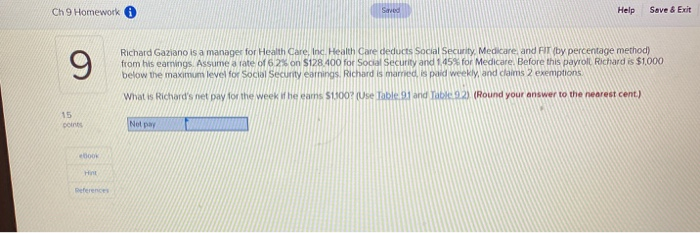

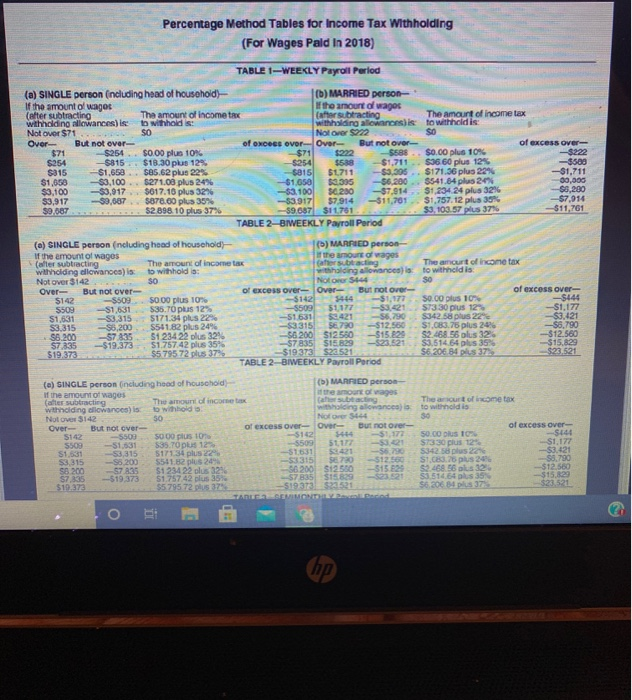

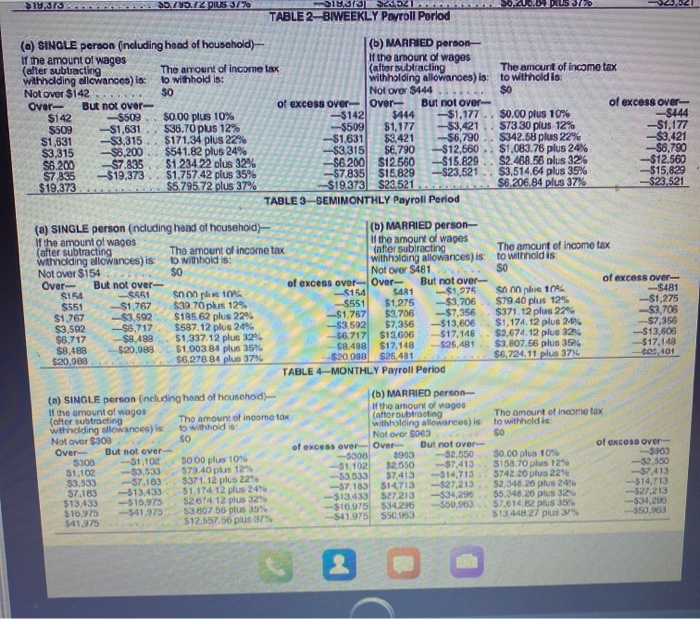

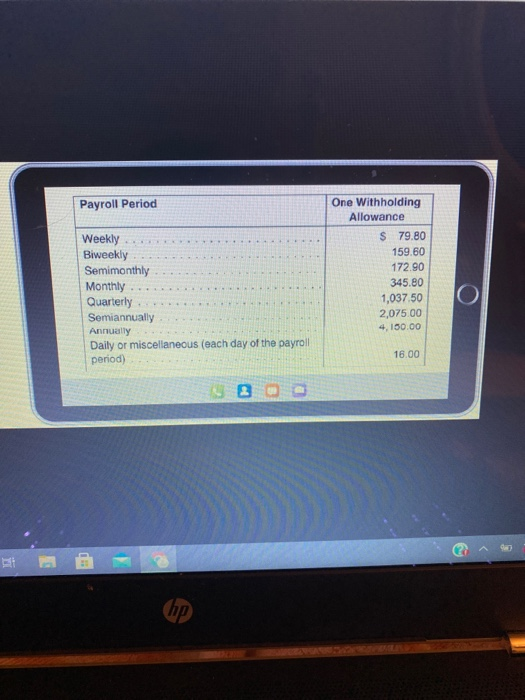

Ch 9 Homework Saved Help Save & Exit 9 Richard Gaziano is a manager for Health Care, Inc. Health Care deducts Social Security Medicare and FIT by percentage method) from his earnings. Assume a rate of 62% on $128.400 for Social Security and 1.45% for Medicare. Before this payroll Richard is $1,000 below the maximum level for Social Security earnings, Richard is married, is paid weekly and claims 2 exemptions What is Richard's net pay for the week if he earns 51100? (Use Table 91 and Table 92) (Round your answer to the nearest cent) 15 points Netpay 000 Hint References 14,313 S0.75.72 pius 3/7 MIDI S2152 TABLE 2-8/WEEKLY Payroll Period (a) SINGLE Person (ncluding head of household) (b) MARRIED person- If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withhold is: withholding allowances) is: to withholdis: Not over $142 $0 Not Over $444 $0 Over But not over- of excess over Over But not over of excess over- $142 -$509 $0.00 plus 10% -$142 $444 -$1,177 $0.00 plus 10% -$444 $509 -$1,631 $36.70 plus 12% $509 $1,177 -$3,421 S73.30 plus 12% -$1,177 $1,631 -$3,315 $171.34 plus 22% -$1.631 $3,421 -56,790 $342.58 plus 22% -$3.421 $3,315 -$8,200 $541.82 plus 24% $3,315 SE, 790 -$12,560 $1,083.76 plus 24% -S8,790 S6.200 $7.835 $1.234 22 olus 32% -S6.200) S12560 $15.829 S2.468.56 plus 32% - $12.560 S7 835 -$19,373 $1,757.42 plus 35% -$7,835 $15.829 -$23,521 $3,514.64 plus 35% -$15,829 $19,373 $5.795.72 plus 37% $19.373 $23,521 $6.206.84 plus 37% -$23,521 TABLE 3-SEMIMONTHLY Payroll Period (2) SINGLE person (ncluding head of household) (b) MARRIED person- If the amount of wages If the amount of wages (after subtracting The amount of income tax after subtracting The amount of income tax wthnolding allowances) is: