Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ch4-11 Check my work GL0401 (Algo) - Based on... LO C1, P2, P3 The Solid Systems Company began operations on December 1, 2021. The unadjusted

ch4-11

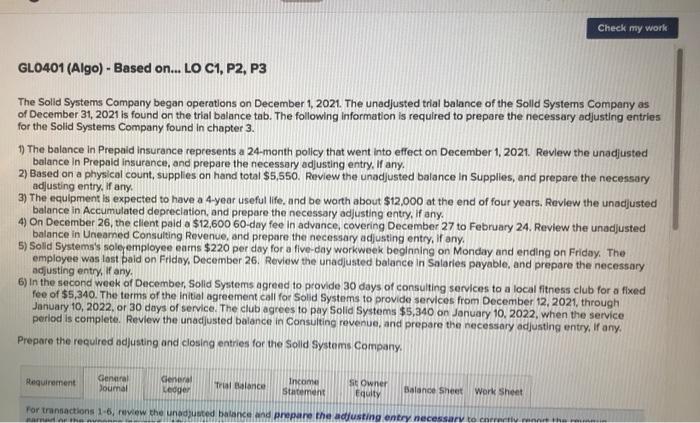

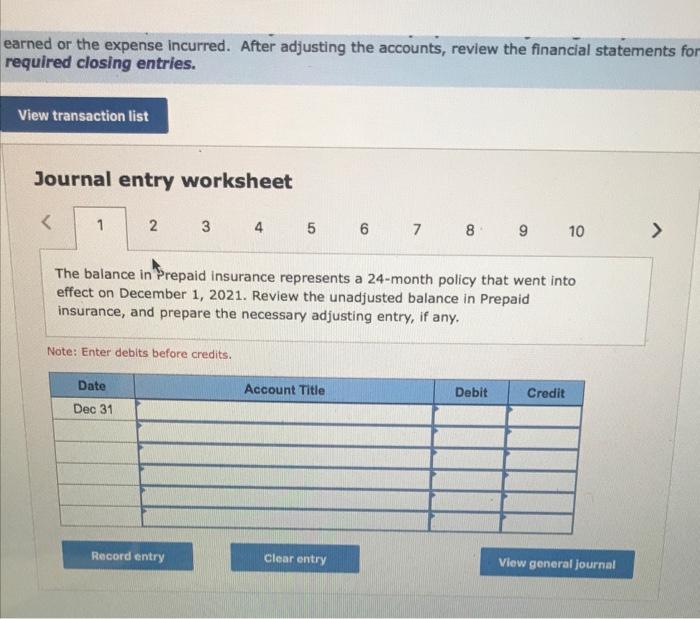

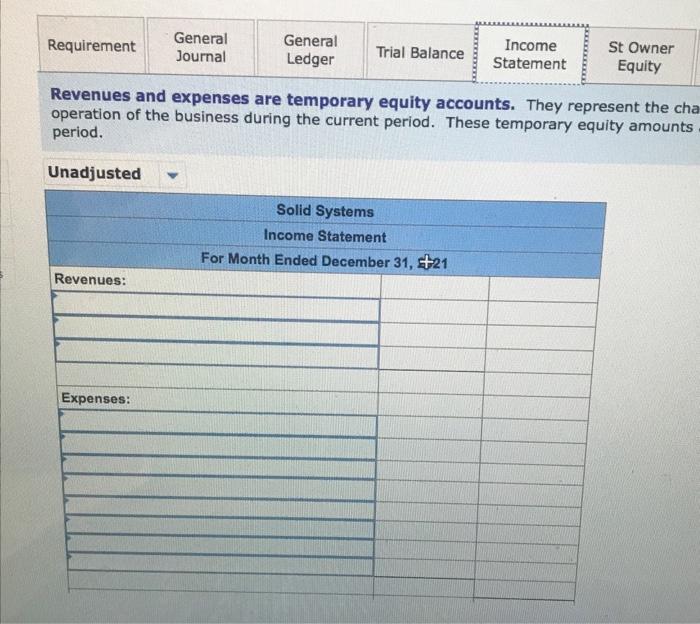

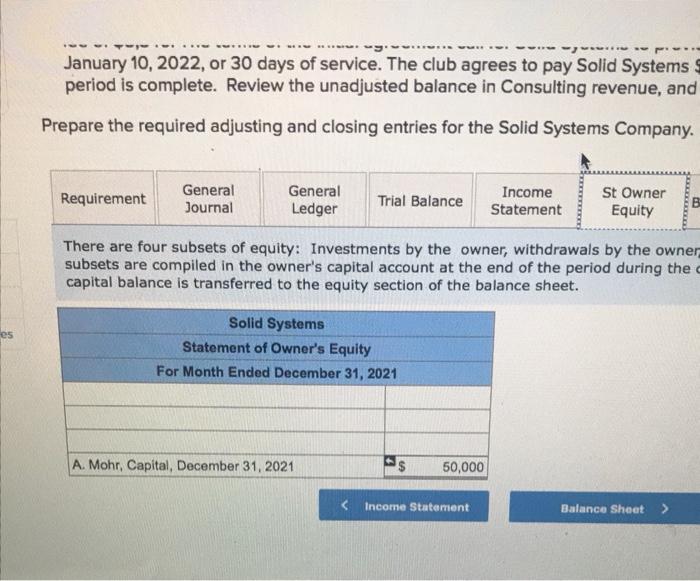

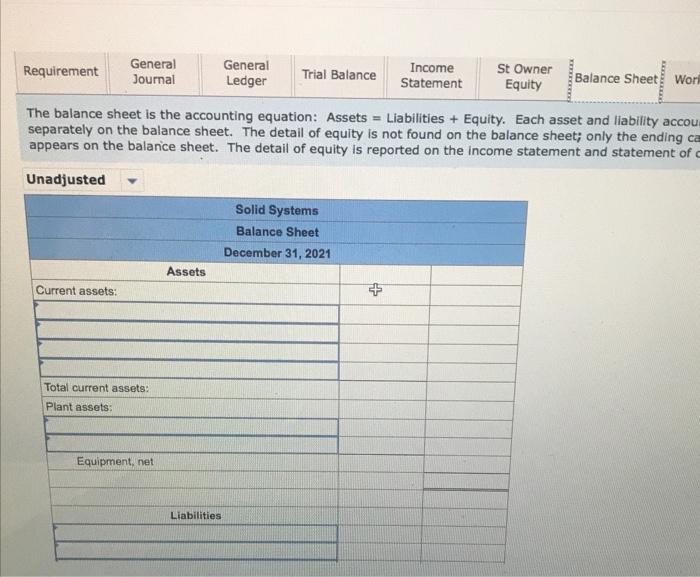

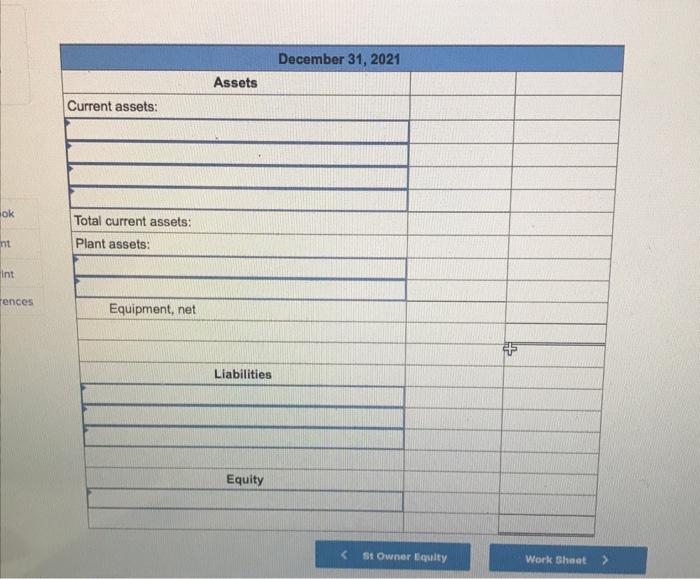

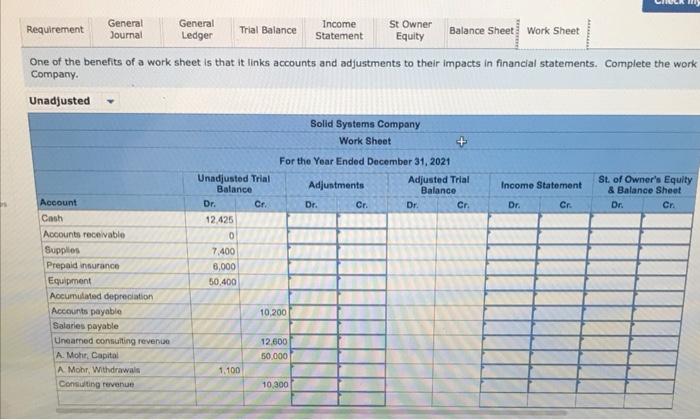

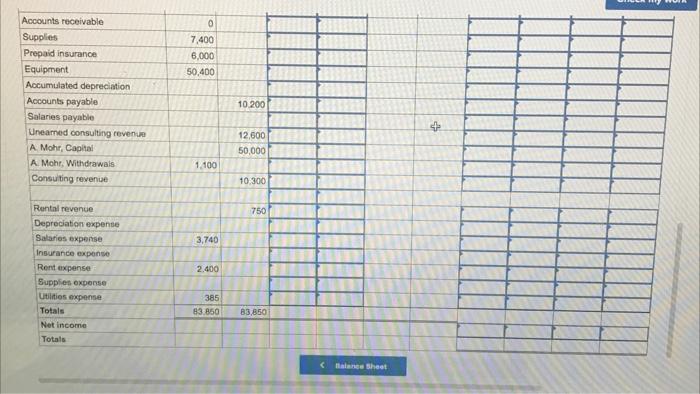

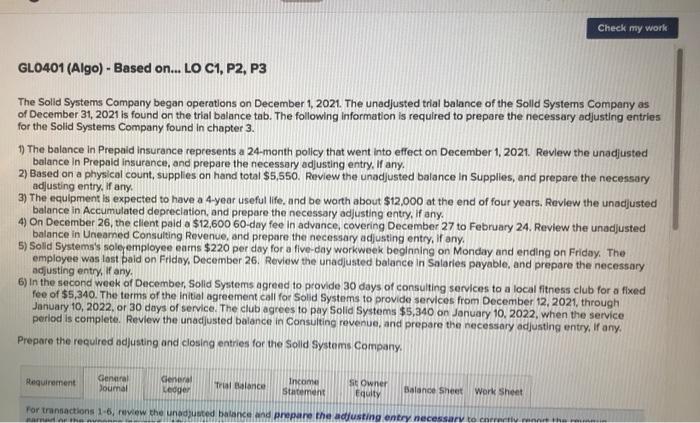

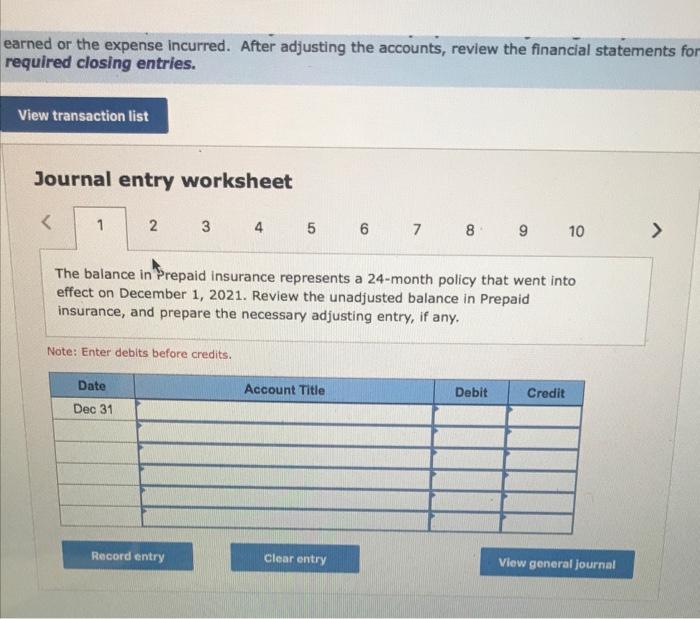

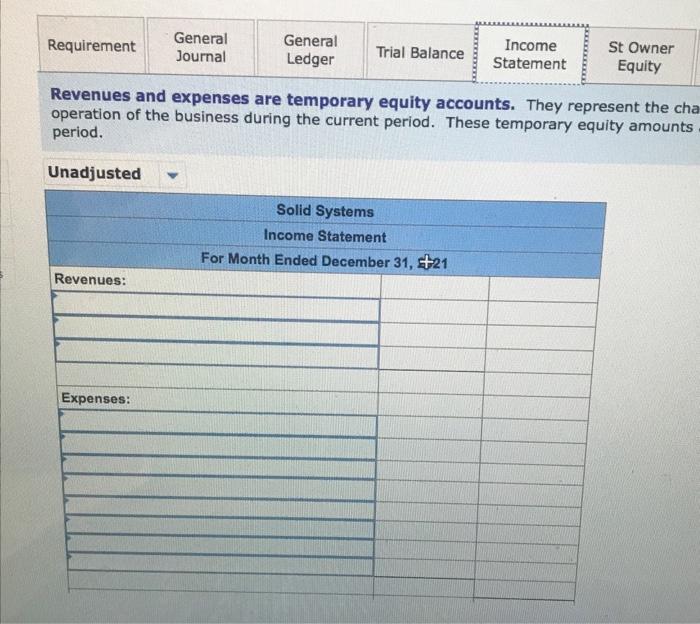

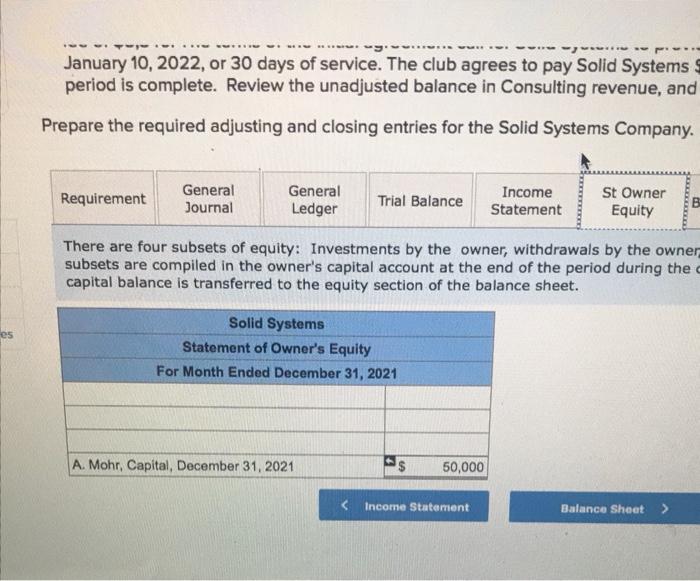

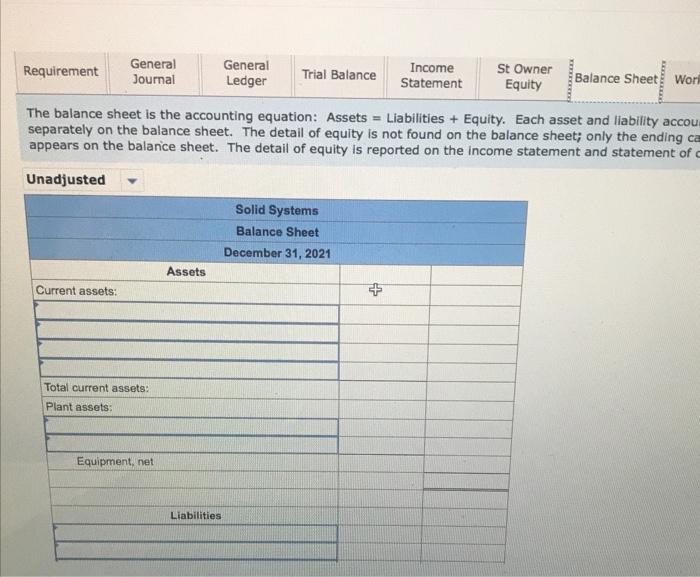

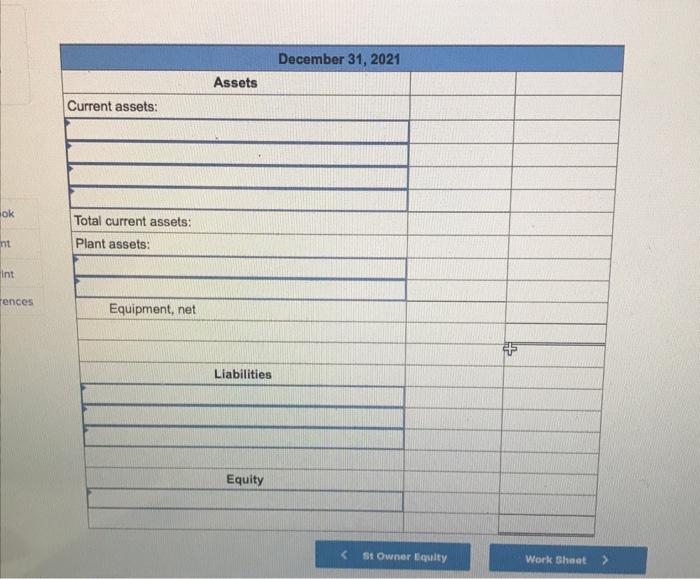

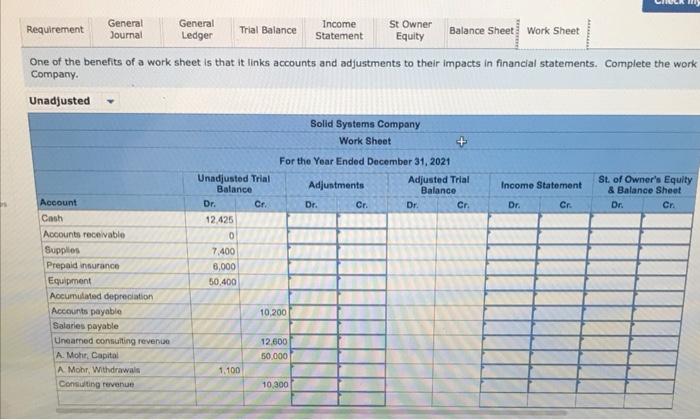

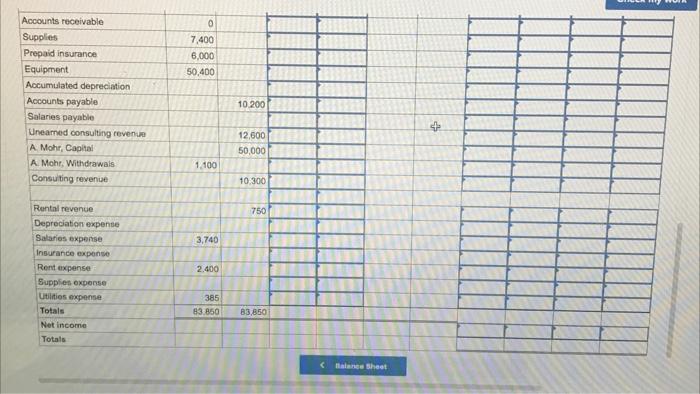

Check my work GL0401 (Algo) - Based on... LO C1, P2, P3 The Solid Systems Company began operations on December 1, 2021. The unadjusted trial balance of the Solid Systems Company as of December 31, 2021 is found on the trial balance tab. The following information is required to prepare the necessary adjusting entries for the Solid Systems Company found in chapter 3. 