Answered step by step

Verified Expert Solution

Question

1 Approved Answer

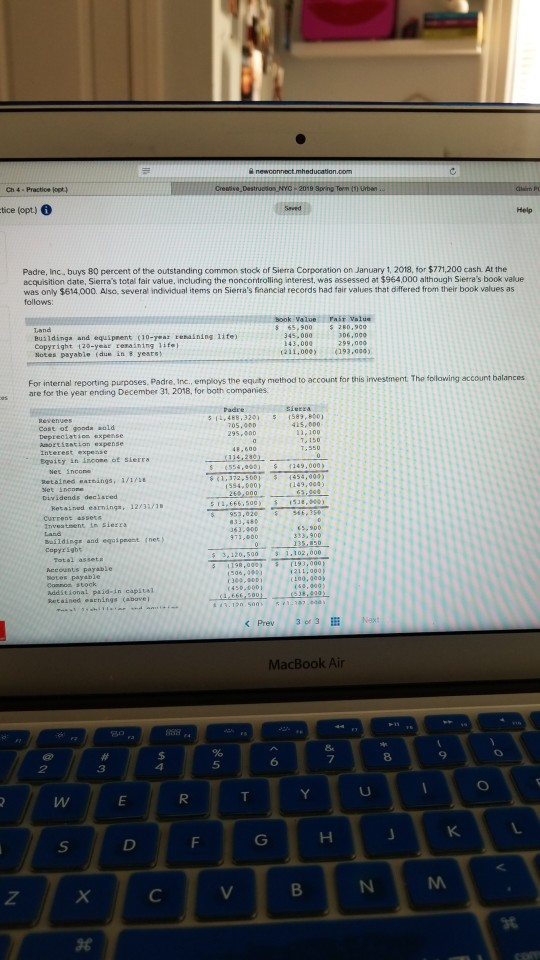

Ch 4 Practioe jopt tice (opt) 6 Padre, Inc, buys 80 percent of the outstanding common stock of Sierra Corporation on January 1, 2018, for

Ch 4 Practioe jopt tice (opt) 6 Padre, Inc, buys 80 percent of the outstanding common stock of Sierra Corporation on January 1, 2018, for $771,200 cash. At the ecquisition date, Sierra's toteal fair value, including the noncontrolling interest, was assessed at $964000 although Sierra's book value was only $614,000. Also, several individual items on Sierra's financial records had fair values that differed from their book values as sook Vale Pair Value 306,000 (211,000193.000) 65,900 345.000 280.900 Buildinga and equipnent (10-yeaz renaining life) Copyright 120-year resaining life ) Notes payable (dun in 8 years s. Padre, Inc., employs the equity method to account for this investment The following account balances For internal reporting purposes are for th e year ending December 31, 2018, for both companies 5,488.3201 (589,800, Cost of gooda sold Depreciation expense 1334 2814,000 Egaity in inoose of SierE ,0051 Retained earnings, /1/2 149,000) Retained earning, 12/31/1 Curren: asseKS Buildings and equipeant (net ) Copyrigbs Accounts payable otes payable Additional paid-in capitAl Retained esrnings (abave Pre 3 3EEE MacBook Air 8 5 6

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started