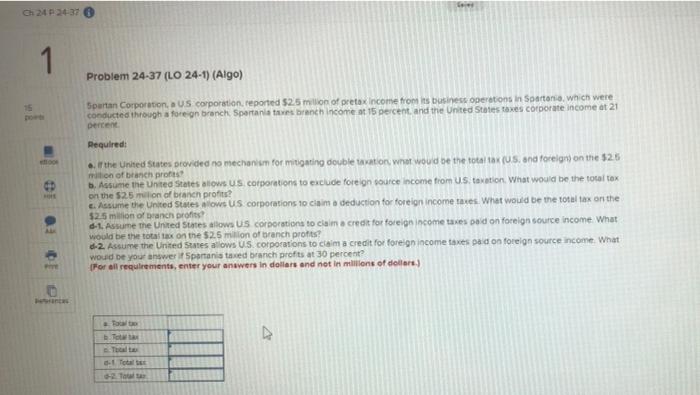

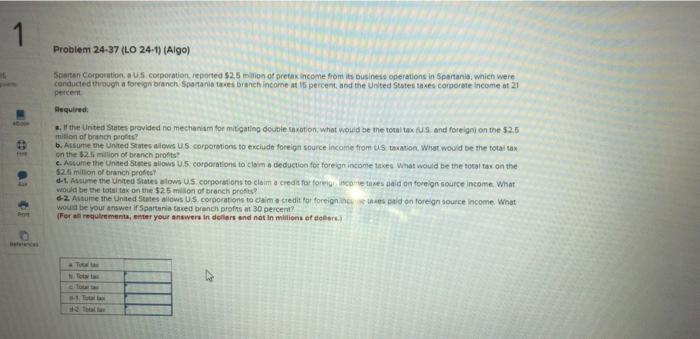

Question: Ch 24 P 24-37 1 Problem 24-37 (LO 24-1) (Algo) Spurtan Corporation, US corporation reported $2.5 million of pretax income from its business operations in

Ch 24 P 24-37 1 Problem 24-37 (LO 24-1) (Algo) Spurtan Corporation, US corporation reported $2.5 million of pretax income from its business operations in Spartans, which were conducted through a foreign branch Sportanla branch income at 15 percent, and the United States taxes corporate income at 21 percent Required: the United States provided no mechanism for mitigating double nation, what would be the total tax (U.S. and foreign on the $26 million of branch props b. Assume the United States allows US corporations to exclude foreign source income from U.S. taxation. What would be the totaltex on the 525 million of branch pros . Masume the United States ows US corporations 10 claim a deduction for foreign income taxes. What would be the total tax on the $2.5 million of branch profits 4-1. Assume the United Stmes allows us corporations to claim a credit for foreign income taxes paid on foreign cource income what would be the total tax on the $2.5 milion of branch pros? 6-2. Assume the United States allows U.S.corporations to claim a credit for foreign income taxes paid on foreign source income. What would be your answer i Spartans taxed branch profits at 30 percent For all requirements, enter your answers in dollars and not in millions of dollars) Toate 1 Problem 24-37 (LO 24-1) (Algo) Sertan Corporation, a US corporation, reported $2.5 million of pretax income from its business operations in Spartania, which were conducted through a foreign branch Spartania a branch income at 15 percent, and the United States taxes corporate Income at 21 percent Required the United States provided na mechanism for mitigating double votion, what would be the totaltex US and foreign on the $2.5 mition of branonprofits? b. Assume the United States allows us corporations to exclude foreign source income from us taxation. What would be the total tax on the $2.5 milion of branch profits c. Acume the United States allows US. corporations to claim a deduction for foreign income taxes What would be the total tax on the 525 million of branch profit -. Assume the United States wows US corporations to claim a credit for forgonetes said on foreign source income What would be the total tax on the 525 millon of branch pros? 6-2. Assume the United States allows US. corporations to claim a credit for foreign could on foreign source income. What would be your answer i Spartani e branch profits at 30 percent (For all requirements, enter your answers in dollars and not in milions of Ch 24 P 24-37 1 Problem 24-37 (LO 24-1) (Algo) Spurtan Corporation, US corporation reported $2.5 million of pretax income from its business operations in Spartans, which were conducted through a foreign branch Sportanla branch income at 15 percent, and the United States taxes corporate income at 21 percent Required: the United States provided no mechanism for mitigating double nation, what would be the total tax (U.S. and foreign on the $26 million of branch props b. Assume the United States allows US corporations to exclude foreign source income from U.S. taxation. What would be the totaltex on the 525 million of branch pros . Masume the United States ows US corporations 10 claim a deduction for foreign income taxes. What would be the total tax on the $2.5 million of branch profits 4-1. Assume the United Stmes allows us corporations to claim a credit for foreign income taxes paid on foreign cource income what would be the total tax on the $2.5 milion of branch pros? 6-2. Assume the United States allows U.S.corporations to claim a credit for foreign income taxes paid on foreign source income. What would be your answer i Spartans taxed branch profits at 30 percent For all requirements, enter your answers in dollars and not in millions of dollars) Toate 1 Problem 24-37 (LO 24-1) (Algo) Sertan Corporation, a US corporation, reported $2.5 million of pretax income from its business operations in Spartania, which were conducted through a foreign branch Spartania a branch income at 15 percent, and the United States taxes corporate Income at 21 percent Required the United States provided na mechanism for mitigating double votion, what would be the totaltex US and foreign on the $2.5 mition of branonprofits? b. Assume the United States allows us corporations to exclude foreign source income from us taxation. What would be the total tax on the $2.5 milion of branch profits c. Acume the United States allows US. corporations to claim a deduction for foreign income taxes What would be the total tax on the 525 million of branch profit -. Assume the United States wows US corporations to claim a credit for forgonetes said on foreign source income What would be the total tax on the 525 millon of branch pros? 6-2. Assume the United States allows US. corporations to claim a credit for foreign could on foreign source income. What would be your answer i Spartani e branch profits at 30 percent (For all requirements, enter your answers in dollars and not in milions of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts