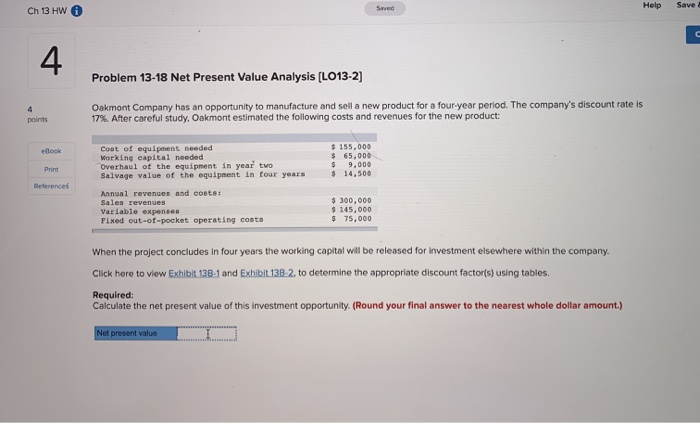

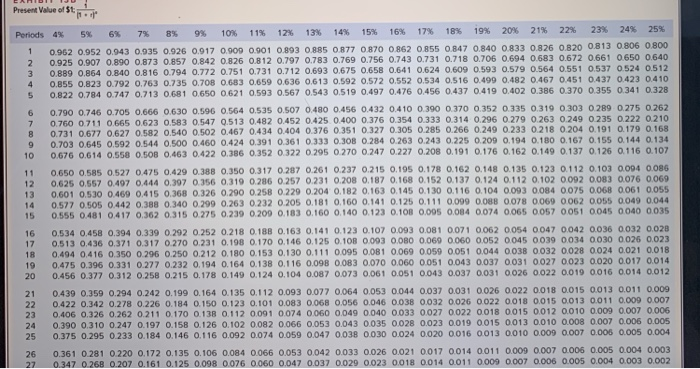

Ch 13 HW Help Save: Problem 13-18 Net Present Value Analysis (L013-2] Oakmont Company has an opportunity to manufacture and sell a new product for a four year period. The company's discount rate is 17%. After careful study, Oakmont estimated the following costs and revenues for the new product: ebook Cost of equipment needed Working capital needed Overhaul of the equipment in year two Salvage value of the equipment in four years $ 155,000 $ 65.000 $ 9,000 $ 14,500 Print Annual revenues and contai Sales revenues Variable expenses Fixed out-of-pocket operating costs $ 300,000 $ 145,000 $ 75,000 When the project concludes in four years the working capital will be released for investment elsewhere within the company Click here to view Exhibit 138.1 and Exhibit 13B-2. to determine the appropriate discount factors) using tables Required: Calculate the net present value of this investment opportunity. (Round your final answer to the nearest whole dollar amount.) Net present value Present Value of St . Periods 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 21% 22% 23% 24% 25% 0.962 0.952 0.043 0.035 0.026 0.17 0.000 0.001 0.893 O RRS O 877 0.870 0 862 0.855 0.347 0.840 0.833 0.826 0.820 0.813 0.806 0.800 2 0.925 0.907 0.890 0.873 0.857 0.842 0.826 0.812 0.797 0.783 0.769 0.756 0.743 0.731 0.718 0.706 0.694 0.683 0.672 0.661 0.650 0.640 3 0.889 0864 0.840 08 16 0 794 0.772 0.751 0.731 0.712 0.693 0.675 0.658 0.641 0.624 0.609 0.593 0.579 0.564 0.551 0537 0524 0.512 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.659 0.636 0. 613 0.592 0.572 0.552 0.534 0.516 0.499 0.482 0.467 0.451 0.437 0423 0410 5 0.822 0.784 0.747 0.713 0681 0.650 0.621 0 593 0.567 0.543 0.519 0.497 0.476 0.456 0.437 0419 0.402 0 386 0370 0355 0 341 0.328 6 7 8 9 10 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.535 0.507 0.480 0.456 0.432 0.410 0.390 0.370 0352 0.335 0 319 0 303 0 29 0275 0.262 0 760 0711 0 665 0623 0583 0 547 0 513 0.482 0.452 0.425 0.400 0.376 0.354 0333 0314 0 296 0279 0 263 0249 0235 0222 0210 0.731 0.677 0.627 0532 0 540 0 502 0.467 0.434 0.404 0.376 0.351 0.327 0.305 0.285 0 266 0249 02330 218 0204 0 191 179 0169 0.703 0.645 0.592 0544 0500 0.460 0.424 0.391 0 361 0.333 0.308 0.284 0.263 0.243 0.225 0 209 0.194 0 180 0.167 0.155 0 144 0.134 