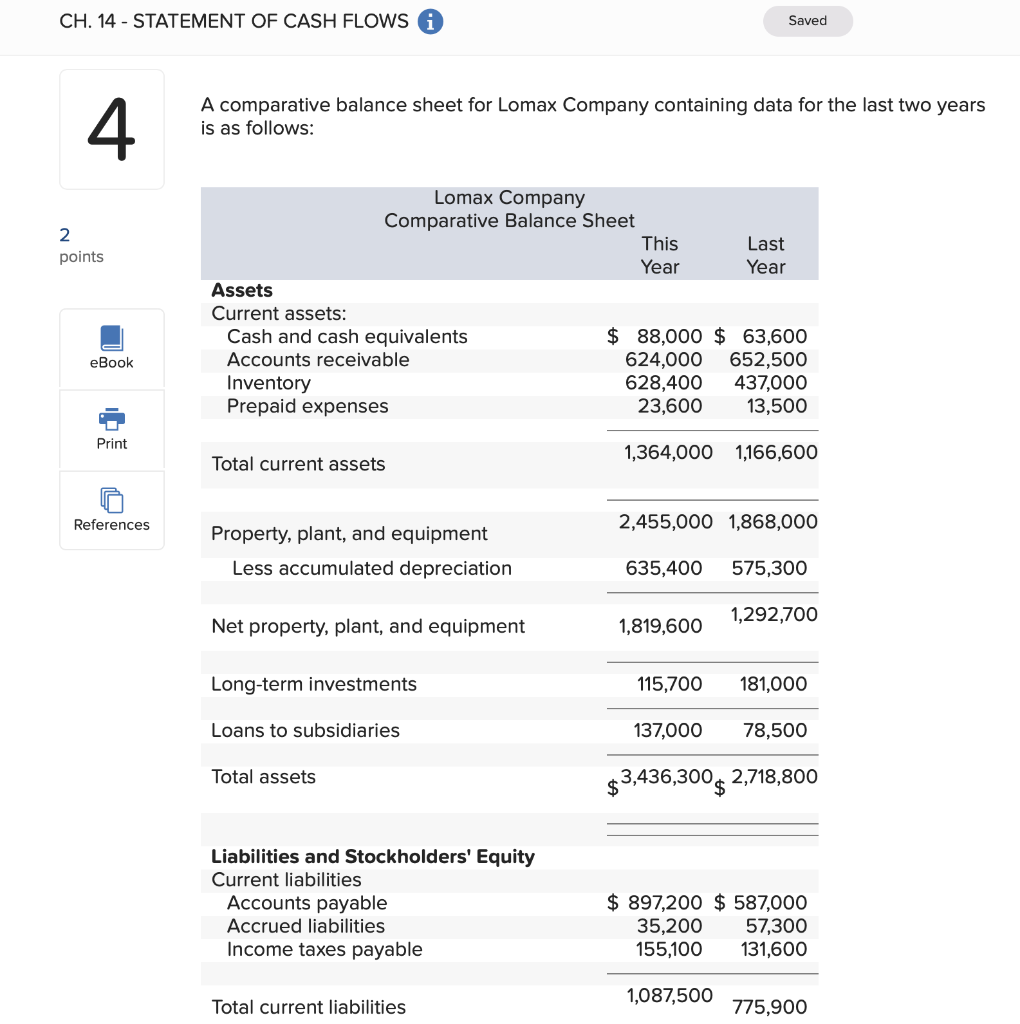

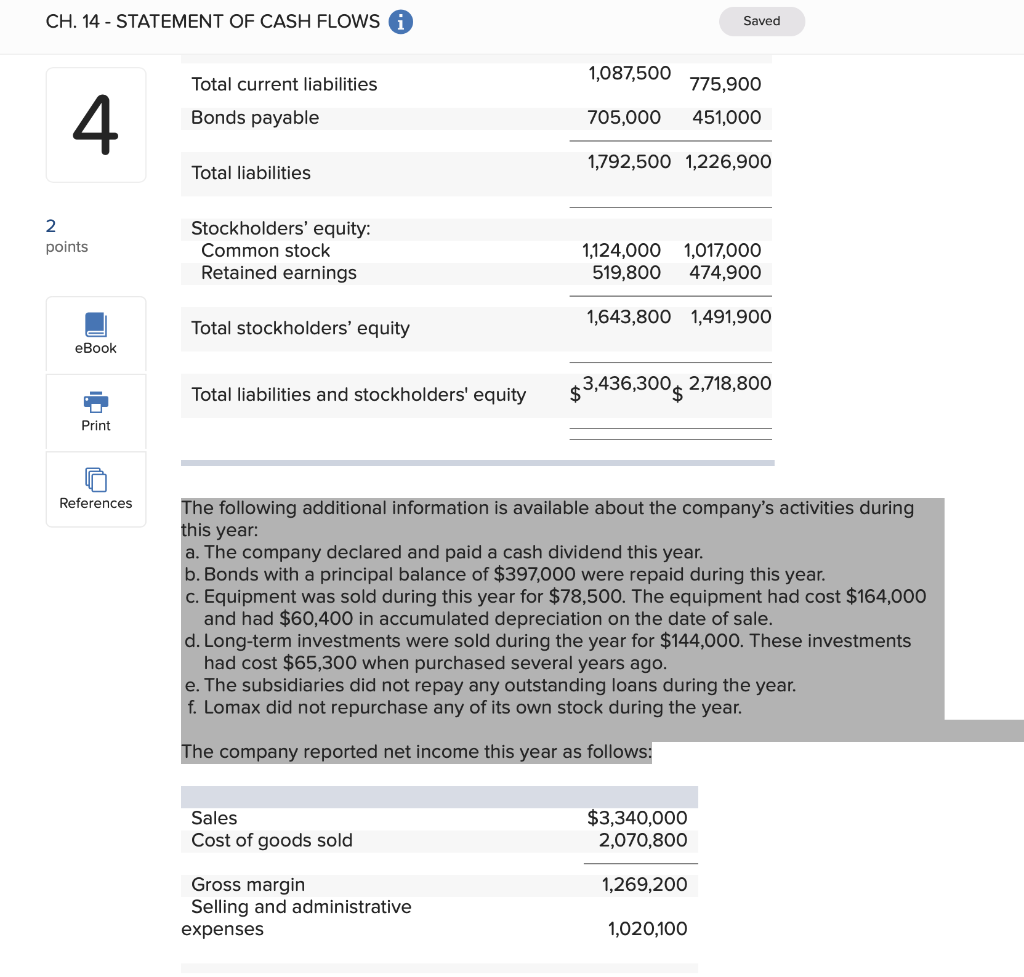

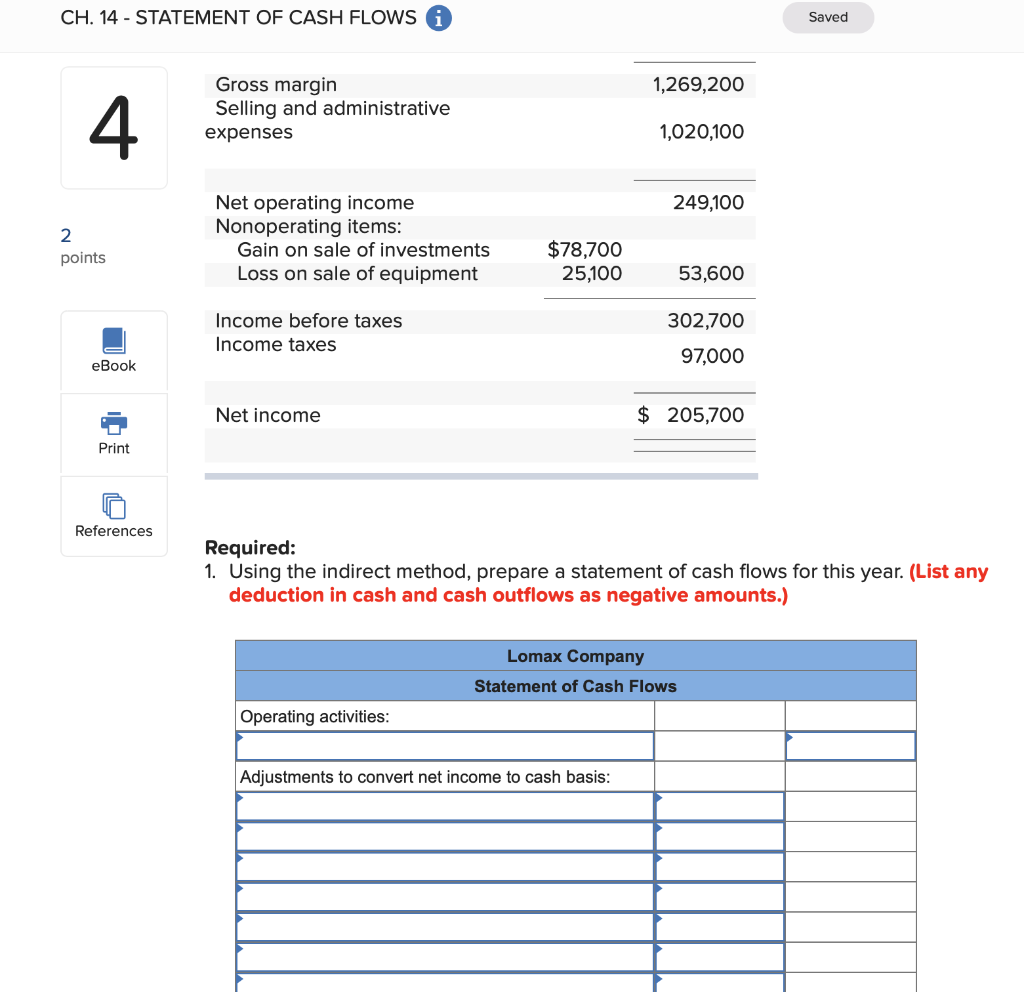

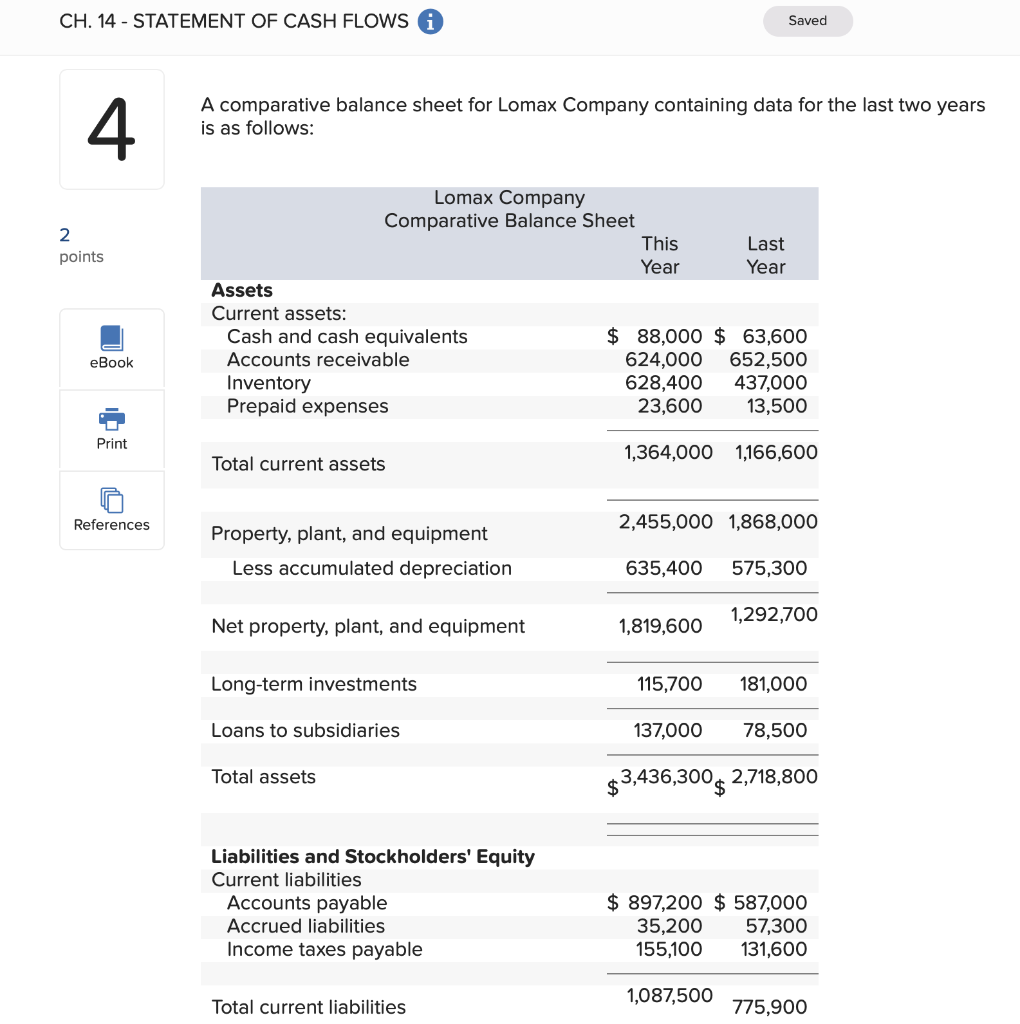

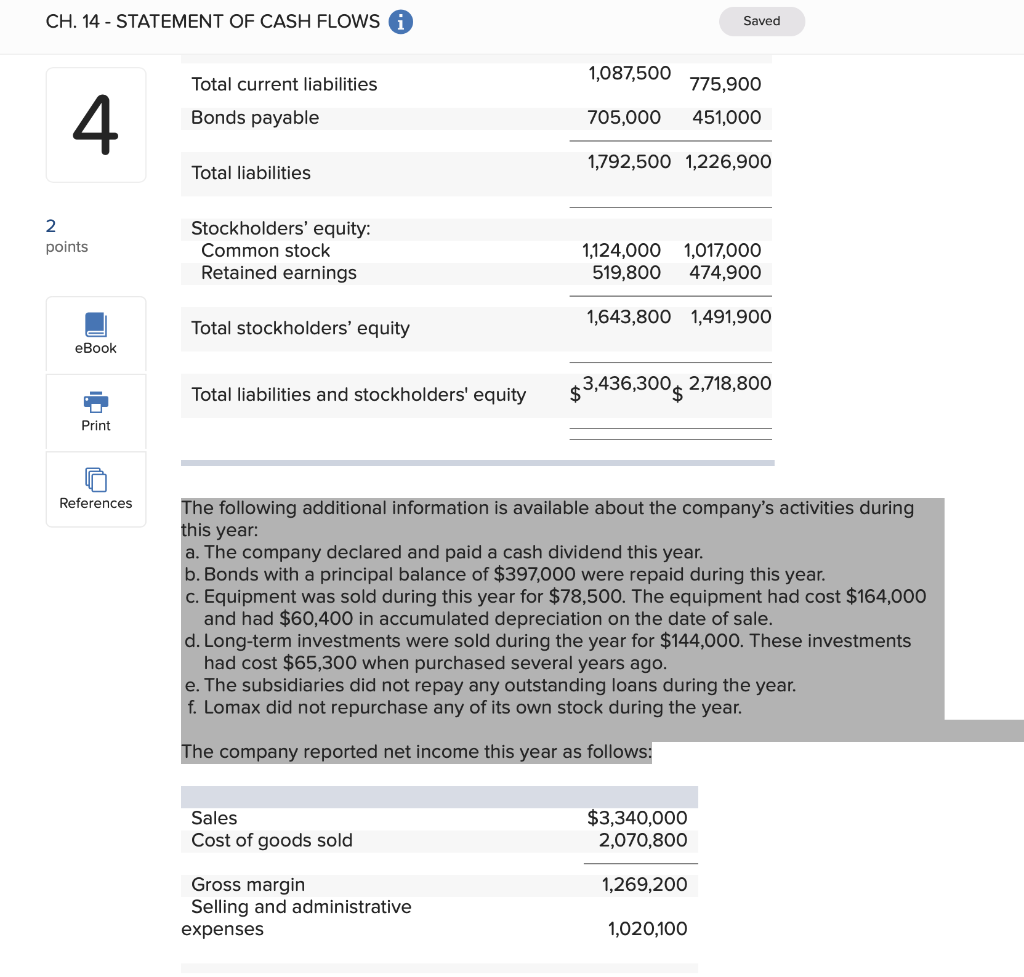

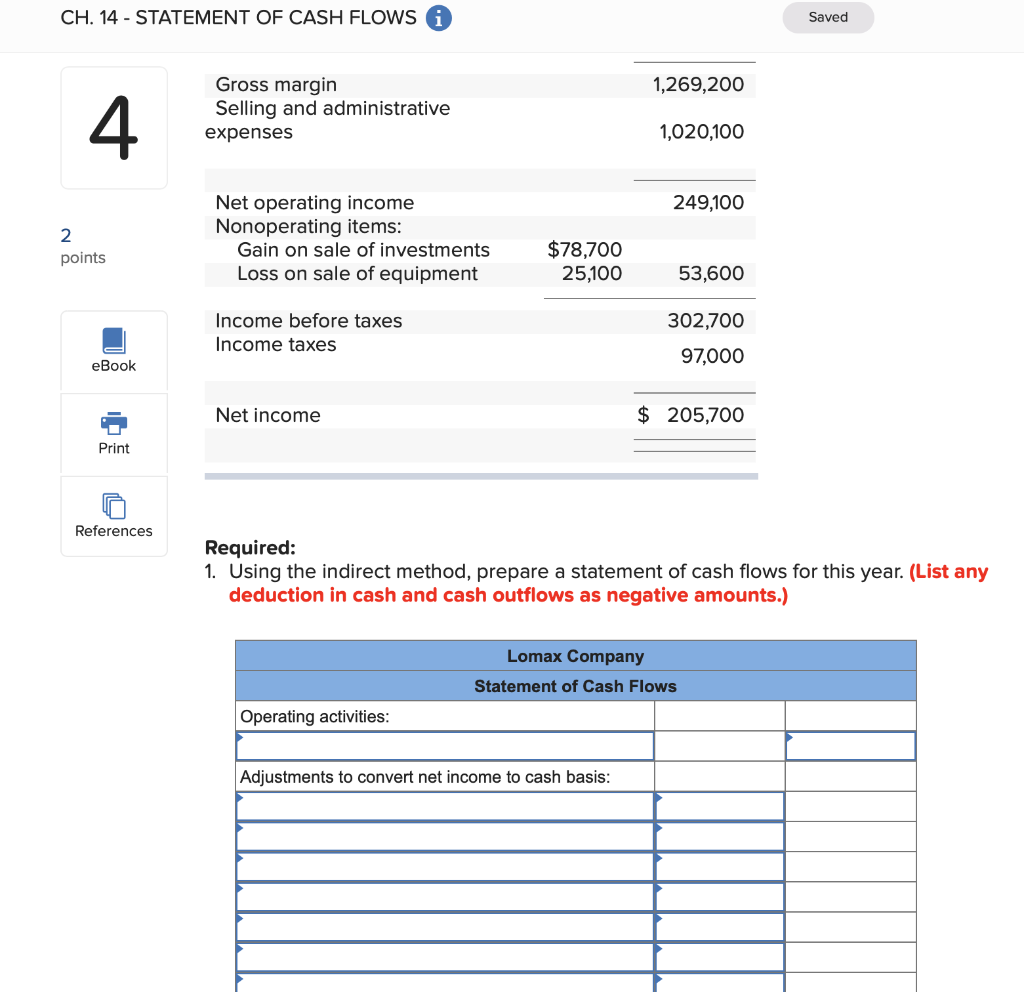

CH. 14 - STATEMENT OF CASH FLOWS Saved 4 A comparative balance sheet for Lomax Company containing data for the last two years is as follows: 2 points Lomax Company Comparative Balance Sheet This Last Year Year Assets Current assets: Cash and cash equivalents $ 88,000 $ 63,600 Accounts receivable 624,000 652,500 Inventory 628,400 437,000 Prepaid