Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chad Funk is a hair stylist who opened a business selling hair products. He imports products from around the world and sells to salons

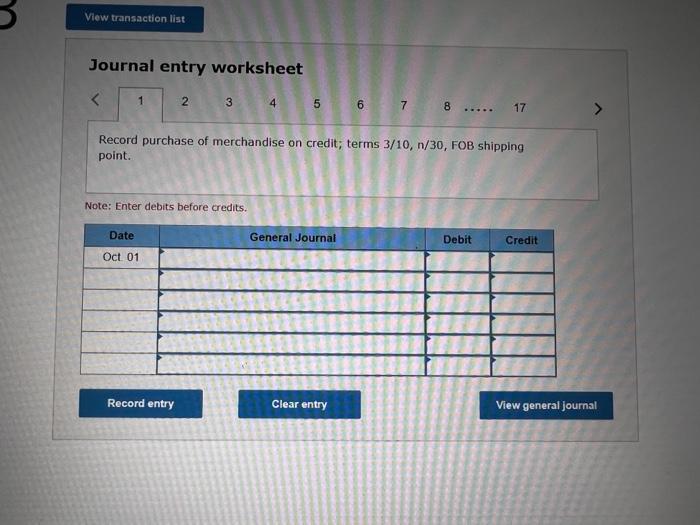

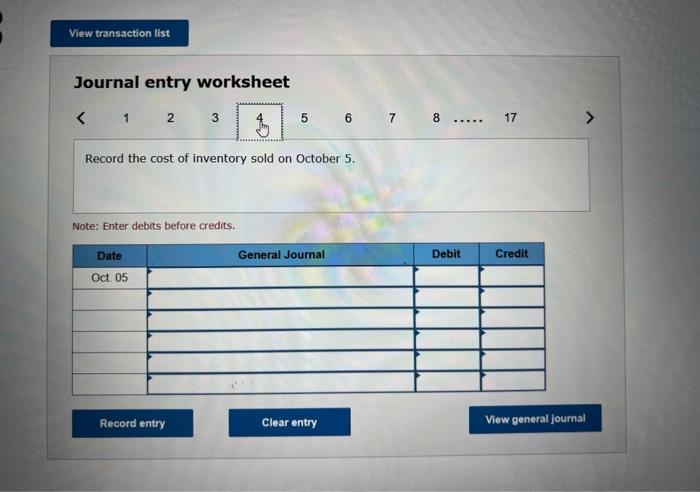

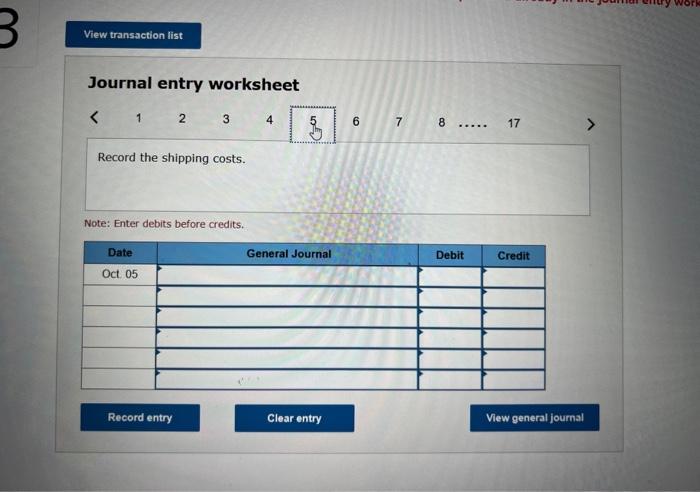

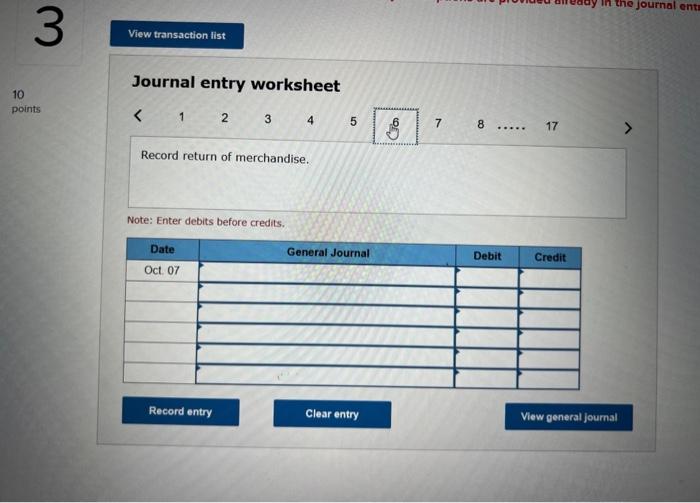

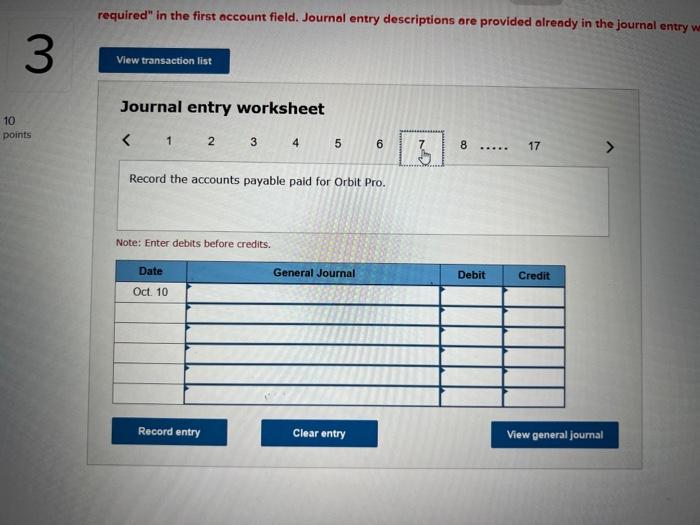

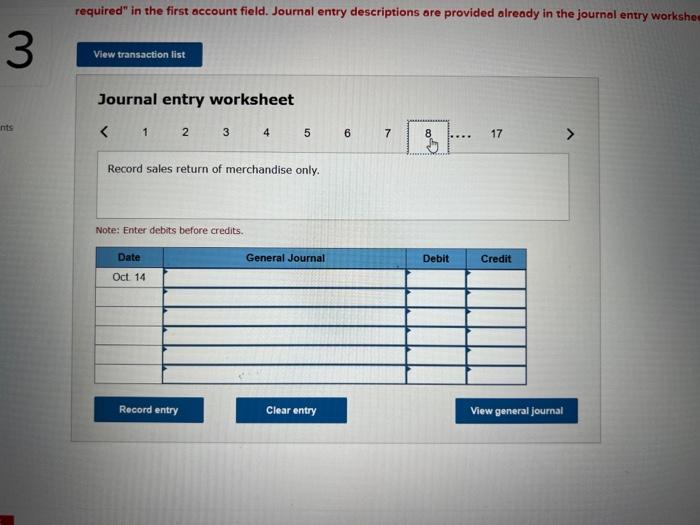

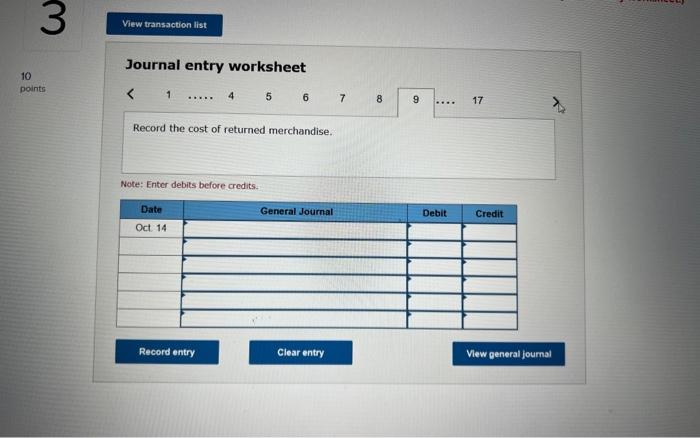

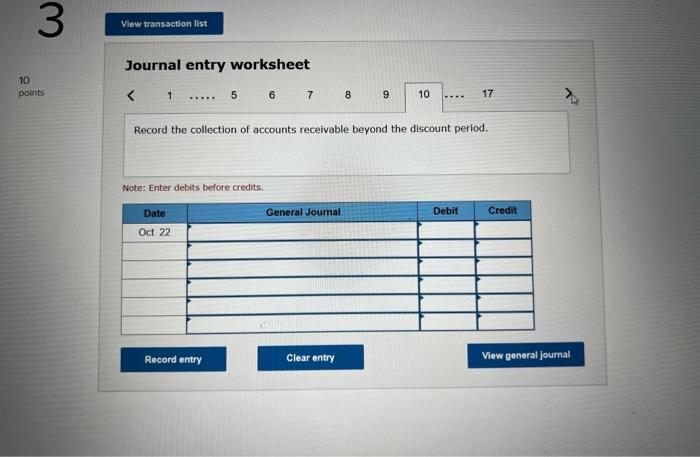

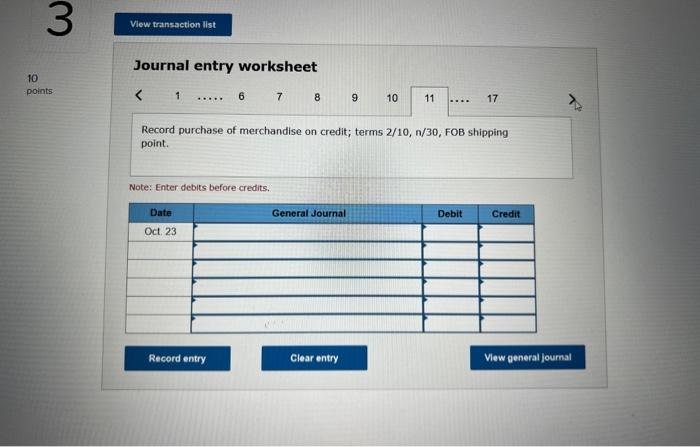

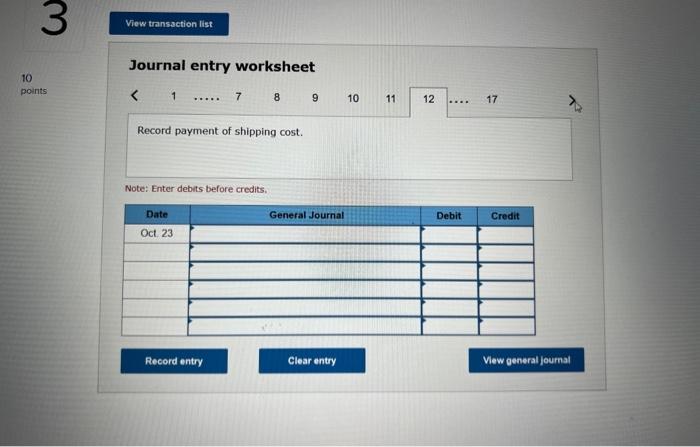

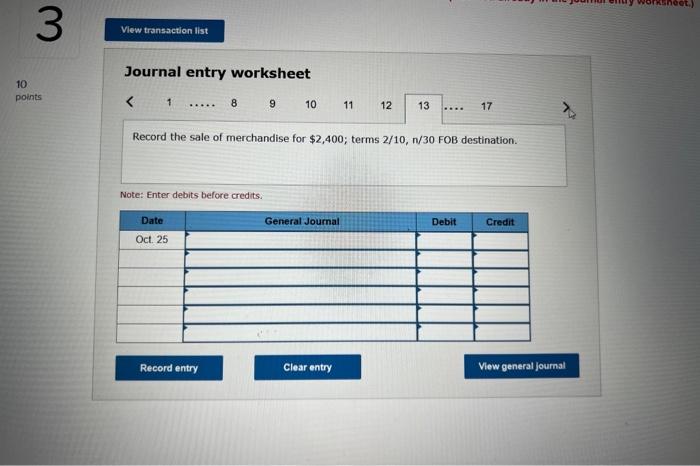

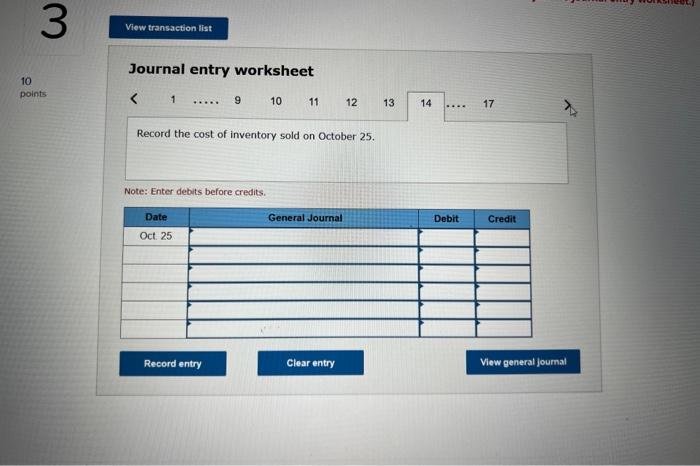

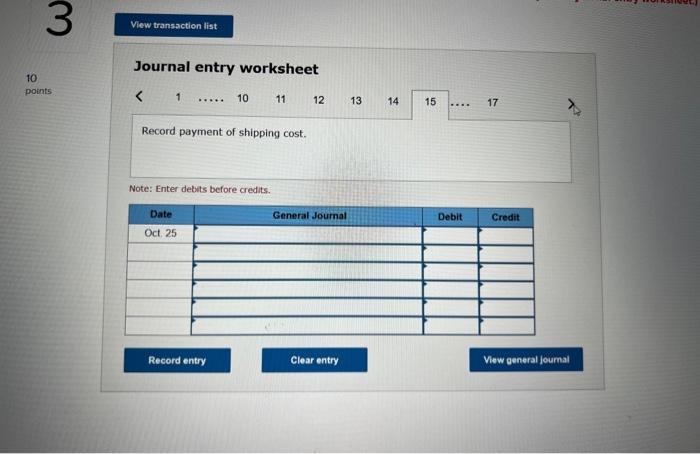

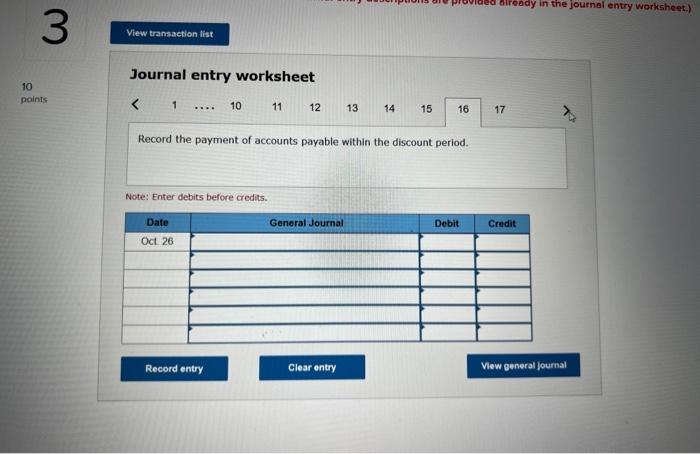

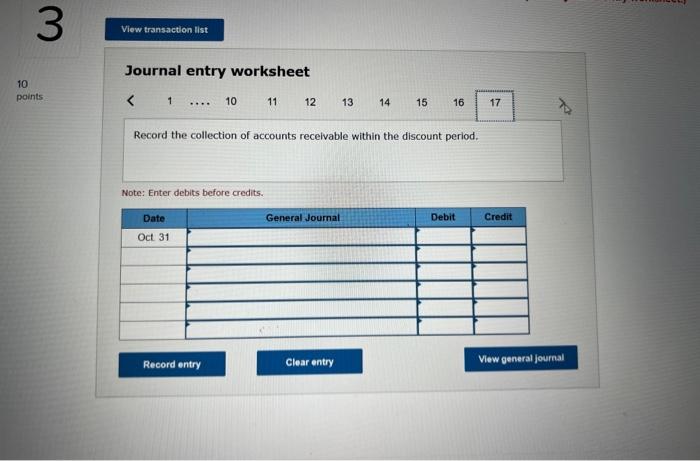

Chad Funk is a hair stylist who opened a business selling hair products. He imports products from around the world and sells to salons in Canada, Oct. 1 Purchased $4,200 of hair spray from Orbit Pro; terms 3/10, n/30, FOB shipping point. The appropriate party paid the shipping cost of $340. 5 Sold shampoo costing $1,400 to Barber & Co. for a price of $2,000 with teres of 2/10, n/30, FOB shipping point. The appropriate party paid the shipping cost of $150. 