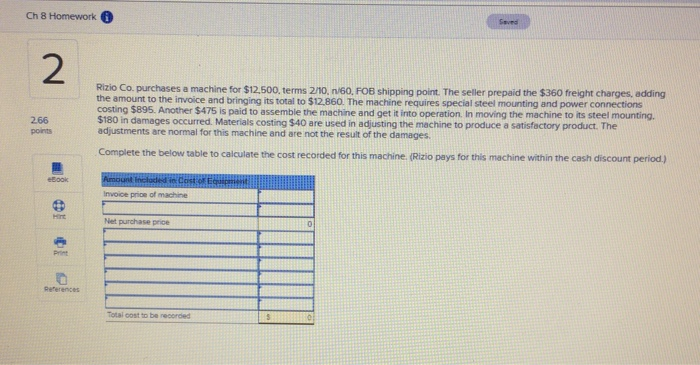

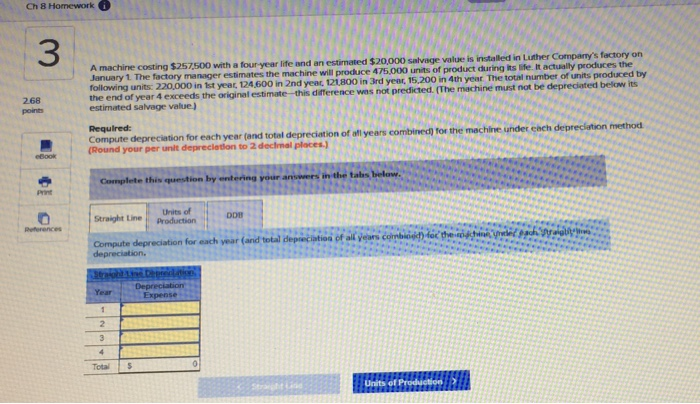

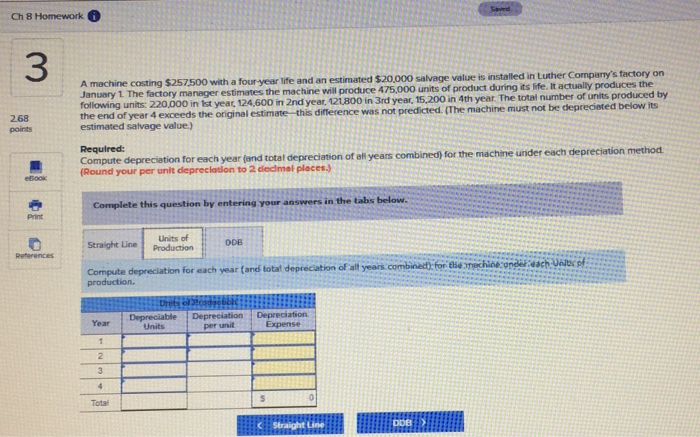

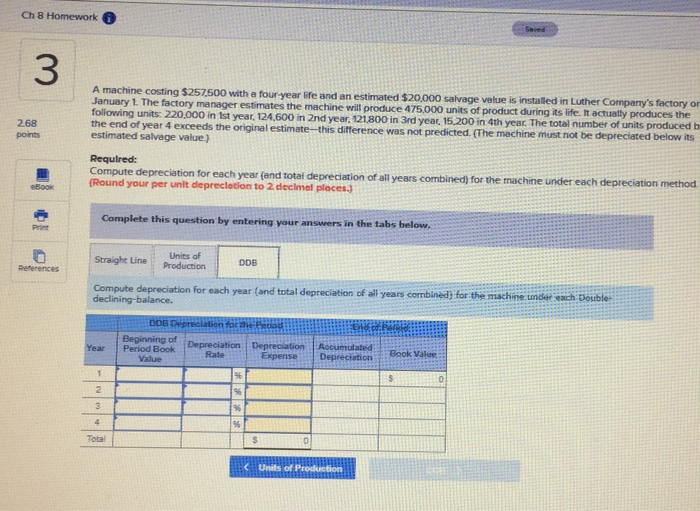

Ch 8 Homework 2 Rizio Co. purchases a machine for $12.500.terms 2/10, n/60. FOB shipping point. The seller prepaid the $360 freight charges, adding the amount to the invoice and bringing its total to $12.860. The machine requires special steel mounting and power connections costing $895. Another $475 is paid to assemble the machine $18 in damages occurred. Materials costi g $40 are used in adjusting the machine to produce a satisfactory prod ct. The adjustments are normal for this machine and are not the result of the damages and get it into operation In moving the machine to its steel mounting. 266 points Complete the below table to calculate the cost recorded for this machine (Rizio pays for this machine within the cash discount period) Invoice price of machine Net purchase price Print Rererences otai cost to be recorded Ch 8 Homework 3 hine costing $257500 with a four-year life and an estimated $20,000 salvage value is installed in Luther Company's fectory on oduced by A mac factory manager estimates the machine will produce 475,.000 units of product during its life. It actually produces the the end of year 4 exceeds the estimated salvage value ) estimadedl stendexceeds the originaf estimate-this imerence was not predicted. (The mchin must not be 268 Compute depreciation for each year (and total depreciation of all years combined) for the mechine under ech depreciation method. (Round your per unit deprecletion to 2 declmal ploces) print Units of Straight Line production DDB Year Total S Ch 8 Homework 6 3 A machine costing $257500 with a four-year life and an estimated $20,000 salvage Januery 1 The factory manager estimates the machine will produce following units: 220,000 in 1st year 124,600 in 2nd yea the end of year 4 exceeds the original estimate this diflerence was not predicted. (The machine must not be deprecioted below its estimated salvage value) value is installed in Luther Company's factory on ar. 121800 in 3rd year. 15.200 in 4th year The total number of units produced by 475,000 units of product during its life. It actually produces the 268 points Compute depreciation for each year (and total depreciation (Round your per unit depreclation to 2 declmal places.) of alt years combined) for the machine under each depreciation method Complete this question by entering your answers in the tabs below. Print Straight LineUnits of ProductionDDB Compute depreciation for each year t production. Year Depreciable Depreciation Depreciation Expense Units per unit Total r Ch 8 Homework 3 A machine costing $257500 with a four-year ire and an estimated $20,000 salvage velue is instaed in Luther Company's factory or January 1. The factory manager following units: 220,000 in 1st year, 124,600 in 2nd year. 121.800 in 3rd year, 15,200 in 4th year The total number of units estimates the machine will produce 475.000 units of product during its life. It actually produces the 268 points producedb estimate- this difference was not predicted.(The machine must not be depreciated below its estimated salvage value) Required: (Round your per unit depreclation to 2 declmel places) Compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method alil years eBook( Complete this question by entering your answers in the tabs below. Print Straighe LineUnits of Compute depreciation for each year (and total depreciation of alf years combined) for the machine under eaich Deutble Production DDB References Period Book Depreciation Accumulated Rate Expense DepreciationBook Vase Value Tota