Answered step by step

Verified Expert Solution

Question

1 Approved Answer

***CH:10 - LO:25*** Hello, can you guys help me out... thanks. 1- 2- 3- 4- CH10: LO-25 eBook 14 Show Me How Residual Income The

***CH:10 - LO:25*** Hello, can you guys help me out... thanks.

1-

2-

3-

4-

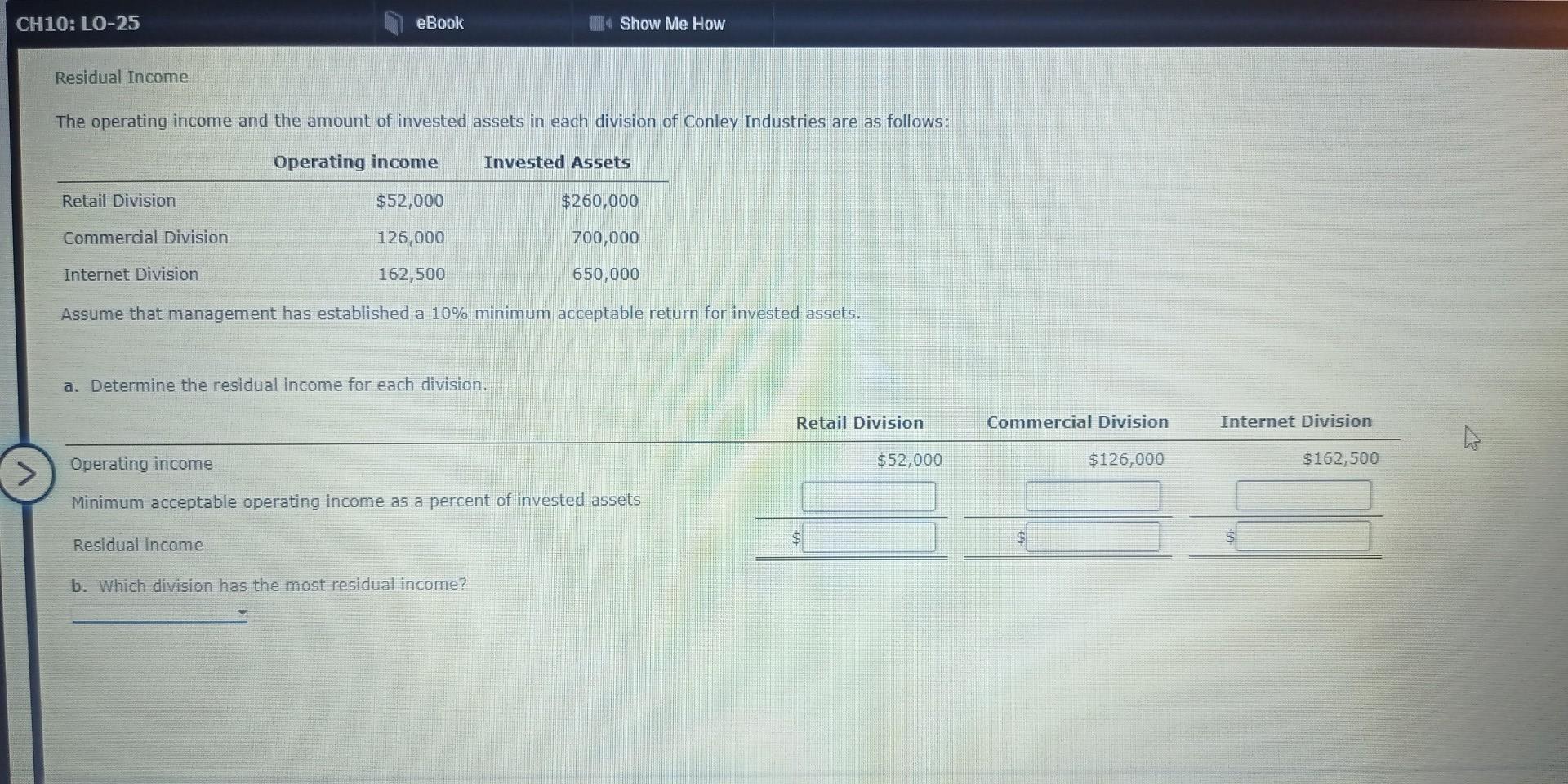

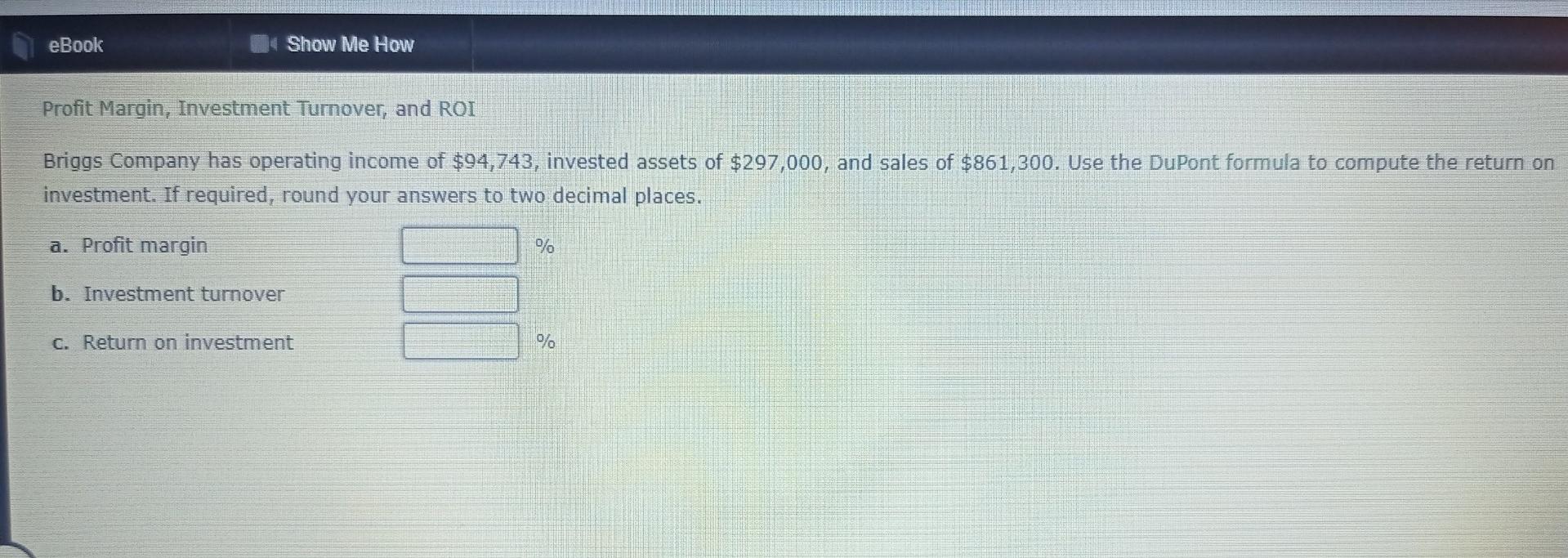

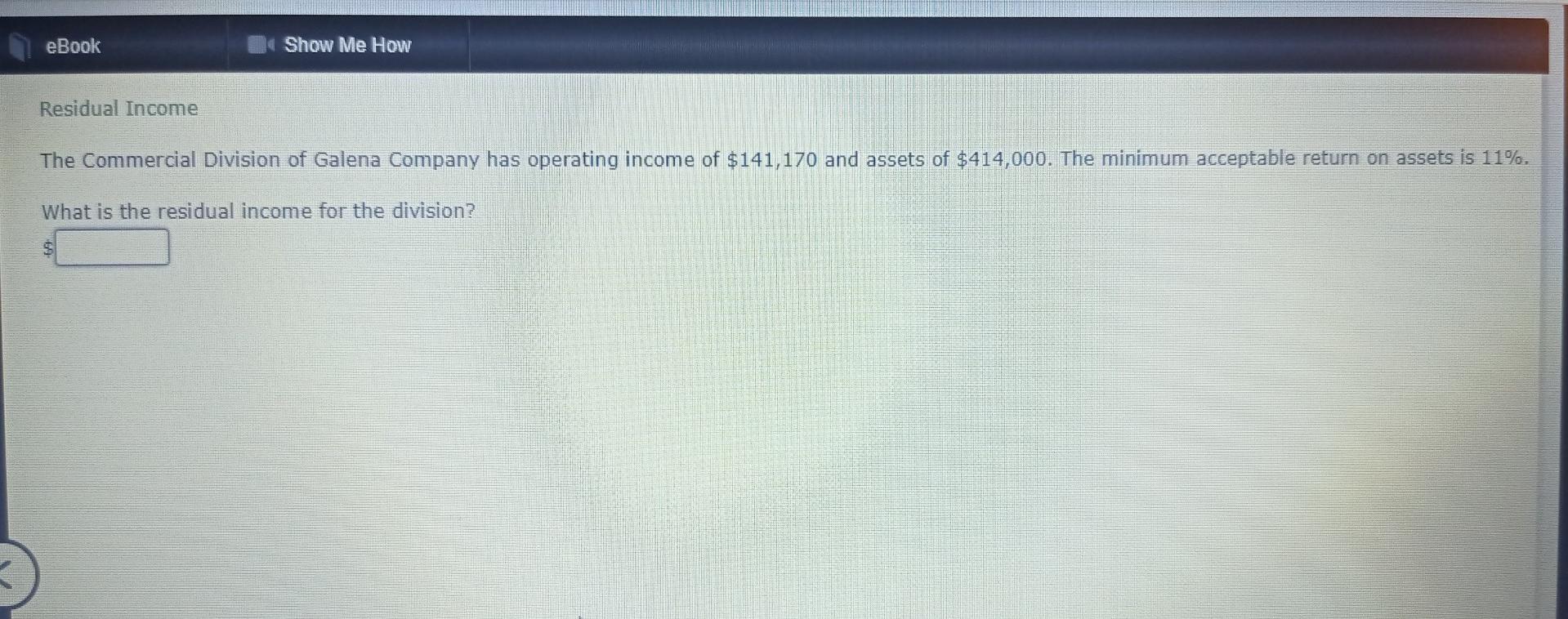

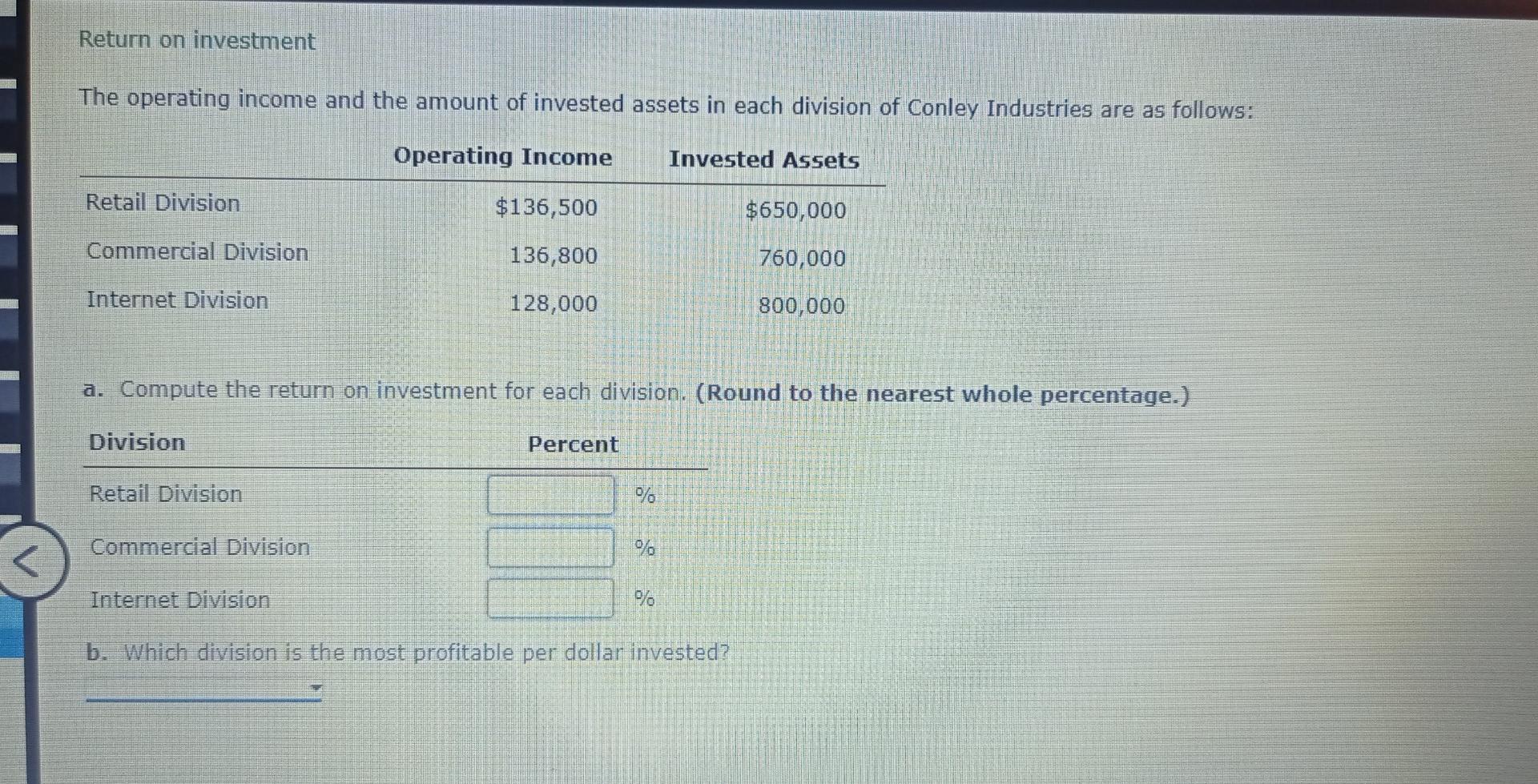

CH10: LO-25 eBook 14 Show Me How Residual Income The operating income and the amount of invested assets in each