Answered step by step

Verified Expert Solution

Question

1 Approved Answer

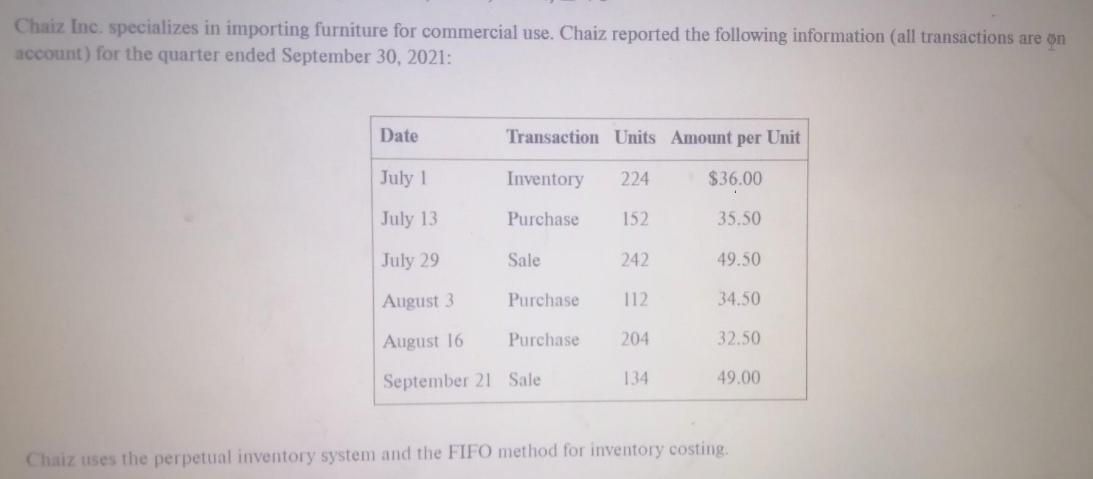

Chaiz Inc. specializes in importing furniture for commercial use. Chaiz reported the following information (all transactions are on account) for the quarter ended September

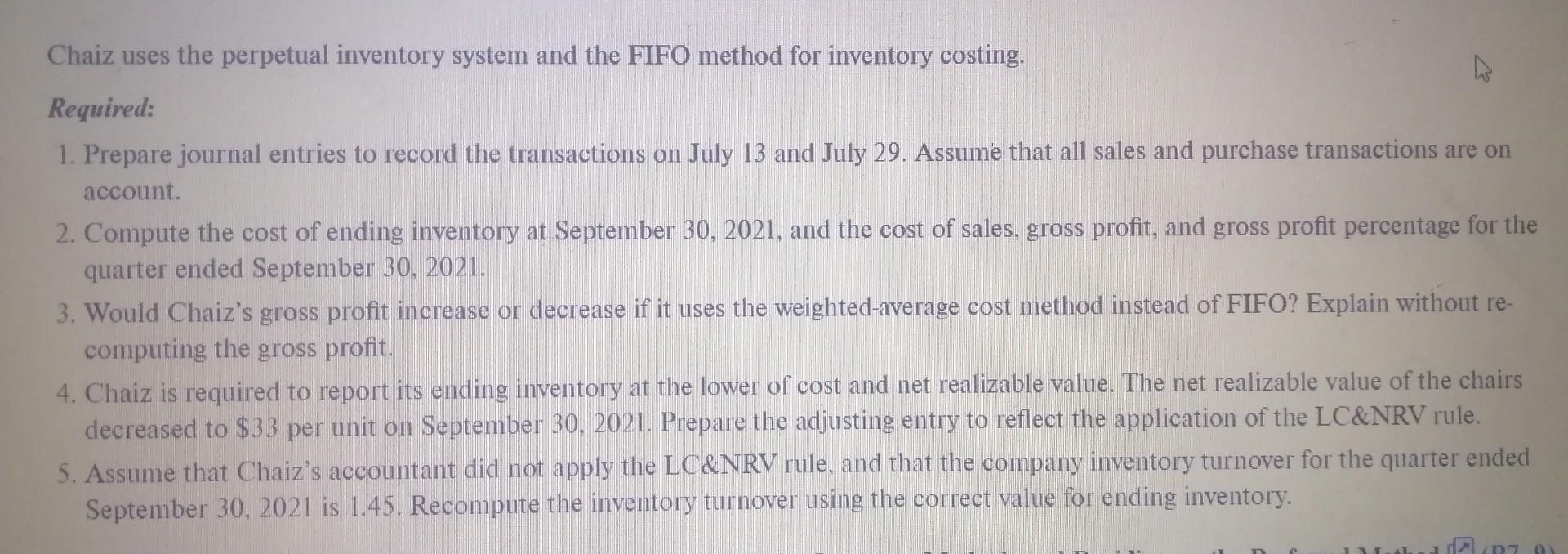

Chaiz Inc. specializes in importing furniture for commercial use. Chaiz reported the following information (all transactions are on account) for the quarter ended September 30, 2021: Date Transaction Units Amount per Unit Inventory 224 $36.00 Purchase July 1 July 13 July 29 August 3 August 16 September 21 Sale Sale Purchase Purchase 152 242 112 204 134 35.50 49.50 34.50 32.50 49.00 Chaiz uses the perpetual inventory system and the FIFO method for inventory costing. Chaiz uses the perpetual inventory system and the FIFO method for inventory costing. Required: 1. Prepare journal entries to record the transactions on July 13 and July 29. Assume that all sales and purchase transactions are on account. A 2. Compute the cost of ending inventory at September 30, 2021, and the cost of sales, gross profit, and gross profit percentage for the quarter ended September 30, 2021. 3. Would Chaiz's gross profit increase or decrease if it uses the weighted-average cost method instead of FIFO? Explain without re- computing the gross profit. 4. Chaiz is required to report its ending inventory at the lower of cost and net realizable value. The net realizable value of the chairs decreased to $33 per unit on September 30, 2021. Prepare the adjusting entry to reflect the application of the LC&NRV rule. 5. Assume that Chaiz's accountant did not apply the LC&NRV rule, and that the company inventory turnover for the quarter ended September 30, 2021 is 1.45. Recompute the inventory turnover using the correct value for ending inventory. M D7 0)

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

1 Date General Journal Debit Credit July 13 Inventory 152 x 3550 5396 Accounts payable 5396 To recor...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started