to invest any new deposits raised in loans yielding 5.50 percent. How far should this thrift institution go in raising its deposit interest rate in order to maximize total profits (excluding interest costs)? 2) R\&R Savings Bank finds that its basic transaction account, which requires a $1,000 minimum balance, costs this savings bank an average of $4.65 per month in servicing costs (including labor and computer time) and $1.83 per month in overhead expenses. The savings bank also tries to build in a $0.75 peumonth profit margin on these accounts. What monthly fee should the bank charge each customer? Further analysis of customer accounts reveals that for each $100 above the $1,000 minimum in average balance maintained in its transaction accounts, R\&R Savings saves about 5 percent in operating expenses with each account. (Note: If the bank saves about 5 percent in operating expenses for each $100 held in balances above the $1,000 minimum, then a customer maintaining an average monthly balance of $1,500 should save the bank 25 percent in operating costs.) For a customer who consistently maintains an average balance of $1,350 per month, how much should the bank charge in order to protect its profit margin? 3) Lucy Lane maintains a savings deposit with Monarch Credit Union. This past year Lucy received $10.75 in interest earnings from her savings account. Her savings deposit had the following average balance each month: What was the annual percentage yield (APY) earned on Lucy's savings account? Ch. 15 problems 4) Please calculate Red River National Bank's total risk-weighted assets, based on the following items that the bank reported on its latest balance sheet. Does the bank appear to have a capital deficiency? Off-balance-sheet items include: 5) Suppose Red River National Bank, whose balance sheet is given in problem 4 , reports the forms of capital shown in the following table as of the date of its latest financial statement. What is the total dollar volume of Tier 1 capital? Tier 2 capital? Calculate the Tier I capital-to-riskweighted- assets ratio, total capital-to-risk-weighted-asset ratio, and the leverage ratio. According to the data given in Problems 5 and 6, does Red River have a capital deficiency? What is its PCA (total capital to risk-weighted assets, Tier 1 capital to risk-weighted assets, and Tier 1 capital to average total assets) capital adequacy category? 6) Richman Savings Association has forecast the following performance ratios for the year ahead. How fast ean Richman allow its assets to grow without reducing its ratio of equity capital to total assets, assuming its performance holds reasonably steady over the period? Ch 15 Addendum Consider the following information: a.Find out the expected loss for this loan: b. Find the unexpected loss for this loan: c.How much economic capital does the bank need to have in excess of the expected (average) loss for this loan? d.Calculate the return on risk-adjusted capital (RORAC) for this loan if the bank charges 4% interest on this loan