division of Conley Industries are as follows: Operating income Invested Assets Retail Division $ 52,000 $260,000 Commercial Division 126,000 700,000 Internet Division 162,500 650,000 Assume that management has established a 10% minimum acceptable return for invested assets. a. Determine the residual income for each division. Retail Division Commercial Division Internet Division v Operating income $52,000 $126,000 $162,500 Minimum acceptable operating income as a percent of invested assets Residual income b. Which division has the most residual income? eBook 1 Show Me How Profit Margin, Investment Turnover, and ROI Briggs Company has operating income of $94,743, invested assets of $297,000, and sales of $861,300. Use the DuPont formula to compute the return on investment. If required, round your answers to two decimal places. a. Profit margin % b. Investment turnover C. Return on investment % eBook 1 Show Me How Residual Income The Commercial Division of Galena Company has operating income of $141,170 and assets of $414,000. The minimum acceptable return on assets is 11%. What is the residual income for the division? Return on investment The operating income and the amount of invested assets in each division of Conley Industries are as follows: Operating Income Invested Assets Retail Division $136,500 $ 650,000 Commercial Division 136,800 760,000 Internet Division 128,000 800,000 a. Compute the return on investment for each division. (Round to the nearest whole percentage.) Division Percent Retail Division % Commercial Division Internet Division b. Which division is the most profitable per dollar invested

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started