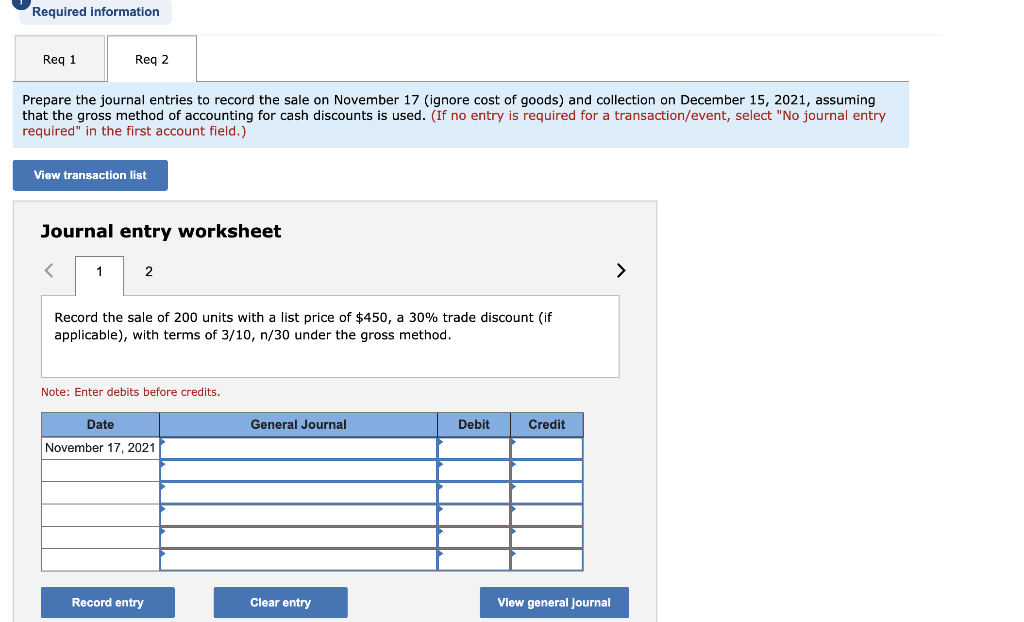

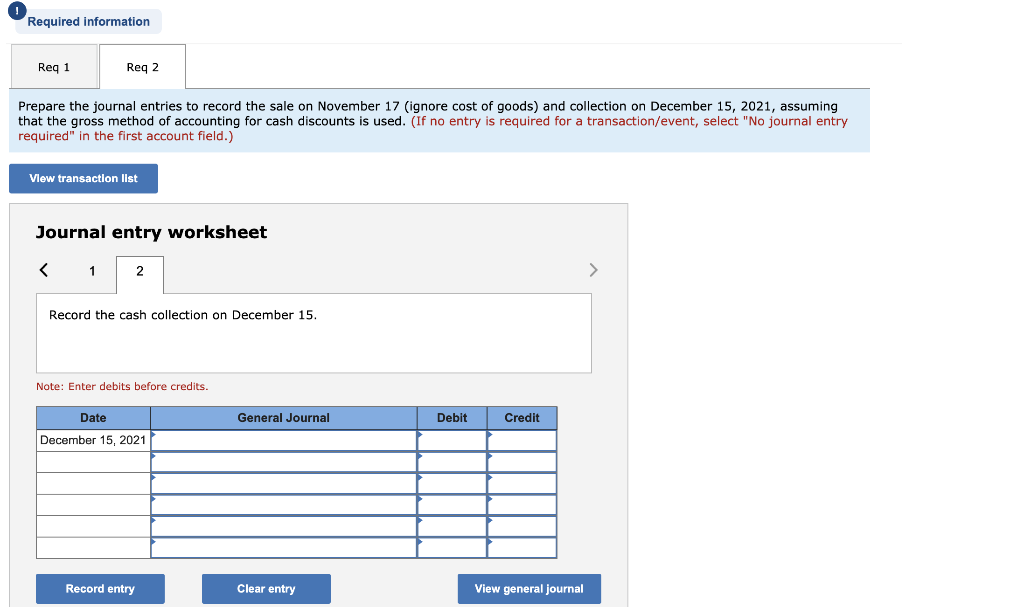

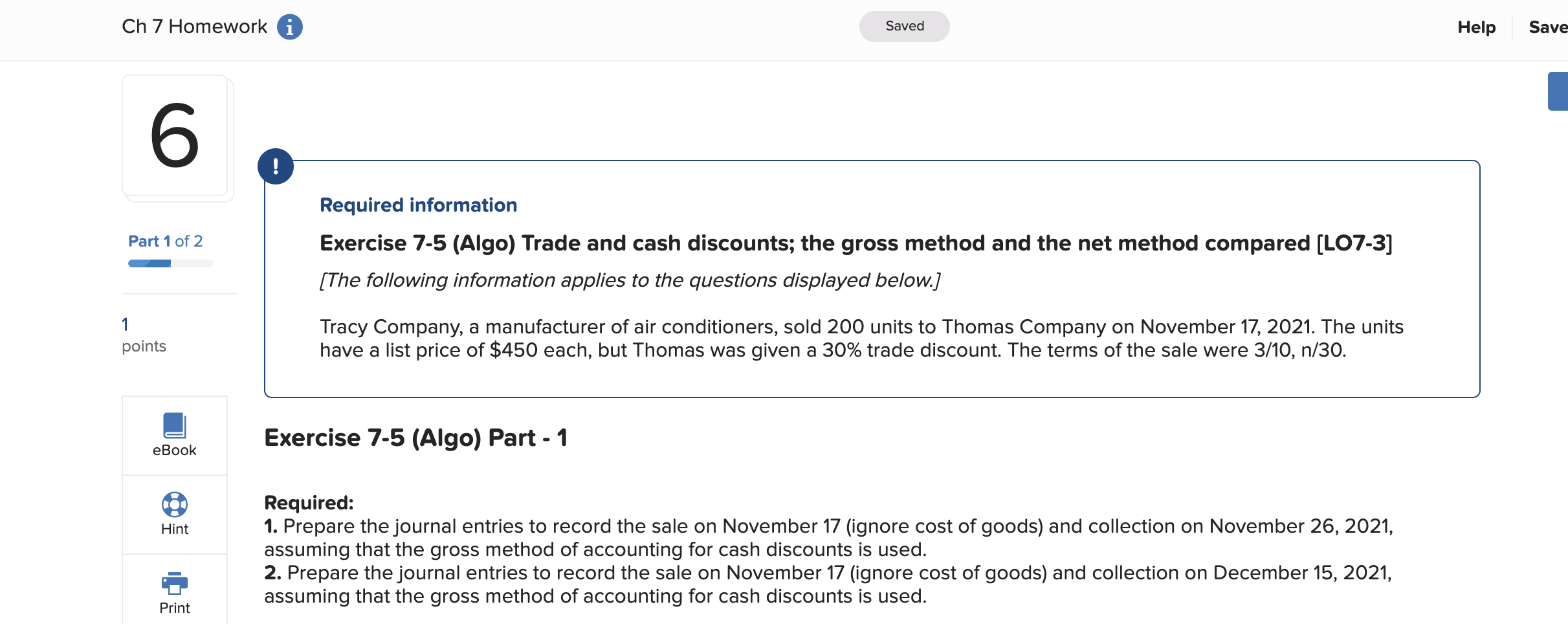

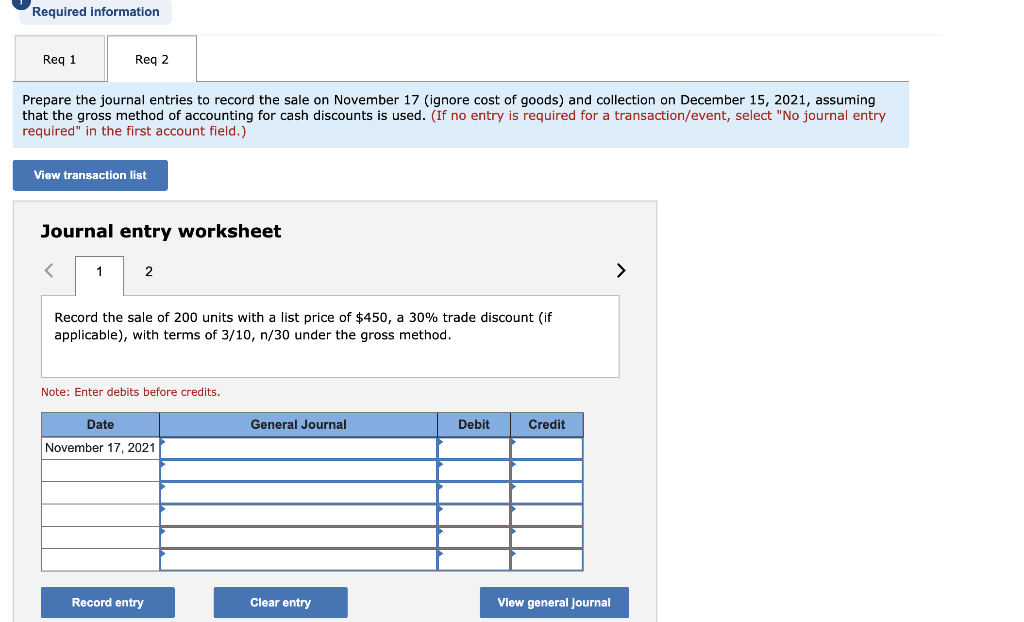

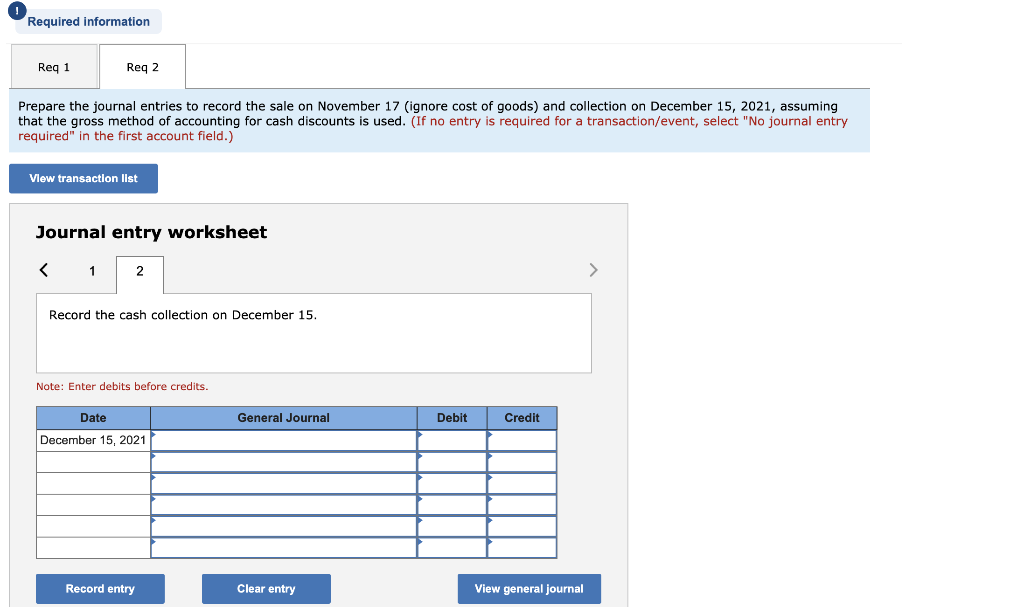

Ch 7 Homework i Saved Help Save 6 ! Required information Part 1 of 2 Exercise 7-5 (Algo) Trade and cash discounts; the gross method and the net method compared (LO7-3] (The following information applies to the questions displayed below.] 1 points Tracy Company, a manufacturer of air conditioners, sold 200 units to Thomas Company on November 17, 2021. The units have a list price of $450 each, but Thomas was given a 30% trade discount. The terms of the sale were 3/10, n/30. Exercise 7-5 (Algo) Part - 1 eBook Hint Required: 1. Prepare the journal entries to record the sale on November 17 (ignore cost of goods) and collection on November 26, 2021, assuming that the gross method of accounting for cash discounts is used. 2. Prepare the journal entries to record the sale on November 17 (ignore cost of goods) and collection on December 15, 2021, assuming that the gross method of accounting for cash discounts is used. Print Required information Req 1 Reg 2 Prepare the journal entries to record the sale on November 17 (ignore cost of goods) and collection on December 15, 2021, assuming that the gross method of accounting for cash discounts is used. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the sale of 200 units with a list price of $450, a 30% trade discount (if applicable), with terms of 3/10, n/30 under the gross method. Note: Enter debits before credits. Date General Journal Debit Credit November 17, 2021 Record entry Clear entry View general Journal Required information Req 1 Reg 2 Prepare the journal entries to record the sale on November 17 (ignore cost of goods) and collection on December 15, 2021, assuming that the gross method of accounting for cash discounts is used. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the cash collection on December 15. Note: Enter debits before credits. Date General Journal Debit Credit December 15, 2021 Record entry Clear entry View general journal