1) The balance in Prepold Insurance represents a 24-month policy that went into effect on December 1, 2021. Review the unadjusted balance in Prepaid insurance, and prepare the necessary adjusting entry, if any. 2) Based on a physical count, supplies on hand total $5,550. Review the unadjusted balance in Supplies, and prepare the necessary adjusting entry, If any. 3) The equipment is expected to have a 4-year useful life, and be worth about $12,000 at the end of four years. Review the unadjusted balance in Accumulated depreciation, and prepare the necessary adjusting entry, if any. 4) On December 26, the client pold a $12,600 60-day fee in advance, covering December 27 to February 24. Review the unadjusted balance in Uneamed Consulting Revenue, and prepare the necessary adjusting entry, if any. 5) Solid Systems's sole employee earns $220 per day for a five-day workweek beginning on Monday and ending on Friday. The employee was last paid on Friday, December 26. Review the unadjusted balance in Salories payable, and prepare the necessary adjusting entry, If any. 6) In the second week of December, Solid Systems agreed to provide 30 days of consulting services to a local fitness club for a fixed fee of $5,340.The terms of the initial agreement call for Solid Systems to provide services from December 12, 2021, through January 10, 2022. or 30 days of service. The club agrees to pay Solid Systems $5,340 on January 10, 2022, when the service period is complete. Review the unadjusted balance in Consulting revenue, and prepare the necessary adjusting entry, If any. Prepare the required adjusting and closing entries for the Solid Systems Company Requirement General Journal Cernal Ledger ral Balance Income Statement St Owner Equity Balance Sheet Work Sheet For transactions 1-6, view the unadjusted balance and prepare the adjusting entry necessary to entre mund the he earned or the expense incurred. After adjusting the accounts, review the financial statements for required closing entries. View transaction list Journal entry worksheet The balance in Prepaid insurance represents a 24-month policy that went