Answered step by step

Verified Expert Solution

Question

1 Approved Answer

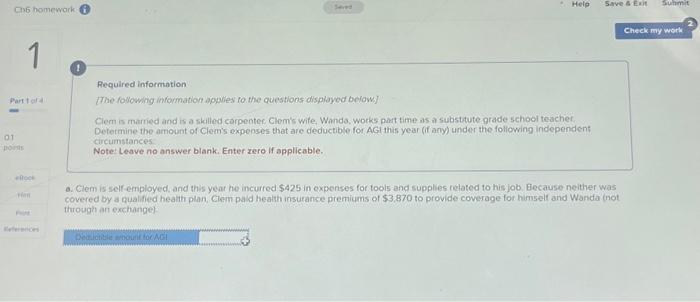

Ch6 homework 1 Part 1 of 4 0.1 points eBook Hint Print References ! Saved Help Required information [The following information applies to the questions

Ch6 homework 1 Part 1 of 4 0.1 points eBook Hint Print References ! Saved Help Required information [The following information applies to the questions displayed below.] Clem is married and is a skilled carpenter. Clem's wife, Wanda, works part time as a substitute grade school teacher. Determine the amount of Clem's expenses that are deductible for AGI this year (if any) under the following independent circumstances: Note: Leave no answer blank. Enter zero if applicable. Deductible amount for AGI Save & Exit a. Clem is self-employed, and this year he incurred $425 in expenses for tools and supplies related to his job. Because neither was covered by a qualified health plan, Clem paid health insurance premiums of $3,870 to provide coverage for himself and Wanda (not through an exchange). Submit Check my work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started