Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ch 19 question 5 The following information is available for Pharoah Corporation for 2020. 1. Depreciation reported on the tax return exceeded depreciation reported on

ch 19 question 5

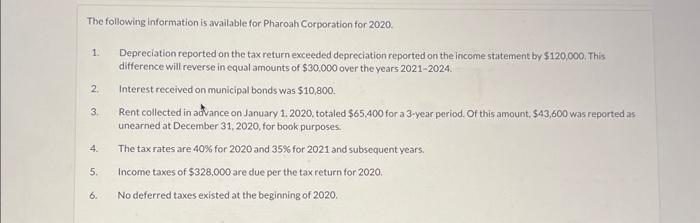

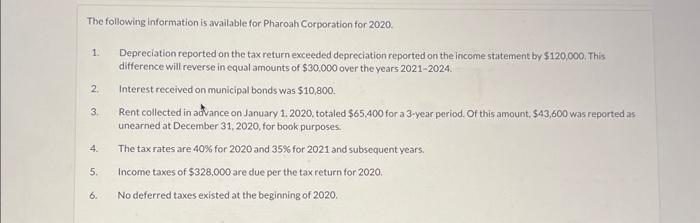

The following information is available for Pharoah Corporation for 2020. 1. Depreciation reported on the tax return exceeded depreciation reported on the income statement by $120,000. This difference will reverse in equal amounts of $30,000 over the years 2021-2024. 2. Interest received on municipal bonds was $10,800. 3. Rent collected in advance on January 1, 2020, totaled $65,400 for a 3-year period. Of this amount, $43,600 was reported as unearned at December 31,2020 , for book purposes. 4. The tax rates are 40% for 2020 and 35% for 2021 and subsequent years. 5. Income taxes of $328,000 are due per the tax return for 2020 . 6. No deferred taxes existed at the beginning of 2020 . (a) Compute taxable income for 2020. Taxable income for 2020 $ The following information is available for Pharoah Corporation for 2020. 1. Depreciation reported on the tax return exceeded depreciation reported on the income statement by $120,000. This difference will reverse in equal amounts of $30,000 over the years 2021-2024. 2. Interest received on municipal bonds was $10,800. 3. Rent collected in advance on January 1, 2020, totaled $65,400 for a 3-year period. Of this amount, $43,600 was reported as unearned at December 31,2020 , for book purposes. 4. The tax rates are 40% for 2020 and 35% for 2021 and subsequent years. 5. Income taxes of $328,000 are due per the tax return for 2020 . 6. No deferred taxes existed at the beginning of 2020 . (a) Compute taxable income for 2020. Taxable income for 2020 $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started