Answered step by step

Verified Expert Solution

Question

1 Approved Answer

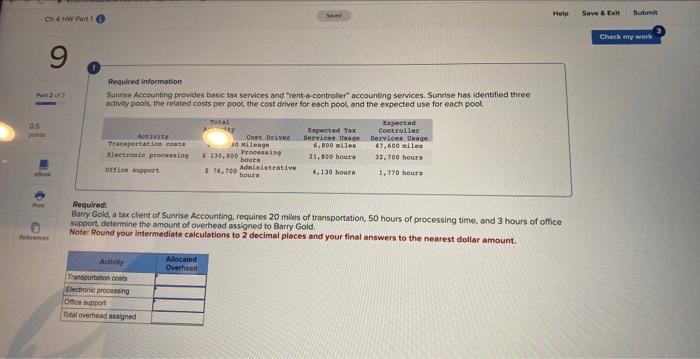

Ch 4 HW Part 1 9 Required information Part 2 of 0.5 P References Sever Sunrise Accounting provides basic tax services and rent-a-controller accounting

Ch 4 HW Part 1 9 Required information Part 2 of 0.5 P References Sever Sunrise Accounting provides basic tax services and "rent-a-controller" accounting services. Sunrise has identified three activity pools, the related costs per pool, the cost driver for each pool, and the expected use for each pool. Total Activity Transportation costs Coat Driver 30 Mileage Electronic processing 130,000 Processing Expected Tax Services Usage 6,800 mile 21,000 hours bourn office support $76,700 Administrative 4,130 hours hours Expected Controller Services Usage 47,600 miles 32,700 hours 1,770 hours Help Save & Exit Submit Required: Barry Gold, a tax client of Sunrise Accounting, requires 20 miles of transportation, 50 hours of processing time, and 3 hours of office support, determine the amount of overhead assigned to Barry Gold. Note: Round your intermediate calculations to 2 decimal places and your final answers to the nearest dollar amount. Activity Transportation costs Electronic processing Allocated Overheed Office support Total overhead assigned Check my work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started