Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ch10-3 Estimated Useful life of Assets: building-15 years equipment-4years truck- 6 years Purchase Price & Estimated Salvage Value: Building- purchase price $70,000/salvage value $30,000 Equipment-

ch10-3

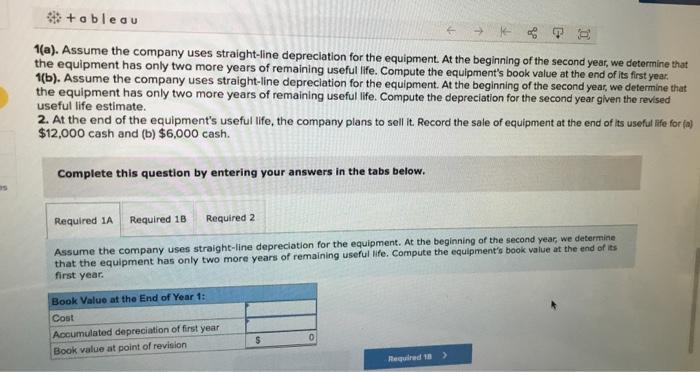

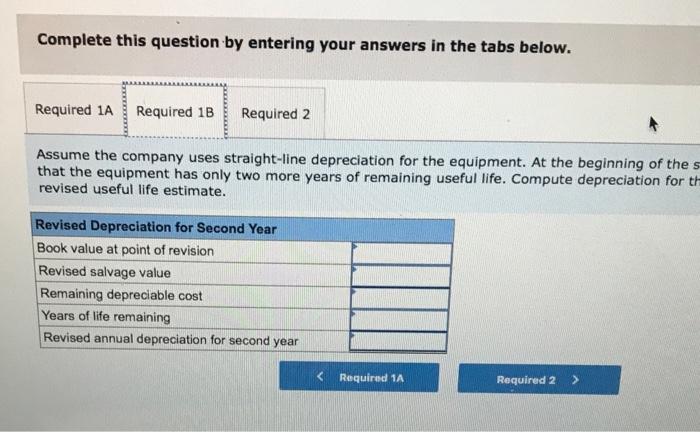

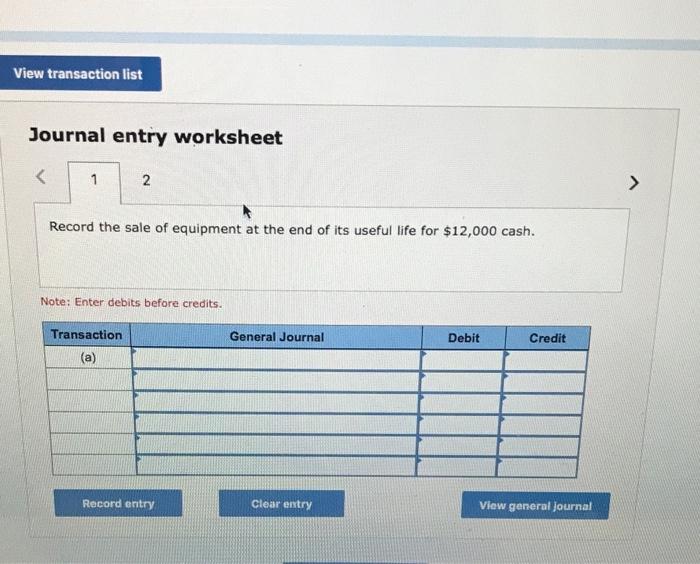

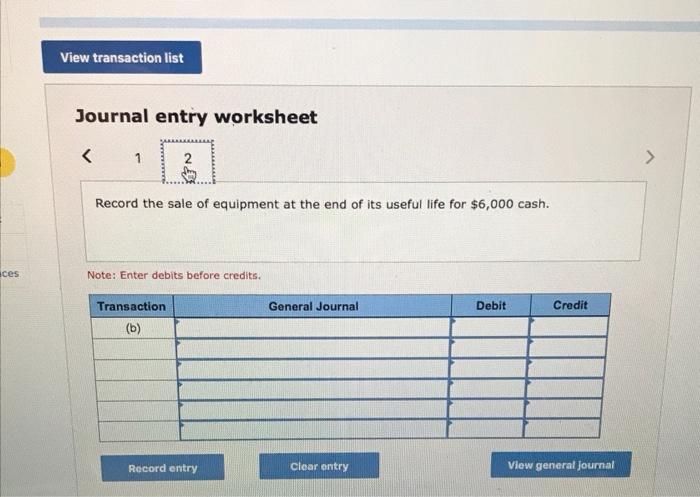

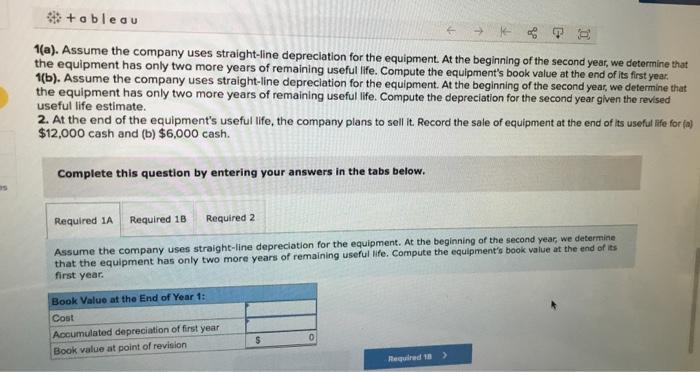

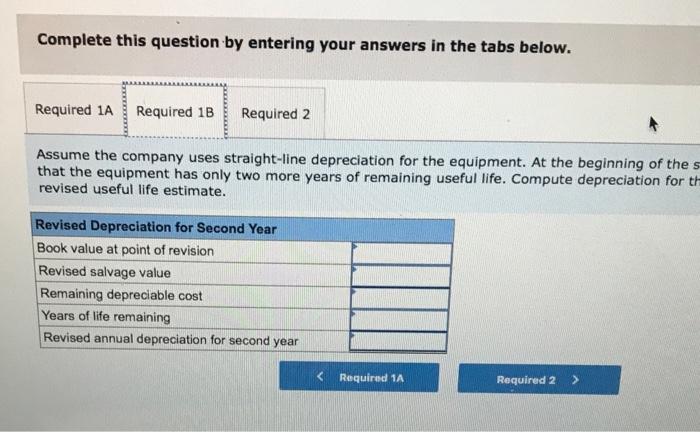

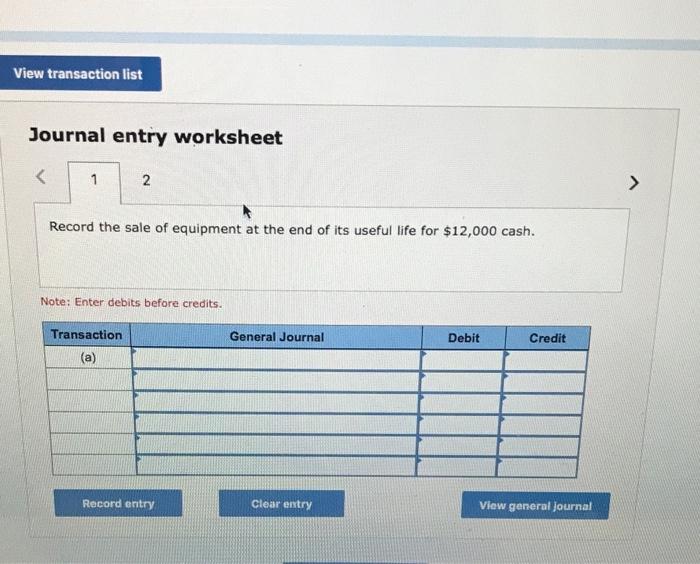

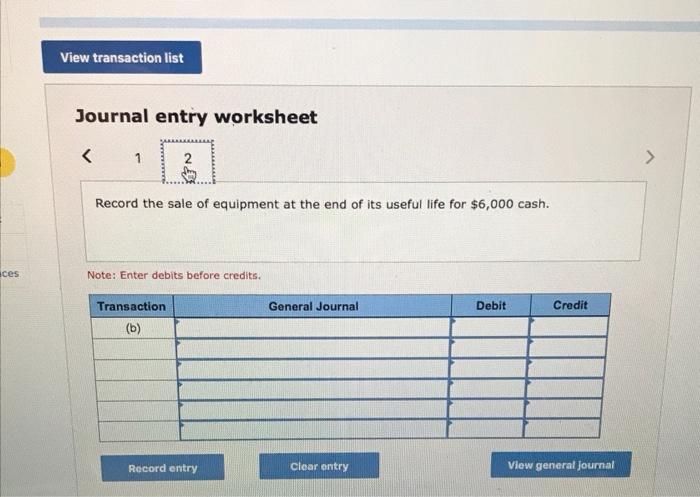

**+obleau 1(a). Assume the company uses straight-line depreciation for the equipment. At the beginning of the second year, we determine that the equipment has only two more years of remaining useful life. Compute the equipment's book value at the end of its first year. 1(b). Assume the company uses straight-line depreciation for the equipment. At the beginning of the second year, we determine that the equipment has only two more years of remaining useful life. Compute the depreciation for the second year given the revised useful life estimate. 2. At the end of the equipment's useful life, the company plans to sell it. Record the sale of equipment at the end of its useful life for (a) $12,000 cash and (b) $6,000 cash. Complete this question by entering your answers in the tabs below. Required 1A Required 18 Required 2 Assume the company uses straight-line depreciation for the equipment. At the beginning of the second year, we determine that the equipment has only two more years of remaining useful life. Compute the equipment's book value at the end of its first year. Book Value at the End of Year 1: Cost Accumulated depreciation of first year Book value at point of revision $ 0 Required 18 > Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 2 Assume the company uses straight-line depreciation for the equipment. At the beginning of the s that the equipment has only two more years of remaining useful life. Compute depreciation for the revised useful life estimate. Revised Depreciation for Second Year Book value at point of revision Revised salvage value Remaining depreciable cost Years of life remaining Revised annual depreciation for second year NE Record the sale of equipment at the end of its useful life for $6,000 cash. ces Note: Enter debits before credits. General Journal Debit Credit Transaction (b) Record entry clear entry View general Journal Estimated Useful life of Assets:

building-15 years

equipment-4years

truck- 6 years

Purchase Price & Estimated Salvage Value:

Building- purchase price $70,000/salvage value $30,000

Equipment- purchase price $40,000/salvage value $10,000

Truck-purchase price $30,000/salvage value $5,000

Actual & Estimated Units-of-Production:

Year 1 actual production- 35,000 units

Year 2 estimated production-55,000 units

Year 3 estimated production- 25,000 units

Year 4 estimated production-5,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started