7 Heturned $1,900 of inventory to Orbit Pro due to an error in the October 1 order. 10 Paid Orbit Pro for the purchase on October 1.1 14 Barber & Co. returned $380 of inventory from the sale on October 5. The inventory had a cost of $266. 22 Received the payment from Barber & Co. on the October 5 sale. 23 Purchased $4,800 of hair conditioner from Keratin Hair; terms 2/10, n/30, F08 shipping point. The appropriate party paid the shipping cost of $1,000. 25 Sold hair gel to Styling Room for an invoice price of $2,400, terms 2/10, n/30, FOB destination. The hair gel had a cost of $1,680. The appropriate party paid the shipping cost of $500. 26 Paid for the purchase on October 23. 31 Received the payment from Styling Room on the October 25 sale. Required: Record the journal entries for the month of October. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry descriptions are provided already in the journal entry worksheet.) View transaction list Journal entry worksheet 1 2 3 4 5 6 7 8..... 17 Record purchase of merchandise on credit; terms 3/10, n/30, FOB shipping point. Note: Enter debits before credits. Date Oct 01 General Journal Debit Credit Record entry Clear entry View general journal View transaction list Journal entry worksheet < 1 2 3 5 6 7 8 17 Record the cost of inventory sold on October 5. Note: Enter debits before credits. Date Oct. 05 General Journal Debit Credit View general journal Record entry Clear entry 3 View transaction list Journal entry worksheet < 1 2 3 4 6 7 8. 17 Record the shipping costs. Note: Enter debits before credits. Date Oct. 05 General Journal Debit Credit View general journal Record entry Clear entry 3 View transaction list Journal entry worksheet points < 1 2 3 4 5 7 8 10 Record return of merchandise. Note: Enter debits before credits. Date Oct. 07 17 77 General Journal Debit Credit ne journal ents Record entry Clear entry View general journal 10 3 required" in the first account field. Journal entry descriptions are provided already in the journal entry we View transaction list Journal entry worksheet points < 1 2 3 4 5 6 Record the accounts payable paid for Orbit Pro. Note: Enter debits before credits. Date Oct. 10 ~ 8. 17 General Journal Debit Credit View general journal Record entry Clear entry 3 required" in the first account field. Journal entry descriptions are provided already in the journal entry workshee View transaction list Journal entry worksheet nts < 1 2 3 4 5 Record sales return of merchandise only. Note: Enter debits before credits. Date Oct 14 16 7 17 > General Journal Debit Credit Record entry Clear entry View general journal 3 View transaction list Journal entry worksheet 10 points < 4 5 6 7 8 9 17 Record the cost of returned merchandise. Note: Enter debits before credits. Date Oct. 14 General Journal Debit Credit Record entry Clear entry View general journal 10 3 View transaction list Journal entry worksheet points < 1 5 6 7 8 9 10 10 Record the collection of accounts receivable beyond the discount period. Note: Enter debits before credits. Date Oct. 22 17 General Journal Debit Credit Record entry Clear entry View general journal 10 3 View transaction list Journal entry worksheet points < 1 6 7 8 9 10 11 17 Record purchase of merchandise on credit; terms 2/10, n/30, FOB shipping point. Note: Enter debits before credits. Date Oct. 23 General Journal Debit Credit Record entry Clear entry View general journal 10 3 View transaction list Journal entry worksheet points < 1 7 8 9 10 11 12 17 Record payment of shipping cost. Note: Enter debits before credits. Date Oct. 23 General Journal Debit Credit View general journal Record entry Clear entry 10 3 View transaction list Journal entry worksheet points < 1 8 9 10 11 12 13 17 Record the sale of merchandise for $2,400; terms 2/10, n/30 FOB destination. Note: Enter debits before credits. Date Oct. 25 General Journal Debit Credit Record entry Clear entry View general journal 10 3 View transaction list Journal entry worksheet points < 1 9 10 11 12 13 14 17 Record the cost of inventory sold on October 25. Note: Enter debits before credits. Date Oct. 25 General Journal Debit Credit View general journal Record entry Clear entry 3 View transaction list 10 points Journal entry worksheet 1 10 11 12 13 333 Record payment of shipping cost. Note: Enter debits before credits. Date Oct. 25 14 15 17 General Journal Debit Credit Record entry Clear entry View general journal 10 3 View transaction list Journal entry worksheet points < 1 already in the journal entry worksheet.) 10 11 12 13 14 15 16 17 Record the payment of accounts payable within the discount period. Note: Enter debits before credits. Date Oct 26 General Journal Debit Credit View general journal Record entry Clear entry 3 View transaction list Journal entry worksheet 10 points < 1 10 .... 11 12 13 14 15 16 Record the collection of accounts receivable within the discount period. Note: Enter debits before credits. Date: Oct 31 17 71 General Journal Debit Credit View general journal Record entry Clear entry

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started