Answered step by step

Verified Expert Solution

Question

1 Approved Answer

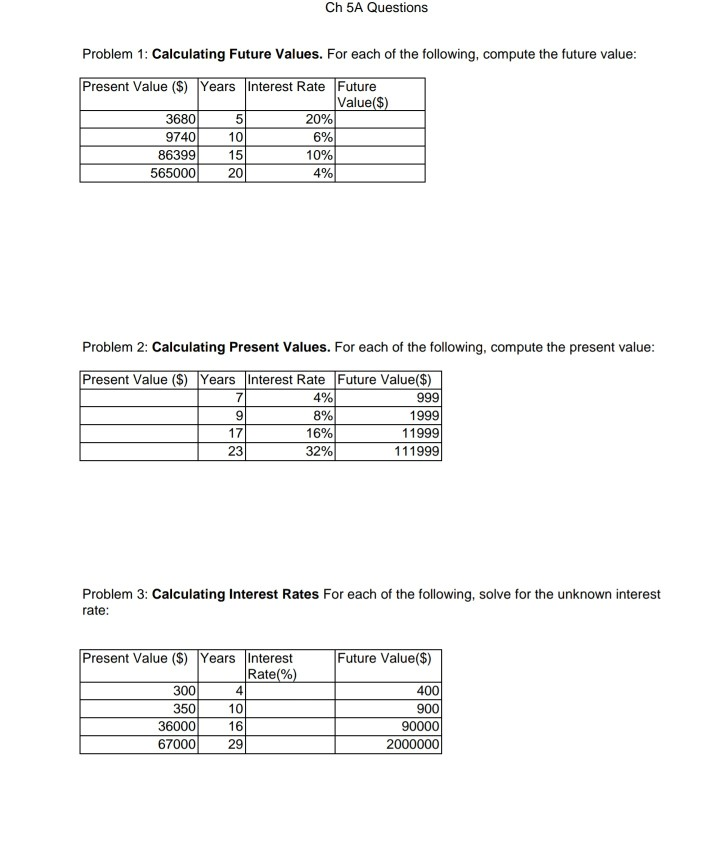

Ch 5A Questions Problem 1: Calculating Future Values. For each of the following, compute the future value: Present Value ($) Years Interest Rate Future Value($)

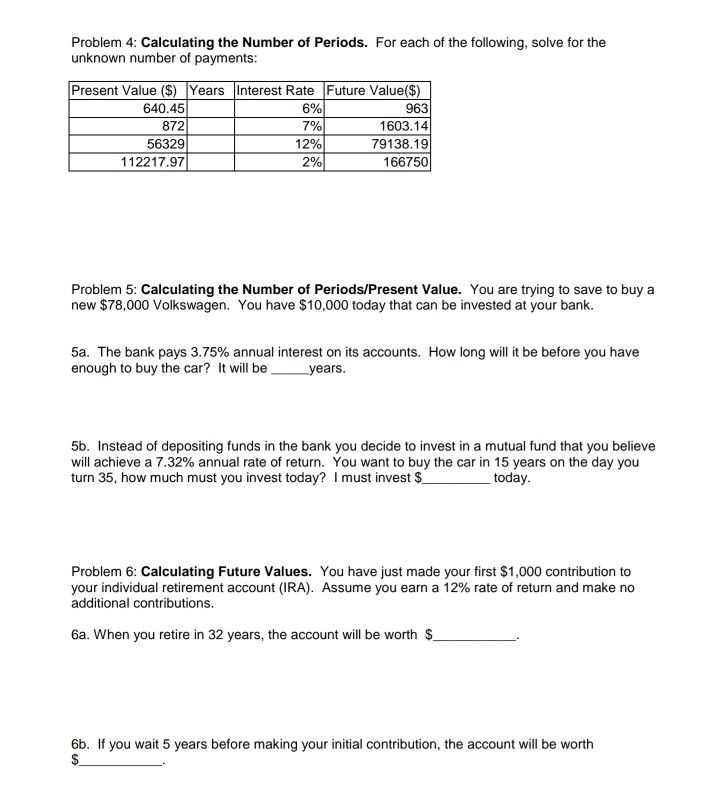

Ch 5A Questions Problem 1: Calculating Future Values. For each of the following, compute the future value: Present Value ($) Years Interest Rate Future Value($) 3680 5 20% 9740 10 6% 86399 15 10% 565000 20 4% Problem 2: Calculating Present Values. For each of the following, compute the present value: Present Value ($) Years Interest Rate Future Value($) 7 4% 999 8% 16% 32% 111999 9 17 23 1999 11999 Problem 3: Calculating Interest Rates For each of the following, solve for the unknown interest rate: Future Value($) Present Value ($) Years Interest Rate(%) 300 4 350 10 36000 16 67000 29 400 900 90000 2000000 Problem 4: Calculating the Number of Periods. For each of the following, solve for the unknown number of payments: Present Value ($) Years Interest Rate Future Value($) 640.45 6% 963 872) 7% 1603.14 56329 12% 79138.19 112217.97 2% 1667501 Problem 5: Calculating the Number of Periods/Present Value. You are trying to save to buy a new $78,000 Volkswagen. You have $10,000 today that can be invested at your bank. 5a. The bank pays 3.75% annual interest on its accounts. How long will it be before you have enough to buy the car? It will be _years. 5b. Instead of depositing funds in the bank you decide to invest in a mutual fund that you believe will achieve a 7.32% annual rate of return. You want to buy the car in 15 years on the day you turn 35, how much must you invest today? I must invest $ today. Problem 6: Calculating Future Values. You have just made your first $1,000 contribution to your individual retirement account (IRA). Assume you earn a 12% rate of return and make no additional contributions. 6a. When you retire in 32 years, the account will be worth $_ 6b. If you wait 5 years before making your initial contribution, the account will be worth

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started