Answered step by step

Verified Expert Solution

Question

1 Approved Answer

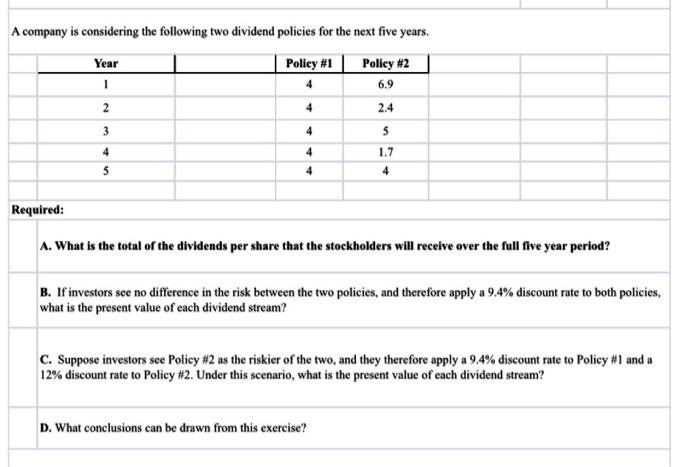

ch 16 study guide Please explain how to get answers A-D I do not understand! Thank you so much A company is considering the following

ch 16 study guide

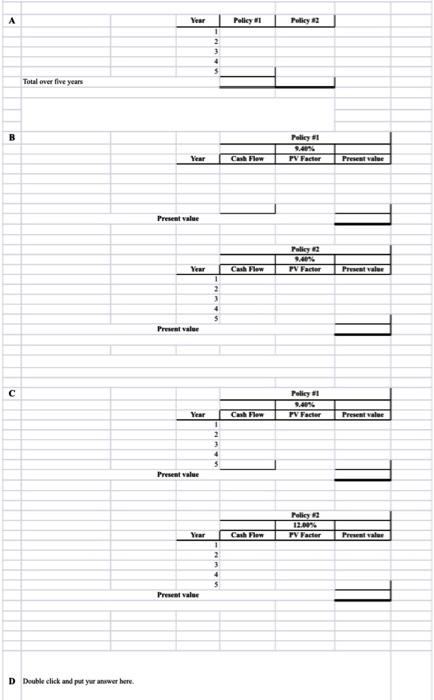

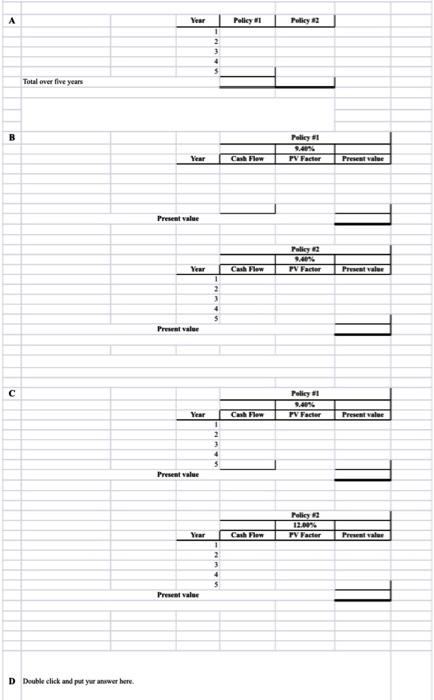

A company is considering the following two dividend policies for the next five years. Requirea: A. What is the total of the dividends per share that the stockholders will receive over the full five year period? B. If investors see no difference in the risk between the two policies, and therefore apply a 9.4% discount rate to both policies. what is the present value of each dividend stream? C. Suppose investors see Policy #2 as the riskier of the two, and they therefore apply a 9.4% discount rate to Policy #1 and a 12% discount rate to Policy $2. Under this scenario, what is the present value of each dividend stream? \begin{tabular}{|l|l|l|l|} \hline A. Pollcy n1 & Folicy an \\ \cline { 2 - 3 } & Vear & & \\ \hline & 1 & 2 & \\ \hline Total over five years & 3 & \\ \hline \end{tabular} B D Double click and pat yer anower bere Please explain how to get answers A-D I do not understand! Thank you so much

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started