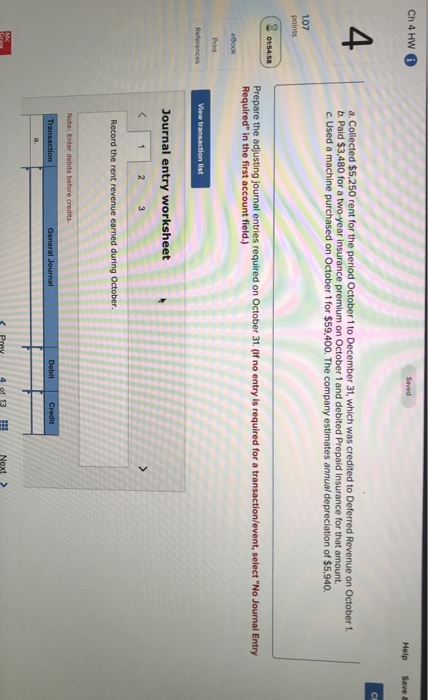

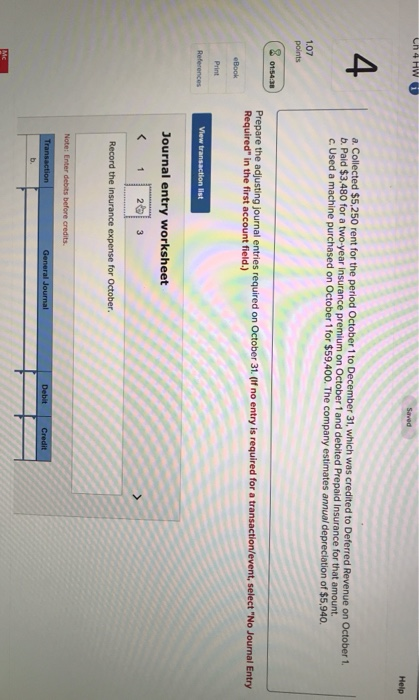

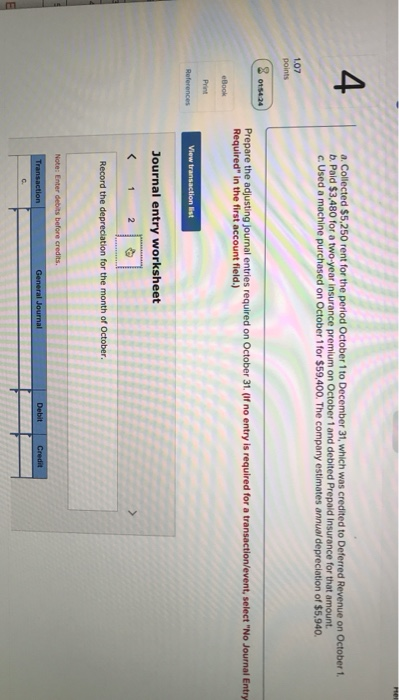

Ch 4 HW Saved Help Save CI 4 a. Collected $5,250 rent for the period October 1 to December 31, which was credited to Deferred Revenue on October 1. b. Pald $3,480 for a two year insurance premium on October 1 and debited Prepaid Insurance for that amount c. Used a machine purchased on October 1 for $59,400. The company estimates annual depreciation of $5,940. 1.07 points 01:54:58 Prepare the adjusting journal entries required on October 31. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) eBook Print References View transaction list Journal entry worksheet 1 2 3 > Record the rent revenue earned during October. Note: Enter debits before credits Transaction General Journal Debit Credit & Next > Ch 4 HW Saved Help 4 a Collected $5,250 rent for the period October 1 to December 31, which was credited to Deferred Revenue on October 1. b. Pald $3,480 for a two-year insurance premium on October 1 and debited Prepaid Insurance for that amount. c. Used a machine purchased on October 1 for $59,400. The company estimates annual depreciation of $5,940. 1.07 points 01:54:38 Prepare the adjusting journal entries required on October 31. (if no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) eBook Print References View transaction list Journal entry worksheet 1 26 3 Record the insurance expense for October Note: Enter debits before credits Transaction General Journal Debit Credit b Mc Her 4 a. Collected $5,250 rent for the period October 1 to December 31, which was credited to Deferred Revenue on October 1. b. Pald $3,480 for a two-year insurance premium on October 1 and debited Prepaid Insurance for that amount c. Used a machine purchased on October 1 for $59,400. The company estimates annual depreciation of $5,940. 1.07 points 01:56:24 Prepare the adjusting journal entries required on October 31, (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) eBook Print References View transaction list Journal entry worksheet 2 Record the depreciation for the month of October, Note: Enter debits before credits Transaction General Journal Debit Credit