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.352 0.322 0.295 0.270 0.247 0.227 0.208 0.191 0.176 0.162 0.149 0.137 0 126 0 116 0.107 11 12 13 14 15 16 17 1B 19 0.650 0.585 0.527 0.475 0.429 0.388 0.350 0.317 0.287 0.261 0.237 0.215 0.195 0.178 0.162 0.148 0.135 0.123 0.112 0.103 0.094 0.086 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.286 0.257 0.231 0.208 0.187 0.168 0.152 0.137 0.124 0.112 0.102 0.092 0.083 0.076 0.069 0.601 0.530 0.400 0.415 0.368 0.326 0.290 0.250 0.229 0.204 0.182 0.163 0.145 0.130 0.116 0.104 0.093 0.084 0.075 0.068 0.061 0.055 0.577 0 505 0.442 0.388 0.340 0.299 0.263 0.232 0.205 0.181 0.160 0.141 0.125 0.11 0.099 0.088 0.078 0069 0062 0055 0049 0.044 0.555 0.481 0.417 0.362 0.315 0.275 0.239 0.200 0.183 0.160 0.140 0.123 0.108 0.005 0.014 0.074 0.065 0.057 0.051 0.045 0040 0.035 0.534 0.458 0.394 0.339 0.292 0.252 0.218 0.18 0.163 0.141 0.123 0.107 0.093 0.081 0.071 0.062 0.054 0.047 0.042 0.036 0.032 0.028 0513 0.436 0 371 0317 0 270 0231 0.198 0.170 0.146 0.125 0.10B 0.093 O OBO 0060 0060 0052 0045 00900014 003 0025 0.023 0.494 0416 0 350 0.296 0.250 0212 0.18 0.153 0.130 0.111 0095 0081 0069 0 059 0051 0044 0038 0032 0028 0024 0.021 0.018 0.475 0.396 0.331 0.277 0.232 0.194 0.164 0.138 0.116 0.098 0.083 0.070 0.060 0.051 0.043 0.037 0.031 0.027 0023 0.020 0.017 0.014 0.456 0.377 0.312 0.258 0.215 0.178 0.149 0.124 0.104 0.087 0.073 0.061 0.051 0.043 0.037 0.031 0.026 0022 0.019 0016 0.014 0.012 0.439 0.359 0.294 0 242 0.199 0.164 0.135 0.112 0.093 0.077 0.064 0.053 0.044 0.037 0.031 0.026 0.022 0.018 0,015 0,013 0.011 0.009 0.422 0.342 0.278 0.226 0.184 0.150 0.123 0.101 0083 0.06 0.056 0.046 003 0032 0.026 0022 0.018 0015 0013 0011 0.009 0.007 0.406 0.326 0.262 0.211 0.170 0.138 0.112 0.091 0074 0 060 0.049 0040 0033 0027 0022 0018 0015 0012 0010 0.009 0.007 0.006 0.390 0.310 0.247 0.197 0.158 0.126 0.102 0.082 0.066 0.053 0.043 0.035 0.028 0.023 0.019 0,015 0,013 0.010 0.008 0.007 0.006 0.005 0.375 0.295 0.233 0.184 0.146 0.116 0.092 0.074 0.059 0.047 0.038 0.030 0.024 0.020 0.016 0.013 0.010 0.009 0.007 0.005 0.005 0.004 0.361 0.281 0.220 0.172 0.135 0.106 0.084 0.066 0.053 0.042 0.033 0.026 0.021 0017 0.014 0.011 0.009 0.007 0.006 0.005 0.004 0.003 0.347 0.268 0.207 0.161 0.125 0.098 0.076 0.060 0.047 0.037 0.029 0.023 0.018 0.014 0.011 0.009 0.007 0.006 0.005 0.004 0.003 0.002 21 22 23 24 25 26 27