expenses 23,600 13,500 eBook Print 1,364,000 1,166,600 Total current assets There are References 2,455,000 1,868,000 Property, plant, and equipment Less accumulated depreciation 635,400 575,300 1,292,700 Net property, plant, and equipment 1,819,600 Long-term investments 115,700 181,000 Loans to subsidiaries 137,000 78,500 Total assets $3,436,300$ 2,718,800 Liabilities and Stockholders' Equity Current liabilities Accounts payable Accrued liabilities Income taxes payable $ 897,200 $ 587,000 35,200 57,300 155,100 131,600 1,087,500 Total current liabilities 775,900 CH. 14 - STATEMENT OF CASH FLOWS Saved 1,087,500 Total current liabilities 4 775,900 451,000 Bonds payable 705,000 1,792,500 1,226,900 Total liabilities 2 points Stockholders' equity: Common stock Retained earnings 1,124,000 1,017,000 519,800 474,900 1,643,800 1,491,900 Total stockholders' equity eBook Total liabilities and stockholders' equity $3,436,300$ 2,718,800 Print References The following additional information is available about the company's activities during this year: a. The company declared and paid a cash dividend this year. b. Bonds with a principal balance of $397,000 were repaid during this year. c. Equipment was sold during this year for $78,500. The equipment had cost $164,000 and had $60,400 in accumulated depreciation on the date of sale. d. Long-term investments were sold during the year for $144,000. These investments had cost $65,300 when purchased several years ago. e. The subsidiaries did not repay any outstanding loans during the year. f. Lomax did not repurchase any of its own stock during the year. The company reported net income this year as follows: Sales Cost of goods sold $3,340,000 2,070,800 1,269,200 Gross margin Selling and administrative expenses 1,020,100 CH. 14 - STATEMENT OF CASH FLOWS Saved 1,269,200 4 Gross margin Selling and administrative expenses 1,020,100 249,100 2 points Net operating income Nonoperating items: Gain on sale of investments Loss on sale of equipment $78,700 25,100 53,600 Income before taxes Income taxes 302,700 97,000 eBook Net income $ 205,700 Print References Required: 1. Using the indirect method, prepare a statement of cash flows for this year. (List any deduction in cash and cash outflows as negative amounts.) Lomax Company Statement of Cash Flows Operating activities: Adjustments to convert net income to cash basis