into effect on December 1, 2021. Review the unadjusted balance in Prepaid insurance, and prepare the necessary adjusting entry, if any. Note: Enter debits before credits. Date Account Title Debit Credit Dec 31 Record entry Clear entry View general journal Requirement General Journal General Ledger Trial Balance Income Statement St Owner Equity Revenues and expenses are temporary equity accounts. They represent the cha operation of the business during the current period. These temporary equity amounts period. Unadjusted Solid Systems Income Statement For Month Ended December 31, +21 Revenues: Expenses: www January 10, 2022, or 30 days of service. The club agrees to pay Solid Systems period is complete. Review the unadjusted balance in Consulting revenue, and Prepare the required adjusting and closing entries for the Solid Systems Company. Requirement General Journal General Ledger Trial Balance Income Statement St Owner Equity SOLO There are four subsets of equity: Investments by the owner, withdrawals by the owner subsets are compiled in the owner's capital account at the end of the period during the capital balance is transferred to the equity section of the balance sheet. es Solid Systems Statement of Owner's Equity For Month Ended December 31, 2021 A. Mohr, Capital, December 31, 2021 50,000 Income Statement Balance Sheet > General General Requirement St Owner Income Journal Trial Balance Ledger Balance Sheet Worl Statement Equity The balance sheet is the accounting equation: Assets = Liabilities + Equity. Each asset and liability accou separately on the balance sheet. The detail of equity is not found on the balance sheet; only the ending ca appears on the balance sheet. The detail of equity is reported on the income statement and statement of Unadjusted Solid Systems Balance Sheet December 31, 2021 Assets Current assets: Total current assets: Plant assets: Equipment, net Liabilities December 31, 2021 Assets Current assets: ok Total current assets: Plant assets: nt int rences Equipment, net + Liabilities Equity St Owner Equity Work Sheet WIL Requirement General Journal General Ledger Trial Balance Income Statement St Owner Equity Balance Sheet Work Sheet One of the benefits of a work sheet is that it links accounts and adjustments to their impacts in financial statements. Complete the work Company. Unadjusted Solid Systems Company Work Sheet For the Year Ended December 31, 2021 Unadjusted Trial Adjusted Trial Income Statement St. of Owner's Equity Balance Adjustments Balance & Balance Sheet Account Dr. Cr Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cri Cash 12425 Accounts receivable 0 Supplies 7.400 Prepaid insurance 6,000 Equipment 50,400 Accumulated depreciation Accounts payable 10.200 Salaries payable Uncated consulting revenue 12,600 A. Mohr, Capital 50.000 A Mohr, Withdrawals 1.100 Consulting revenue 10.300 0 7,400 6,000 50,400 Accounts receivable Supplies Prepaid insurance Equipment Accumulated depreciation Accounts payable Salaries payable Uneamed consulting revenue A Mohr, Capital A Mohr. Withdrawals Consulting revenue 10.200 + 12,600 50.000 1.100 10,300 750 3,740 Rental revenue Depreciation expense Salaries expense Insurance expense Rent expense Supplies expense Utilities expense Totals Net income Totals 2.400 385 83.850 83,850

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started