Chabwino limited is a company that operates in the carpentry and joinery industry in Lusaka. A new Finance director has just been appointed and is

Chabwino limited is a company that operates in the carpentry and joinery industry in Lusaka.

A new Finance director has just been appointed and is currently reviewing the performance of the company. One of the board members hinted to him that the company might be operating below the expectations of the company strategy and short term objectives.

The Finance director has thus decided to conduct a variance analysis for the last period in order to respond to the concern of the board member.

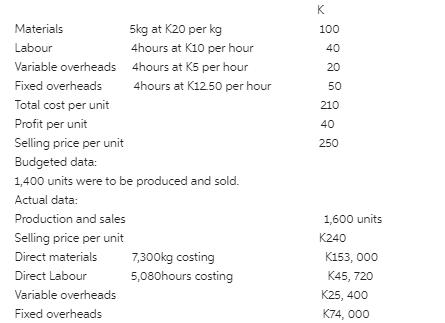

He has collected the following information to help with the task at hand:

Standard cost card per unit of product:

Required:

- As Cost accountant of the company, you have been asked to calculate all relevant variances, in as much detail as possible, and prepare a statement that reconciles budgeted profit to actual profit for the period under review.

- From your answers in (a), advice the Finance Director whether the concerns of the board member are justified. Give reasons for your answer.

- Identify three areas of concern which you feel Management should look at. For each area of concern, suggest two ways in which the issue can be resolved to facilitate improvement going into the next period.

- Describe four types of standards that can be used in formulating the standard cost card of the company. Recommend one of these standards which you think would be suitable for the management role of budgetary control.

K. Materials 5kg at K20 per kg 100 Labour 4hours at K10 per hour 40 Variable overheads 4hours at K5 per hour 20 Fixed overheads 4hours at K12.50 per hour 50 Total cost per unit 210 Profit per unit 40 Selling price per unit 250 Budgeted data: 1,400 units were to be produced and sold. Actual data: Production and sales 1,600 units Selling price per unit Direct materials K240 7,300kg costing K153, 000 Direct Labour 5,080hours costing 45, 720 Variable overheads K25, 400 Fixed overheads K74, 000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Direct Material Cost Variance Standard Cost Actual Cost 7000 Favourable 1600520 153000 Direct ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started