to withhold is: withholding allowances) is: to withhold is Not over $154 SO Not Over $481 SO Over- But not over- of excess over-Over But not over of excess over S15 -S451 non plus 10 -$154 S481 -$1,975 snon plus 10% -$481 $551 - $1,767 $39.70 plus 12% -S551 $1,275 -$3,706 $79.40 plus 12% -S1,275 $1,767 -S3,592 $185.62 plus 229 -$1.767 $3,706 -$7,356 $371.12 plus 224 -$3,706 $3,592 S6,717 $587.12 plus 24% -$3,592 $7,356 -$13,606 $1,174.12 plus 20% -$7,356 $6.717 $9.499 $1,337.12 plus 32% -S6.717 $13,606 $17,146 $2,674.12 plus 32% -$13,608 $8.488 $20.088 $1.003.84 plus 35% $8.488 $17,148 $25,481 $3,807.56 plus 396 $17,148 $20.088 56.278 84 plus 37% $20.088 $25,481 $6.724.11 plus 3714 COS, 401 TABLE 4-MONTHLY Payroll Period (a) SINGLE person including head of household (b) MARRIED person- If the amount of wagos If the amount of wagos (after oubtracting The amount of income to (aftoroubtracting The amount of income tax withholding allowances) is to withhold is withholding allowances) is to withholdie Not over $308 SO Not over $063 SO Over But not over of excess over Over But not over of excess over- S303 - 31.102 S000 plus 10% -5308 5933 -$2,550 50.00 plus 10% -$903 31.102 33,533 579.40 plus 12" -$1.102 $2.550 -37,413 S158.70 plus 12% -32.550 $3,533 -57,183 3371.12 plus 229 -53.533 37,413 -314,713 5742.20 plus 229 -$7,413 $7,183 -$13.433 $1.174 12 plus 24% -S7183 $14713 -$27.213 52,346.20 plus 20% -$14,713 $13,433 -$16.975 52674.12 plus 32% -$13.433 27.213 -$34.290 $5.348.26 plus 32% -$27.213 $16.975 -541,975 53 807 56 plus 35% $16.975 534296 -$50.963 57,614.82 plus 35 -334,200 $41,975 $12.557 56 plus 37% -$41.975 S50953 $13.448.27 plus 37% -550.000 Payroll Period Weekly Biweekly Semimonthly Monthly Quarterly Semiannually Annually Daily or miscellaneous (each day of the payroll period) One Withholding Allowance $ 79.80 159.60 172.90 345.80 1,037.50 2,075.00 4,150.00 16.00 hp