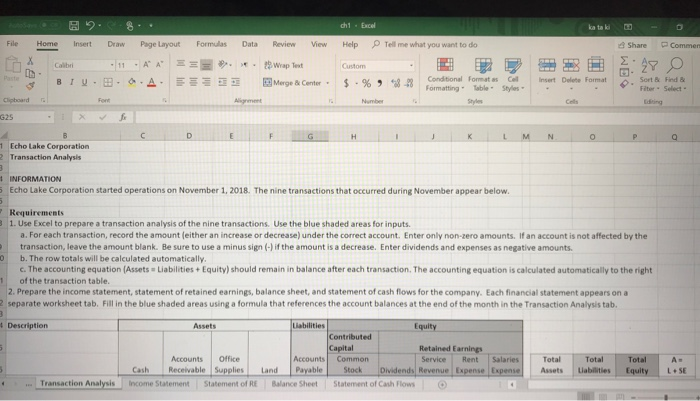

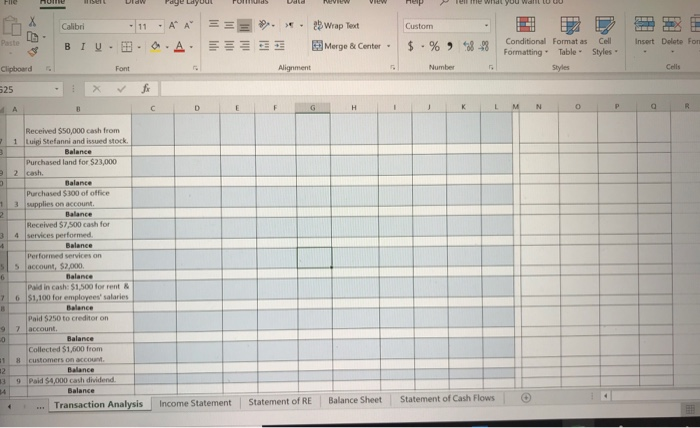

ch1 Excel ka ta ki DD File Home Insert Draw Page Layout Formulas Data ReviewView Help Tell me what you want to do Share Commen Conditional Format as Cell Insert Delete Format FormattingTable- Styles Merge & Center iter Select Styles G25 1 Echo Lake Corporation 2 Transaction Analysis INFORMATION Echo Lake Corporation started operations on November 1, 2018. The nine transactions that occurred during November appear below Requirements 1. Use Excel to prepare a transaction analysis of the nine transactions. Use the blue shaded areas for inputs a. For each transaction, record the amount (either an increase or decrease) under the correct account. Enter only non-zero amounts. If an account is not affected by the transaction, leave the amount blank. Be sure to use a minus sign (-) if the amount is a decrease. Enter dividends and expenses as negative amounts 0 b. The row totals will be calculated automatically c The accounting equation AssetsLiabilities + Equity should remain in balance after each transaction. The accounting equation is calculated automatically to the right 1 of the transaction table 2. Prepare the income statement, statement of retained earnings, balance sheet, and statement of cash flows for the company. Each financial statement appears ona separate worksheet tab. Fill in the blue shaded areas using a formula that references the account balances at the end of the month in the Transaction Analysis tab. t Description Assets Liabilities Equity Contributed Capital Retained Earnings Service Rent Salaries Total T Accounts Office Accounts Common Total A Cash Receivable Supplies Land PayableStock Dividends Revenue Expense Expense Assets Liabilities Equity L SE | Transaction Analysis | Income Statement | Statement of RE Balance Sheet | Statement of Cash Flows Custom Conditional Format as Cell Insert Delote Fon Conditional Formatas . Cell FormattingTable Styles Paste Insert Delete Fon Merge & Center $-% , . Clipboard Font Alignment Number Cells Received $50,000 cash from 1 Luigi Stefanni and issued stock. Balance Purchased land for $23,000 2 cash. Balance Purchased $300 of office 1 3 supplies on account Received $7,500 cash for 3 4 services Balance Performed services on Paid in cash: $1,500 for rent & 6 $1,100 for employees salaries Paid $250 to creditor on 9 7 laccount. Collected $1,600 from 18 customers on accoumt 9 Paid $4,000 cash dividend Balance | | Balance Sheet Statement of Cash Flows | Transaction Analysis Statement of RE Income Statement